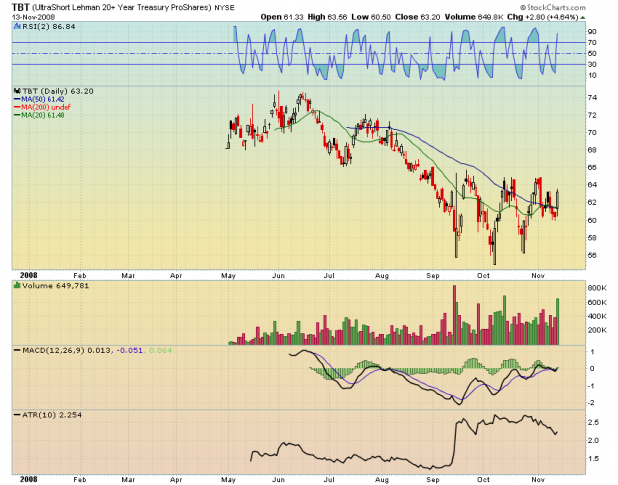

I should have updated the blog on Monday, as [[EFU]] stopped out just 46 cents from the low of the day. Instead, I spent the better part of the evening planning my revenge on the @#^& Pacific Exchange lowlife who filled my purchase of EFU at $163.92.Â

Had EFU not stopped out, the position would be getting closed out tomorrow, as the RSI(2) closed today well above 80. The gain would have been approximately $2,000. If anyone out there took this trade and is still in it, be careful with any market order to sell on the open. My advice would be to try a limit order, or to wait a minute or two after the open, while closely watching the bid/ask spread.

The bright side of this trade was that I stayed in it, even after my egregiously bad fill. If I can sell the position tomorrow at a price close to this evening’s close, I will still pocket 14 points. Not bad for a trade that went against me by 15 points on the first day.

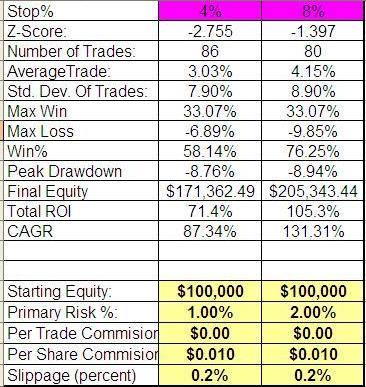

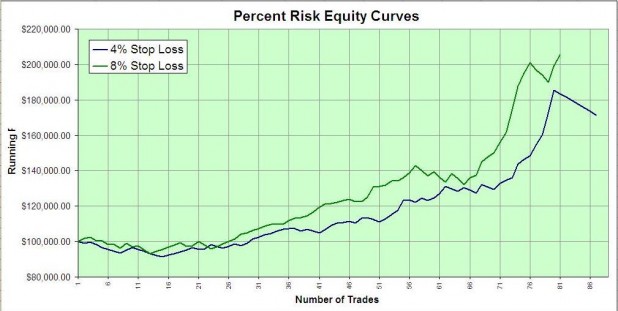

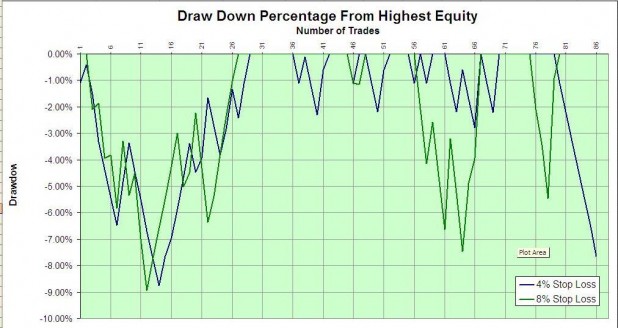

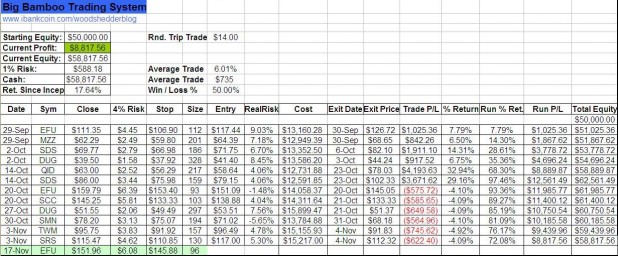

I will make the final decision over the weekend, but I am leaning heavily towards making all future trades of the Big Bamboo with an 8% stop and 2% risk. The 4% stop is too tight, even when on the right side of the trade from the get-go.

Special Note: Try out the new Disqus comments format. I plan to put up a poll in the near future to see if you all like it better, or not.

Comments »