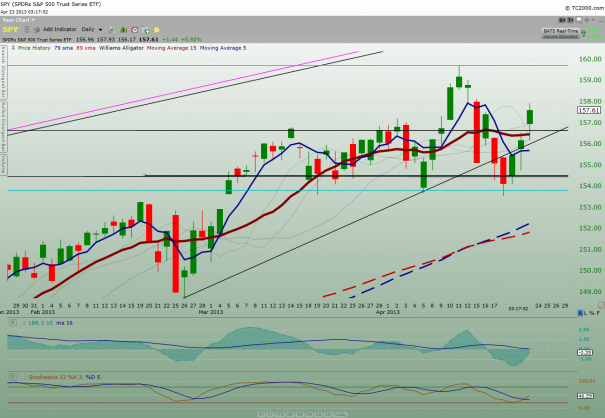

Today $SPY rally continues on and price action is now above the 2007 high once again. On top of that, price action is now back over the up trendline that has started from 02/26 low. However, I like to see price action takes out the previous high of 04/11 to be considered a full-on bull trend.

Take a look at the $SPY daily chart below:

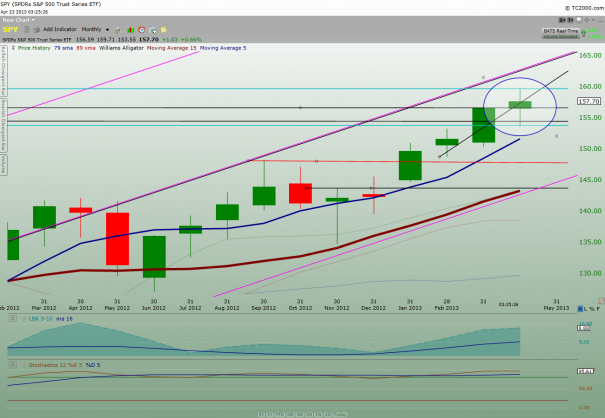

Now take a look at the monthly $SPY chart again below:

Did you see the forming of a spinning top candlestick for the month of April?

Let’s take a closer look.

A spinning top at or near critical historical resistance such as 2007 high can be a significant tell-tale sign. I will be more cautious going forward from here in light of May being the month of patterned down month.

Below is the primer for Spinning top candlestick pattern:

Definition of ‘Spinning Top’

A type of candlestick formation where the real body is small despite a wide range of price movement throughout the trading day. This candle is often regarded as neutral and used to signal indecision about the future direction of the underlying asset.

Investopedia explains ‘Spinning Top’

If a spinning top formation is found after a prolonged uptrend, it suggests that the bulls are losing interest in the stock and that a reversal may be in the cards. On the other hand, if this formation is found in an defined downtrend, it suggests that the sellers are losing conviction and that a bottom may be forming.

Cautiously optimistic is the way to perceive current rally.

My 2 cents.

Comments »