Cuervo has posted over in the Peanut Gallery a simple trading system he calls the 357SPY.

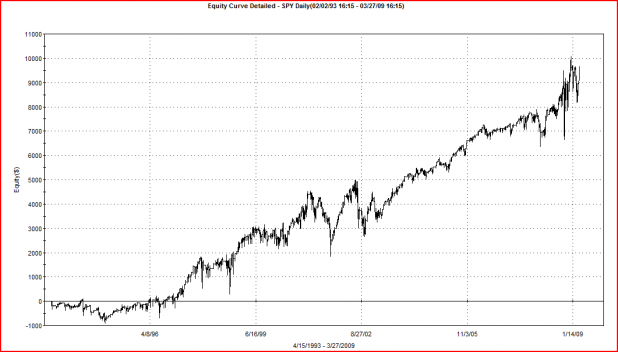

Nothing can quite explain how the system trades like an equity curve, so I am including one below, of the 357SPY.

For these tests, I assume 10K per trade, without compounding gains, .01/share commissions, and no stops.

The results aren’t too bad. If nothing else, with a 65% win rate over 546 trades, the 357SPY may make a good timing indicator.

Still, we can run additional tests to determine how robust a system is.

Lately I have been experimenting with Monte Carlo simulations after discovering a neat, free utility called Equity Monaco. For the more discretionary traders out there, Equity Monaco will work for you as well because all that is needed for the calculations are the profit/loss figures from each trade, in a .txt file. For example, here are the results for the first 10 trades from the the 357SPY: -198.47 22.70 -85.80 39.96 24.64 81.00 28.99 17.84 -24.53 6.66

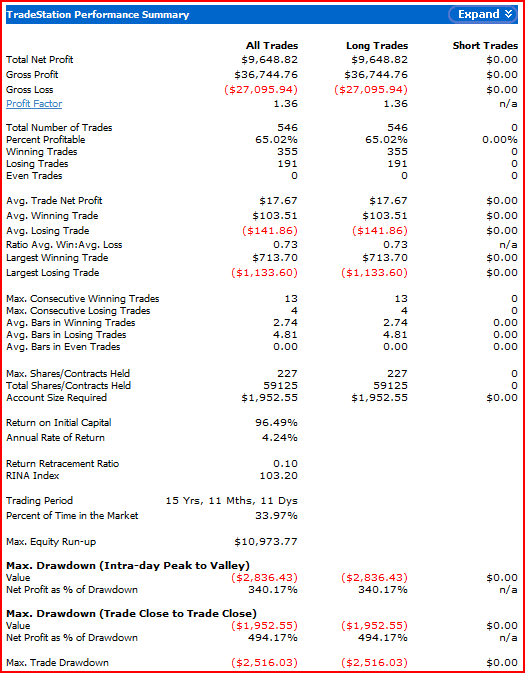

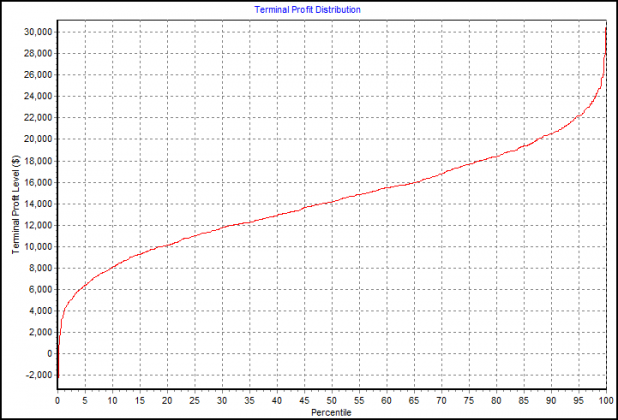

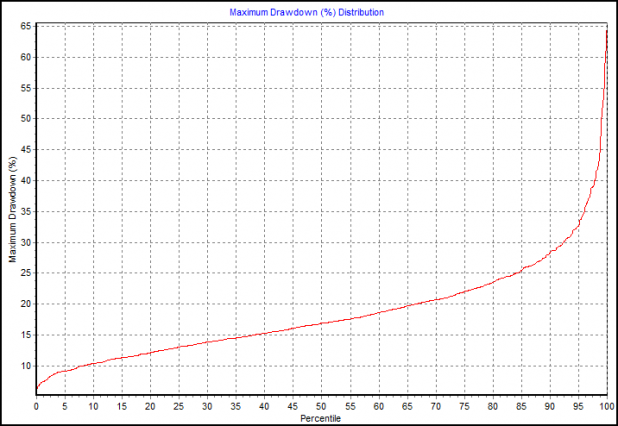

This Monte Carlo simulator takes the historical sequence of trade results from the 357SPY and scrambles their order, (randomizes them) then puts them back together, and re-calculates the results: The profit, drawdowns, wins in a row, etc., of the sequence of trades are then recorded. It then does this 1,000 more times, recording and plotting the results of each trial.

The Monte Carlo results will help us determine if the 357SPY’s results are due to chance, or because of a legitimate edge. In the tests below, starting capital of 10,000 was assumed.

Terminal Profit Distribution shows that in 95% of the trials the 357 system made less than $22,000 in profit. However, in less than 5% of trials did it make less than ~$6,000.

Max Drawdown (%) Distribution shows that 95% of the trials had drawdowns less than 34%.

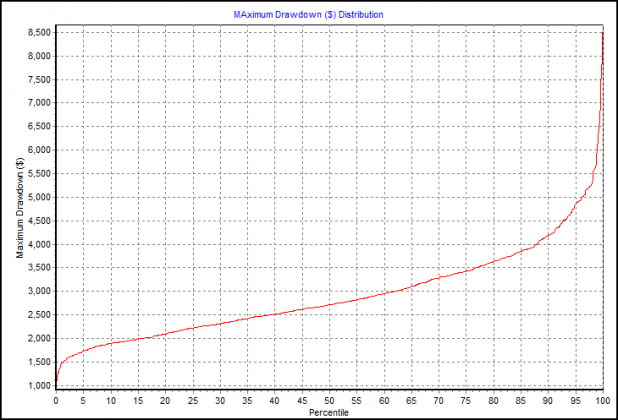

Max Drawdown ($) Distribution shows that 95% of the trials had maximum drawdowns less than $4,750.

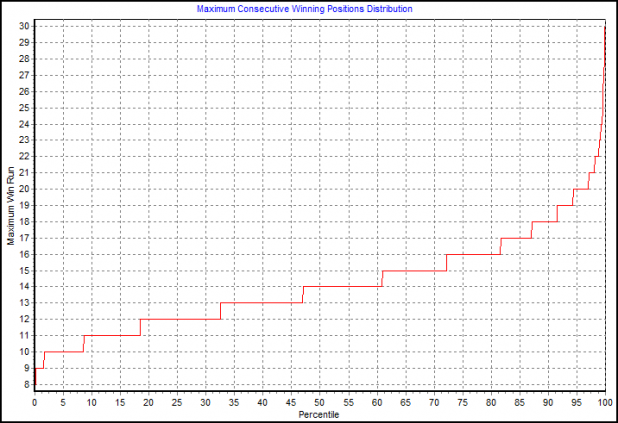

Max Consecutive Winning Positions shows that 95% of the trials had 20 or fewer wins in a row.

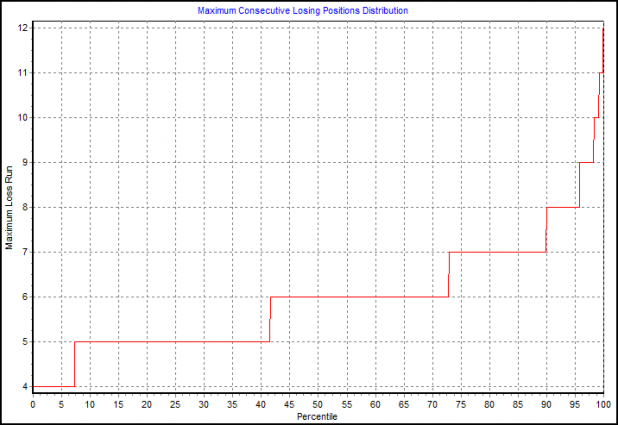

Max Consecutive Losing Positions shows that 95% of the trials had 8 or fewer losers in a row.

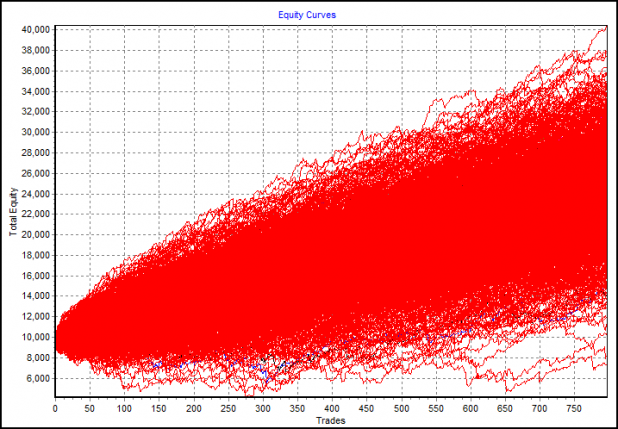

The Equity Curves show all of the possible equity curves from the randomized trade data. Of interest here is that only 2 trials had terminal equity of less than 10,000. (Look at the very right side of the chart for the two squiggly red lines beneath the 10,000 line.) A hand-drawn best fit line looks to me as if it might end somewhere between 22 and 24K. This would represent profits of between 12-14K over starting equity. The system, as tested on Tradestation shows a total equity of $19,648.82. While this might be slightly less than we would expect, the number still falls well-within the fat part of the distribution of equity curves.

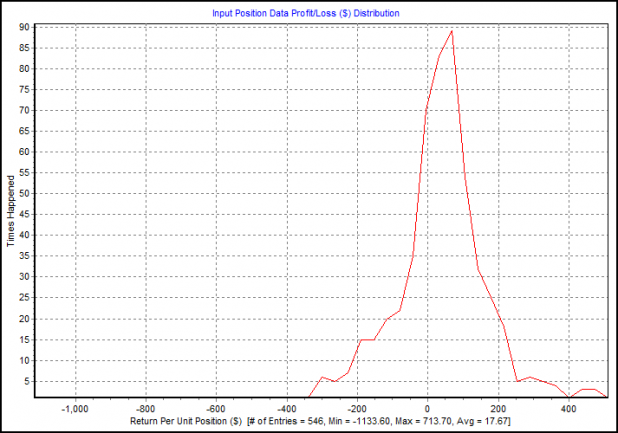

The distribution above is perhaps the easiest to understand. It shows the distribution of the raw trade data.

Summary

While the 357SPY can only be expected to earn a small but consistent single-digit return, one would likely not have lost money trading it (unless you were really, really unlucky) over the past 16 years (not including opportunity costs and inflation). In other words, one won’t get rich trading this system, but neither is he likely to lose money, if he trades it over a long enough period of time.

Of course the market is always free to undergo a regime change, which means that the 357SPY may stop working one day soon. However, the results of the last 16 years do not appear to have been achieved by luck alone.

very, very cool.

I thought you might like that B!

Wow. Thanks for the follow up on my post. Again I’m honoured.

I went to sleep last night thinking the same thing about this system being more useful as a timing indicator however, the unfortunate bit is that any freely available database of equities over the last 16 years (such as Yahoo!) will have survivorship bias.

Thanks, that thing is a lot of fun. I got a test spit out by TOS from it’s strategy module, and for the settings, I used the same number of positions as the test had, and fixed trades at 1 contract. Results were above the total of the test itself in 99% of cases, up to over double. So, the test itself was near the low edge of the equity curve blob – not sure why it isn’t the average..?

Oop, got it, used wrong number of positions (trades).

Cuervos, no problem man. You know I like to run this type of stuff!

I could be wrong, but I do not think survivorship bias is an issue with the ETFs.

Now, if you were testing this individually over all the stocks of the S&P500 over the last 15 years, then yes, there would be survivorship bias unless you pay for great data.

Well, I was thinking of equity tracking for the sixteen years via going long equities with high beta when the 357SPY calls for a buy.

I thought I saw somewhere a formula to ‘detrend’ surviorship bias but I may be imagining it.

357SPY is a buy today…

Yep – looks like it might end the week with a positive trade. ChiScore == 7

Yay…first trade with the 357 was a win.

Long monday @78.79

out today @81.03

only did 100 shares.

Congrats Rob!

Nice one Rob.

Keep your eyes peeled in the PeeG – I have another post coming.

@cuervos: nice, cant wait.

its kinda funny that i took the position because who would have though it would have worked out with Monday closing below the 50sma and gaping down real hard with the GM news. Only to fill the gap today. I would normally never take overnight risk like that, but i figured with all the probability on my side and it was only 100 shares whats the worst that could happen. 🙂

Rob, with these mean reversion systems, it is possible to enter a position and then be wrong for several days to a couple of weeks before the exit signal hits.

Just be ready for that eventuality and be sure to have a plan to deal with it when it occurs.

@Rob – you should backtest the 357SPY in October 08.

It took a few trades that literally would have made your head spin.

The revised version (LOG2SPY) takes a $10.34/share hit on a closed sale that started on 10.2 and ended on 10.13

It followed up with five back to back trades over the next four weeks to end up with an aggregate win of $10.99/share

But, heed Wood’s warnings very closely. Just because it’s right 67% of the time doesn’t mean your account can’t get seriously hurt.

Thanks for the advise. I pairs trade, so i know how nasty reversion can get. I made up a plan based on that equity monaco software and excel so i am going to play it forward to see how it goes.

@cuervos: i am not risking much of my account, so the only thing that would get seriously hurt is my faith in the system. I am doing it to find out how the system trades, and maybe find a way to improve on my pairs trading. As you and wood were saying before, it might be a good timing indicator.

Keep us updated Rob.

Did you try out the Equity Monaco?

@wood: yes, i have been looking for a program like that for a while (thanks!). i have been doing most of my statistics/probabilities in excel or c# and its a bear to have to learn about all the math involved and they wonder if you are applying it right.

Glad to help Rob! I think it is a really neat free application.

357 wins again!

4/7 MOC @ 81.65

4/8 MOC @ 82.66

Nice job Rob. 2 in a row, no?

I guess I need to start publishing the signals.

yarrrr…2 in a row it bee

Make that 3 in a row.

4/20 [email protected]

4/22 [email protected]

Nice Rob. I need to go back and look at how streaky the system has been.

Using all the SPY data available, this system just hit a new equity high.

There were 18 occurrences of 3 wins in a row

12 occurrences of 4 wins in a row

7 occurrences of 5 wins in a row

5 occurrences of 6 wins in a row

6 occurrences of 7 wins in a row

There was one occurrence each of a winning streak of 9,10, and 13, winning trades in a row.