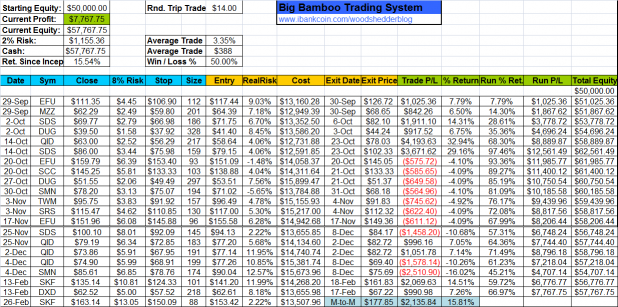

Highlighted above in a pleasing blue hue is the latest Big Bamboo trade, marked-to-market as of Friday’s close. Personally, I’d be closing the trade on Monday’s open, even though the exit criteria has not quite been met (the exit criteria might change in the near future. See below).

The column “RealRisk” calculates the distance from the stop price to the entry. The system uses the previous night’s closing price as the entry price in order to calculate position-size for the next open. It shows that SKF gapped down over 6%. (Perfect RealRisk would be 8%) When the diETF gaps up, the RealRisk metric gets more interesting as it shows how much more risk the trade is taking on, should the stop not get adjusted. Worst case scenario is that it gaps up big and then reverses, taking out the original stop set for the approximate entry. This scenario ensures a loss greater than 8%.

When I trade these signals, (I don’t always trade them. The BB is experimental) I use an offset stop which will automatically set 8% beneath my open no matter whether the diETF gaps up or down. This avoids the risk issues discussed above.

I’m Going to Be Making Some Changes In the Big Bamboo

I’ve really not put a lot of time into this system. I started out publishing it here primarily to deal with the psychology of system trading. Because of this, I have not applied any serious optimization, and I have not added any leverage or trend position-sizing to it. (For trend position-sizing, see the posts part 1, 2, and 3.)

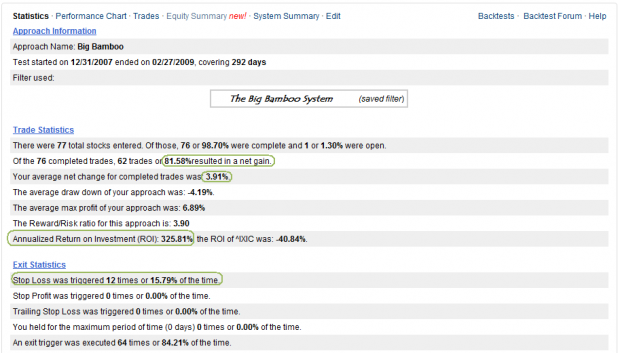

A system that has been my primary focus over the last few months is finished, so I’m ready to move on to working on some new ones. I’ve been reviewing the Big Bamboo system results since 12/31/2007, and frankly I think it deserves greater attention as it seems to show promise.

What I’m Going to Consider Changing First

- The exit: Currently the exit is a close with RSI(2) > 80. That is probably going to change to RSI(2) > 70. It needs more testing, but preliminary results show that it improves things a bit. Feel free then to sell SKF on the open Monday, not that anyone takes these trades! I have also developed a completely different exit for this system. I will continue testing it and will report progress as necessary.

- The entry: As Technical Analysis of the Leveraged ETFs is not supposed to work, I’m going to try generating the entry signal from the underlying index or ETF rather than from the leveraged ETF. I have already done preliminary testing of the entry on the SPY, DIA, and QQQQs and it is has been consistently profitable over the past 15 years. It may be that the system improves, or does not, generating the entry from the underlying. I am also going to run some optimization over the entry signal to see what happens.

- The trend filter: As currently configured, the system uses a rudimentary light-switch style trend filter which turns the system on when it gets a trade with the trend and turns it off otherwise. I believe I can configure the Big Bamboo to trade twice as often, both with the trend and against it, and generate even better returns using trend position-sizing.

Overview of Results Since 12/31/2007

8% stop used. A max of 2 new entries a day was allowed with no more than 4 total positions. These results use an exit of RSI(2)>70.

The results are simplified and should only be viewed as a proof of concept.

What program (website?) generated the statistics report for the Big Bamboo System?

David, Stockfetcher. It is great for preliminary testing, proof-of-concept type stuff.

Wood: Good idea to model with the unlevered index. That makes a big difference in my studies. Also, I’ve found that triggering off of mutual fund indices is much more efficient, as compared to ETFs, because the intraday volitility is just not there–presumably, action in the mutual fund index better reflects the price of the underlying components. Who knows…

I was also surprised a few days ago when I ran my S&P trade system on IWM. The fit was much better (by a bunch). The S&P system also showed a huge benefit when run on QQQQ and QLD. Now, this is only on data from the first of the year, so, I don’t know how it backtests prior to that. It has definitely made me think of switching over to the Russell and Q’s for near-future trades. With the Russell you could get 1X, 2X, and 3X, and that would interrelate to the drawdown issues you’ve been discussing lately.

OT, but over the weekend I’m also going to try the Wilshire index for kicks (VTI), because that presumably models the entire universe. So, one might expect it to have less “noise” in terms of generating signals for trends–maybe not. I’ll let you know if anything interesting shows up.

Hope you feel better after the whatever you had….