I like $GALE. Besides the potential disruptive biotechnology that can eradicate breast cancer, it is launching the sales of ABSTRAL® (fentanyl) sublingual tablets which are indicated for the management of breakthrough pain in cancer patients 18 years of age and older who are already receiving and who are tolerant to opioid therapy for their underlying persistent cancer pain.

Basically, while we are waiting for the development of their breast cancer treatment to come to fruition, they have the mean to start generating revenues from the specialized painkiller. This is the kind of painkiller that will provide faster pain relief than the usual opiate drug such as morphine.

I was lucky to sell before the secondary offering and then giving the opportunity to buy them back after the secondary offering.

Sidebar: I’ve learned to take advantage of the opportunity of a dip provided by secondary offering. If the company has a solid fundamental, secondary offering is an “offering” of an opportunity for investors to either add or buy at a discount. I had been waiting for a chance to get back on the 3D printer and $SSYS gave me the opportunity with a secondary offering.

Now, I’m waiting for the fundamental to take effect to drive the $GALE back up based on the future revenues of Abstral or the possibility of a take-over.

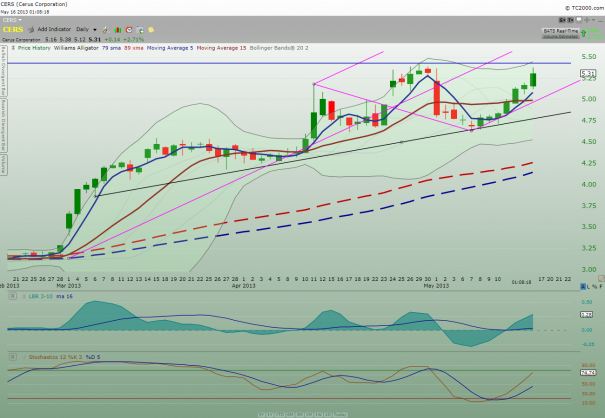

Take a look at the daily chart below:

There is a breakout to the upside today from the consolidation after the secondary offering. This signifies that the momentum is still bullish despite a gap-down. There may be some resistance from here due to the overhang of the 79SAM and 89XMA. If price can take out these two MAs, then we are heading up.

Take a look at the weekly chart below:

Did you see that the uptrend is still intact? Did you see the price is bouncing off the 79SMA and 89XMA? This bounce off is more significant than the short-term daily 79SMA and 89XMA resistance I mentioned earlier from the daily chart.

Now, you know why $GALE should be your best friend, eh?

My 2 cents

Comments »