And by big down day, I mean a day where it loses more than 0.99%. Recently, $SPY has traded for significant amounts of time without a big down day.

- On 1.27.11, $SPY had traded for 42 days without a significant down day.

- On 3.5.2012, $SPY had traded for 45 days without a significant down day.

- On 9.24.2012, $SPY had traded for 44 days without a significant down day.

What does all this mean? I don’t really know. Sometimes it is just fun to play around with the data. I played around with idea before here: 40 Days Without a 1% Pullback: Bullish or Bearish?

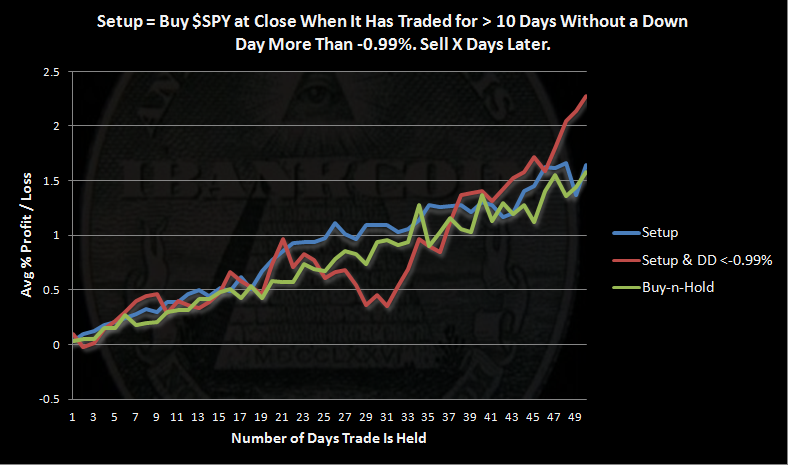

Today was the 10th day $SPY has traded without a down day of <-0.99%. Let’s treat this as a setup and look at what has happened in the past.

The Rules:

- Buy $SPY at the close when it has been > 10 days without a down day of <-0.99%

- Sell at the close X days later.

- All $SPY history used.

- No commissions or slippage included.

For fun, I’m adding an additional variable (Setup & DD<-0.99%) which is simply the setup and a down day of <-0.99%.

The Results:

So yeah, nothing much to see here. The setup tracks fairly well with buy-n-hold.

Perhaps one takeaway is that once the down day occurs, results tend to get a tad more volatile. However, without running more tests, I can’t say for sure that the increased volatility is due to the down day or because the market is changing after the down day or because there were fewer samples.

It would be a mistake to assume that just because $SPY hasn’t had a big down day that performance will revert to the mean. Instead, there may be a miniscule edge here.

ASX hasn’t had such a setback since November

Running on fumes up here

Incredible!

And, did I jinx the market with this post?