$SPY has completed 3 higher closes above its upper Bollinger Band.

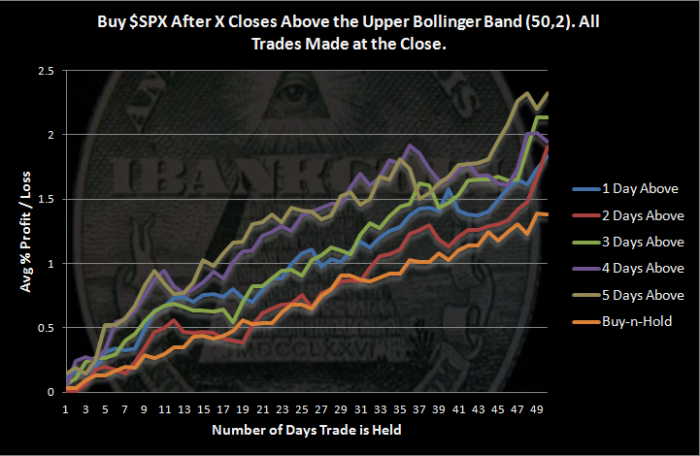

I have authored a fair amount of studies about what happens when the S&P 500 closes above its upper Bollinger Band (50, 2). One can read most of those articles under this category: Abnormal Markets.

I have not, however, completed a study where I examined what happens after 3 higher closes above the upper Bollinger Band. And, sorry for the tease, but I will not publish such a study tonight. I’m guessing that there are not very many instances of this happening and that the study will not be generalizable.

But the real reason is that I turn 40 very soon and the celebrations began (somewhat unexpectedly) tonight.

Likely tomorrow I will examine what happens after this probably rare occurrence of 3 higher closes above the upper Bollinger Bands. Until then, one thing I can say for sure is that an abnormal market is abnormal, even when it is making you money.

Comments »