Consider that to be an open question from a guy who rides a trend with little consideration as to what might be the fundamental reason for the trend.

The Fidelity Sector Rotational System has been long transports for a couple of months. The trend has seemed odd to me, with rising fuel prices and all that. It seemed odd to Scott Bleier as well. He declared it a Constanza trade:

The economy is tanking & energy prices are soaring. So what is leadership? Transportation. #COSTANZA http://t.co/CXYLGviB @woodshedder

— Scott Bleier (@CreateCapital) February 20, 2013

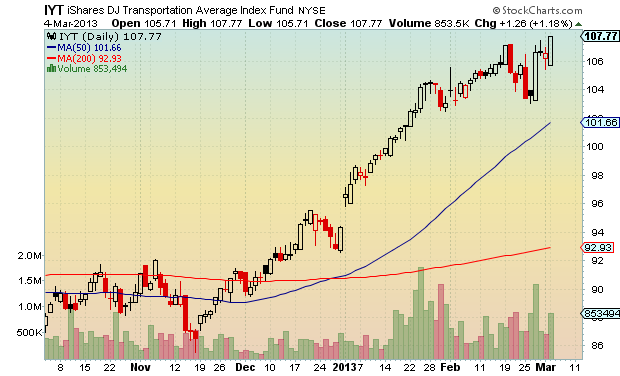

So now $IYT has broken out again, and Air Transportation and Transportation funds are the top 2 ranked Fidelity Sector Funds.

And so I ask, “Why are transports breaking out?”

Anyone know or care to guess what is driving this trend? I would very much appreciate hearing from you in the comments section.

The “perception”, mistaken or not, that the economy will be doing better later this year.

Perception is the only reality that matters…

Has to be the people breaking down numbers inside this sector and then projecting more “growthiness” and lower fuel costs. Not sure how real data is shaping up in terms of shipping, inter-modal, air, etc., activity.

What I come back to in general is…many indices near all time highs…2007 levels…is economy “as good”? Is potential growth more than 2-3%? Has employment recovered? Are banks lending as much as 2006-7, is loan demand recovered? Has housing recovered? Pretty much all answers are No or maybe. But what is different is that there is a lot more $$ sloshing around the system looking for a home…if you are nervous about a Bond bubble and want yield…guess where the big boys are going to park money? Now why $IYT vs. other sectors? Maybe viewed more stable on average, along with Utilities, which have been doing well of late. Everyone knows tech will git ya eventually and the banks ran a lot last year and are really still only in business due to the grace of the Clam…maybe transports are the choice of least regret? Just some musings…

Shipping activity is by no means booming. Coming from someone in the biz of managing fuel purchases…

POMO + AMBS + QE4 + QE5…

The US will be energy independent (well, maybe include Canada) within 5 or 10 years. Look at the production and consumption graphs for oil. The price of gas will be set by XOM and Congress, and the Saudis will be out of the picture. Europe, well they are another story.

It doesn’t mean low prices, but predictable prices.

You are deluded if you think that is true…

Really? Look at the data.

The only question is the decline rates on fracked wells, which is a fairly controversial number. Even a slightly optimistic interpretation is wildly bullish for US energy.

Very interesting.

I agree, the ball is in our court for fuel. However us diesel demand is still struggling. Shipping less at cheaper prices…

a full timer i know @ fedex says it’s slower than molasses, and still cutting hours on the part timers. which brings me to your title,so think about this correlation of perception.why is it not, that the dollar stores aren’t ripping tits,going back to dltr’s split.so the perception of those stocks getting hammered,that the poor are no more, and dont need those stores, and are all going back to shopping at tgt,and wmt, because it’s an “all clear” sign.when in fact those two stores are crying the blues. so who keeps the prices of these dollar stores down so much,while you are elbow to elbow with customers at these stores?

Thanks for all the comments. I enjoyed them and you all gave me things to think about!

with regard to the rails especially cn and cp, both are well run and are squeezzing efficiency. hunter harrison made cn the effecient operator it is, and is now just starting to do the same with cp. if you ever had a chance to listen to him ; you would be certain that he will succeed. he understands railroading like the fly understands the ppt. both of these companies are also benefitting from increased oil transprt due the lack of decision on the keystone pipleline. and this should continue for years to come. as housing picks up in the states lumber shipments also will be stronger. lastly there is discussion about converting their locomotives to natty. further efficiency and green. if energy prices stay at current levels the rails have a big advantage over trucks. cp and cn have come along way in a year for sure, but i think the future looks bright. i own cn… u.s. rails hauling coal , may be another story.