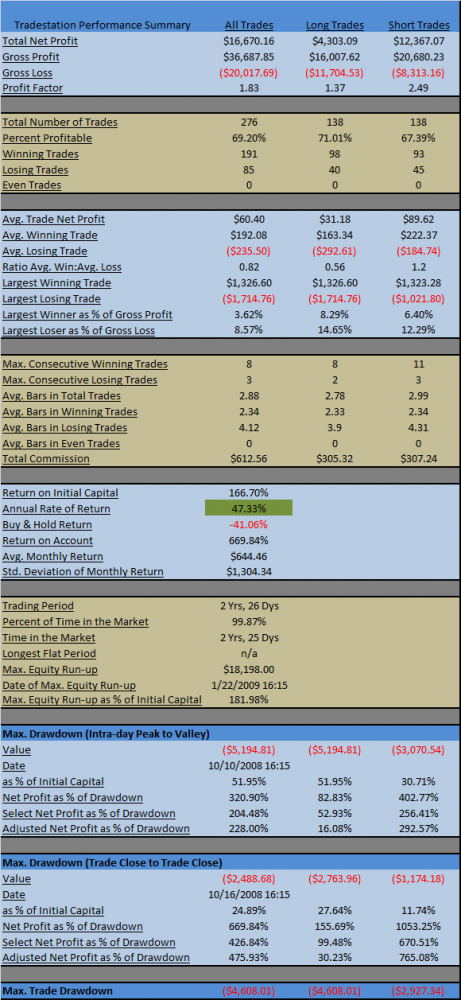

And I bet it has outperformed 99% of all traders over the past 2 years.

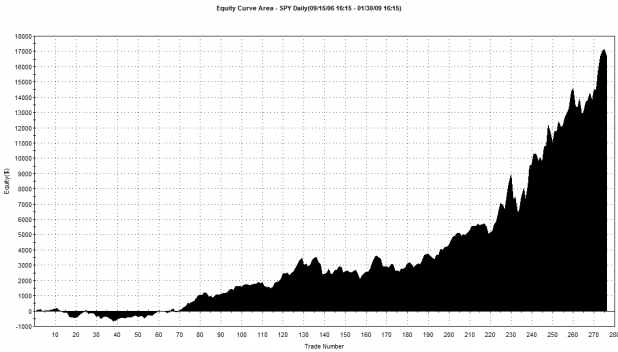

Annualized, over the past 2 years, the system has returned 47.33%

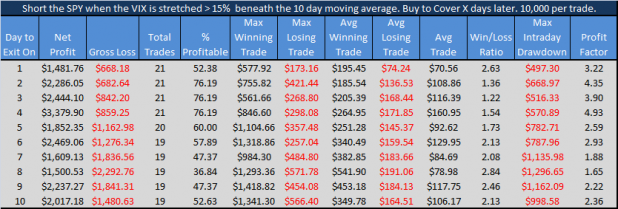

Here are the rules:

1. If the close is below the 2 day moving average, buy the SPY.

2. If the close is above the 2 day moving average, sell the long position and sell-short the SPY.

Below is the equity curve. The first trade was on 1/05/07.

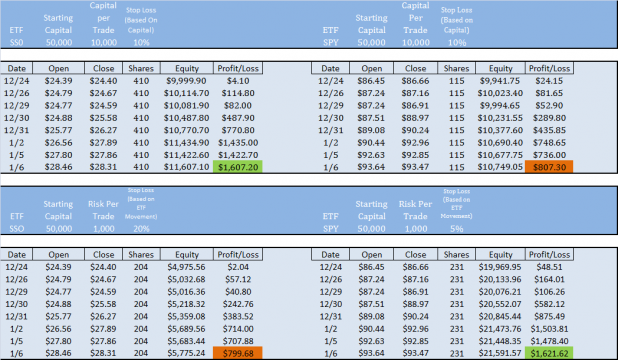

And here are all the trade statistics. Assume $10,000 in starting equity with net profits added to each trade (gains are compounded). Commissions of .01 / share are included.

I am not recommending this as a viable system. Instead, I think it does a good job of detailing the type of market conditions we have experienced over the past 2 years. Furthermore, I think it may have some important implications for the future, in regards to what we should expect in terms of the changing market conditions.

Specifically, how can the market get any more short-term mean reverting? The only way I can see it could become more short-term is if it scales down from a daily basis to an even shorter time frame. What about a moving average based on hourly bars? It could certainly vacillate around a 2 hour moving average.

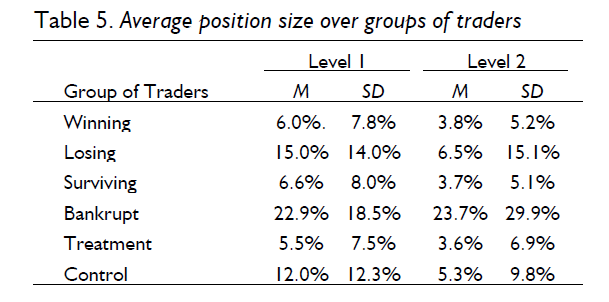

Instead, I believe that at some time over this year we will see extreme short-term mean reversion begin to fail and the re-emergence of short-term trending conditions. Based on this theory, moving average mean-reversion strategies will have to be built around longer moving averages. Similarly, short-term momentum and maybe even breakout strategies may begin to perform, once again.

What this could look like is watching for breakouts to pullback to the 10DMA, before buying (remember how well the 20DMA used to work for buying pullbacks?).

Certainly these volatile, mean-reverting conditions can remain for a long, long time. But when the 2DMA optimizes as the best moving average to use for buying and selling price crossovers, over the past 2 years, it seems as if conditions cannot be drilled down much further.

I am also including a shot of of some of the recent trades the system would have taken. The 2DMA is included. LE=Long Entry and SE=Short Entry.

Feel free to leave any thoughts about the implications of this study in the comments section.

Comments »