Let me start off this post with a quote from Calvin Coolidge:

Nothing in this world can take the place of persistence. Talent will not: nothing is more common than unsuccessful men with talent. Genius will not; unrewarded genius is almost a proverb. Education will not: the world is full of educated derelicts. Persistence and determination alone are omnipotent.

In hindsight, we know the market has marched on ahead in an upward, albeit in a wavy manner, direction in the year of 2013; nevertheless, my personal path to achieving stock market gain was an uphill battle fraught with potholes and slippery slopes.

Potholes I fell into in 2013:

- $ECTY- large losses (company filing bankruptcy)

- $ETRM- medium losses (failed Phase III study)

Slippery slopes I encountered:

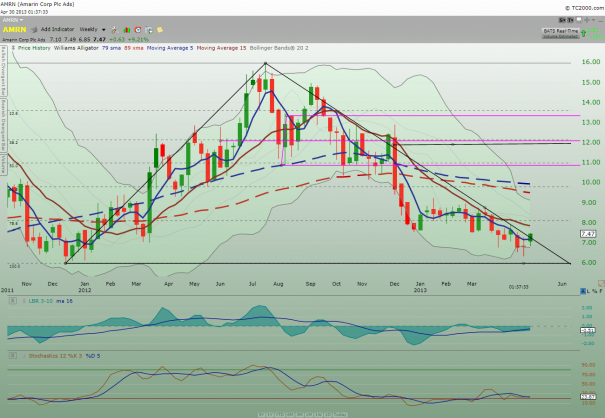

- $AMRN- large losses (you know the story)

- $USU- large losses (I bailed before the reverse split and the ensuing gigantic rally afterward)

- $SZYM- medium losses (whipsawed from over-trading in downtrend market)

- $APRI- medium losses (holding against a downtrend and gave up before the recovering year-end rally)

- $NCTY- medium losses (mistake in betting big on a thinly traded and small float stock)

Despite the multiple losses I endured from the above trades, they were all managed losses. In other words, I didn’t let these losses get out of control by averaging down. While some of the losses were large, it was because I made the initial large bet to begin with and not as a result of averaging down While I had suffered mental frustration with these controlled losses (who wouldn’t?), I did not wallow in self-pity, I got back up and moved on. I am persistence because I know I can get my money back as long as I’ve my capital intact. It is a matter of being perseverance in searching for the stocks that will give me back the money and more.

Sidebar: It is extremely important that you manage your losses according to sound money management principle. If I had not managed my losses, I would not be able to recover no matter how persistence I could be. The rule of trading world is that you MUST protect your capital to fight another day. My trading style is focused on finding the hi-beta stocks that will give me the jackpot I’m looking for; thus, I know I’ve to take some hits from time-to-time. While this has been my endeavor, I’m still developing and evolving as a trader; therefore, trading mistakes were made (as in $SZYM, $APRI, and $NCTY) and I’m learning from them.

Having covered my losses, let’s go over my wins!

- $KNDI- very large gain

- $INO- very large gain

- $LRAD- large gain

- $GALE- medium gain

- $GOGO- medium gain

- $NUGT- medium gain

- $CERS- medium gain

- $CLIR- medium gain

My biggest win in 2013 was $INO. Upon hearing about $INO, I did my research but was initially skeptical since stock price had been trading below below $1.00 for first half of the year. But when price started to climb to near dollar, I began to take notice of a possible breakout. Then the proliferation of positive preclinical news came into the foreground. With price advancing over $1, I began to average UP. Not only that, I kept averaging up on each bounce up after a brief consolidation; by the time price reached $3, I was sitting on such huge gain it would be foolish not to lock in profit especially when I knew the preclinical trials result was still a long way to human trials. In other words, the price went up too far too fast. I exited about 80% of my position at an average price of $2.75 and the rest in mid-to-low $2.xx. It was a very profitable trade.

$KNDI was a trade I found after I got burned by $ECTY. Despite the punch on the stomach (figure-of-speech), I refused to give up my beliefs in the potential of EV. $TSLA has pretty much convinced me that EV does have a place in our society after my few failed attempts to short $TSLA with put option. My shorting $TSLA was based on simple assumption that the market cap had gone too far ahead of the fundamental; however, when I saw the actual Tesla Model S in the showroom and the elegant and simple design of the electric motor compared to the complicated ICE (internal combustion engine); I was sold on the concept of EV.

Tesla high-end car succeeds because Elon Musk knows that the top 10% of the wealth will buy the car if it looks nice and function perfectly. And when Consumer Reports magazine gave the Tesla Model S the highest score in its Ratings: 99 out of 100 back in July, I knew then that EV is here to stay.

However, the only problem is that if $TSLA, the only EV with a much longer driving range on a single charge than its cheaper competition, already captured the top 10% wealth; who will buy the cheaper EV models with shorter range? Hence my belief that $ECTY was the key solution to expanding the EV market for cheaper EV models. Little did I know that $ECTY was so badly managed, despite its being the company chosen by US Department of Energy to spearhead the charging station project, that I promptly lost 80+% of my investment in a single day after $ECTY made an announcement of its major issues.

Still very much believing in the EV potential and that $ECTY mismanagement did not equal to EV failure, I kept on researching for the next EV stock to speculate.

Then I found $KNDI.

What tickle me the most about $KNDI is that it is not selling directly to the consumer which I know will not work because of the range anxiety. Without the proliferation of charging station everywhere, it will be difficult for an accelerated growth in consumer buying. But $KNDI is offering a solution that automatically solves the range anxiety issue; not only that it also solves the charging station issue as well. By embracing the concepts of car-to-go and zipcar except that the EV must be returned to the garages strategically located at multiple fixed locations for recharging purposes, $KNDI found an optimal solution to the range anxiety and battery dilemma in the EV market. What is more important is that consumers do not need to buy the car but simply rent them for a very low price that is cheaper than hiring a taxi.

At the time when I found $KNDI, price was trading around $5 after it came back down from a quick run to $8. Because of the secondary offering after the spike to $8, the stock was mercilessly attacked by the short. On top of that, the uncertainty from having to wait for the new China EV subsidies that had yet to be announced only added fuel to the short.

Hmmm….

Instead of going away like most everyone because of the history of bad blood from some stock scams from China, I began to see this as an opportunity to buy when it was still cheap. After reading all the due diligence performed by other $KNDI believers and compared them to those who short, my own analysis prompted me to start building a position in $KNDI. While I was building my position, $KNDI was trading in a tight range b/w $4.50 and $5.50. Plenty of patience was required on my part.

The good thing about having a large position on a stock is that you tend to watch its trading pattern very closely on a daily basis. And when price crossed back over the 79 & 89 MA lines to the upside, I could sense a coming rally. Thus, I decided to buy a boatload of Dec $7.50 call to supplement my stock position. As luck would have it, right after I had bought the options, the stock became a runner the very next day. When price reached $9 and started to reverse direction, I had the good sense to lock in profit on 70% of my option trades. The rest I gave back to the market when it expired worthless. Having exited most of my option trades, I decided to reduce my stock position as well to lock in profit. My swing trade mentality was in full-swing.

From then on, I bought and sold $KNDI to supplement my core position without success for two months. In fact, my realized gain was slowly leaking thru the multiple whip-saws from my trading in-and-out of the trading position. And then the news of Geely announcing to the public that it would have the EV version of the London black taxi available in five years. That was all I needed to hear to double-down on $KNDI. After the Geely announcement, I knew it was time to stop swing trading $KNDI. Why did I feel that way? It was the subtle message from Geely that it is committing to the EV market; otherwise, why made such a bold statement? With $KNDI being in a 50/50 joint venture with Geely for the sole purpose of building EV cars, $KNDI has a LOT to gain from this announcement.

Again, I was correct in my assessment; thanks to my double-down on $KNDI, my gain was quite phenomenon in the last week in 2013.

Sidebar: Performing daily homework in researching for potential runner is the discipline that keeps me going forward. And I’m not just talking about picking up stock ’cause so and so says he/she is buying. I need to analyze the fundamental and decide if the stock has the “story” as well as a chart pattern to support it before I venture in. If you are willing to do YOUR own analysis and homework on a stock regardless where you hear it from, the stock will become YOUR own pick; not someone pick. And you will trade this stock according to YOUR trading strategy; not someone’s. The benefit of doing YOUR own analysis is that you will LEARN from your mistake and grow as a trader. Otherwise, you will never grow as a trader if all you do is to follow someone pick.

My purpose of writing about my thought process in my $KNDI and $INO trades is to emphasize the importance of doing your own research. By doing your own research, you will get a much better sense of the stock and how it is trading. If you are the more risk-taking type, you may even augment your position size like I’ve done with $INO and $KNDI.

$GOGO came to mind as another perfect example. After The Fly made the call on $GOGO, I began to research the stock and like what I saw. Then I started to build up my position based on my analysis of the chart-pattern. In other words, I began to trade $GOGO irrespective of what The Fly was doing with his $GOGO position. If you do your own homework, you make the stock your own and you only have yourself to blame if the stock doesn’t perform. This is the ONLY way you can learn and grow as a trader.

To conclude my post, despite having my portfolio down in the middle of the 2013 due to my losses mentioned above, I was able to climb back out of the hole and ended the year in a very positive note.

Due to my evolving as a trader, I am now focused on shepherding my current portfolio of nine hi-beta stocks for the potential run-up in 2014. Holding on to a winning position for as long as I can is the only way to make the big bucks. I like to see all nine of my stocks, if possible, to run the way $LNG and $CLDX ran in 2013 (both of these stocks I used to own but got out way too early!)

Current holdings:

$KNDI – I believe $KNDI will dominate in China with its business model of selling to the car-sharing garages.

$LRAD – I believe its newly minted mass-notification technology will dominate the replacement of the obsolete bullhorn speaker notification system worldwide.

$KGJI- I believe that the new wealth in China will increase consumers’ crave for 24K gold products that $KGJI will have blow-out quarter-to-quarter revenues that price has no choice but to keep going up.

$CERS- I believe that FDA will approve $CERS blood purification system. Why? ’cause they are selling them to Europe already without any issues.

$INO- I am “betting” that $INO has finally tweaked its synthetic DNA enough to work in human.

$GALE- I believe its Astral drug will sell well quarter after quarter. I’m also “betting” that its NeuVax breast cancer treatment will succeed.

$XONE- I believe its 3D manufacturing machines will become dominant in the manufacturing sector.

$AMRN- I believe FDA will meet $AMRN half-way on its Vascepa label expansion.

$TINY- I believe that its portfolio of private investment in multiple nanotechnology companies will take fruition in 2014.

I wish everyone a happy and prosperous New Year!

My 2 cents.

Comments »