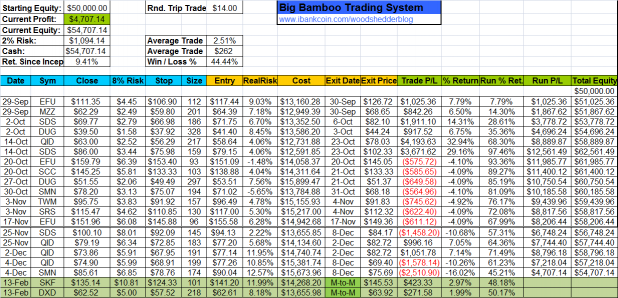

On Friday’s open the system bought SKF and DXD. The trades closed in the money. DXD has met the exit criteria of RSI(2) > 80 and so it will be sold on Tuesday’s open. SKF has an RSI(2) still in the 70s so it will be held Tuesday.

The spreadsheet shows a win percentage of 44%. This is much lower than the backtested 76.71% win rate over 73 trades since 12/31/2007. I can reason that there are two explanations for this. The first explanation is that the Big Bamboo is losing / has lost its edge. While this is certainly possible, I doubt it. When I test the entry (proprietary) across other markets and combine it with different exit criteria, the edge is very strong. As RSI(2) is still very effective for timing both entries and exits, I do not think the exit criteria is weakening either.

The second explanation is that the system is at the bottom of the inevitable performance valley. If it is going to trade out of this valley and to another peak, the win percentage will climb back to meet or exceed historical expectations. I find it likely that the system is going to rip off a half-dozen or so winning trades in a row, bringing the win percentage up with it.

For anyone not familiar with this system or the series of posts that accompanies it, I am not recommending trading the system, although I have, from time to time, traded the signals in my personal account. Instead the posts are to help non-system traders understand how trading a system presents its own psychological challenges and does not necessarily “remove emotions from trading” as some might like to believe.

Back in December when the Big Bamboo was in the midst of a losing streak, some were wanting to proclaim the death of the system. This is the same mistake that some system traders make, which is to quit trading the system during the deepest part of a drawdown. My experience leads me to believe that systems will recover some of their drawdowns, even if they are beginning to fail.

It will be fun to see what happens going forward.

Woodshedder,

I should have been more clear about the after hours (AH) question. I was thinking more of strategies that could be played at earnings announcement time, such as buying at limit in the AH to catch a spike at a good price on earnings. XYZ closes at 100. I have a limit order for $102 hoping it will bounce on earnings. If the limit order is filled, I will then decide to sell or hold during the next regular session. I’ve never heard anyone speak on the subject.

Thanks

Dave, unfortunately I don’t think I’d be much help there.

If I were to look at a system built around that concept, here is how I would structure it.

1. Use intraday bars, say 15 minute bars.

2. If close of first 15min bar after earnings release is X% > than the close of the 3:45p.m. bar, go long at the open of the next bar.

3. Continue using 15 minute bars and test how many bars pass, on average, before price falls beneath the entry point.

That would give you a preliminary understanding of whether the system is worth developing further.

For example, you might find that on the current setup, on average, 60% of the time the trade stays in the money for 6 bars after entry.

Historically i have stayed away from trading around earnings announcements so I have never formally tested a system such as you mention.

Thanks for the input.

Shed, thanks for the recommendations. For some reason I never checked the Library tab. I’ll check some of those titles out.

Dave, as I think more about this, one of the problems would be getting the data ready so that testing starts on the day of the earnings release. I’m sure that someone out there knows how to format the data to start on ER days, but I do not.

Hey, just curious if you have a specific criteria for determining when a system has stopped working as opposed to just being in a drawdown.

I could imagine someone with a ton of faith in their system riding it all the way down to nothing waiting for it to pull out of a slump. I could also see someone losing their nerve and abandoning a good system in the midst of a normal streak of losses,as you mentioned above.

Would you stop trading with it when it exceeded the max. drawdown that is expected from testing? Do you trade smaller as the losses continue?

Fred, we are working on specific criteria for determining when a system has stopped working as opposed to just being in a drawdown.

When evaluating System Health, it will include a Chi^2 score, a plot of actual win% over the last N trades to compare to expected win%, and it might include other statistical measures such as Z Score, as well as a rolling average of profits/losses.

As for riding a system down to nothing, possible, but I highly doubt a profitable system just quits and goes to nothing. Likely it would quit working over a period of many months or years. Hopefully this would give enough time evaluate the underpeformance and either tweak the system or forget it.

I hope that traders would have ascertained an expected number of losing trades in a row, and then doubled that, to have realistic expectations. Similarly, I would expect that the worst drawdown is always on the horizon. Therefore I would want to expect that the worst drawdown may be double the historic drawdown.

Trading smaller during underperformance is a great way to minimize the pain. I advocate a percent-risk formula which will size down after losing trades.

Strangely enough, the system we have been working the hardest on to roll out SOON will not use a stop and will not use percent-risk position sizing.

I’m off to V-day dinner. I’ll continue thinking on this and chime in later this evening.

Shedder-

Did you know that Ben Bernanke used to work at South of the Border on I-95 in Dillon,SC? He actually grew up there.

He also went to the same school that Obama mentions with the train running next to it, decrepit…

Dillon,SC.

from the WSJ

http://online.wsj.com/article/SB123454070638883495.html

Put a moving average on your returns and when that MA starts to turn down, flip your strategy. That makes great sense to me. Market sci says 200, I would probably use 100. Now the strategy adapts to changes in market psychology.

Fred Garvin -nice posedown!

I always like to begin the session by striking a few seductive poses.

http://www.truveo.com/Saturday-Night-Live-Fred-Garvin-Male-Prostitute/id/388647488

Thanks Shed, I’m reading Tharps “Trade Your Way…” currently. I’m new to the systems approach so it’s all very interesting. I appreciate all the work you’re doing and sharing with everyone.

Cheese, no way! Nice link. Being an SC boy, I have friends in Dillon, and as my family is still in the state, I pass through South of the Border many times each year. Very weird. I always assumed Bernanke was from NYC.

Shed-

Every-time I see a Pedro sign I now think of Bernanke serving burritos at SOTB.

Obama mentions the damn school every chance he gets(last weeks prime time), I doubt he realizes his fed secretary went to school there. Not to mention the whole yes we can video by will.i.am. What a load of shit.

watch here at 3:10:

http://www.youtube.com/watch?v=jjXyqcx-mYY&feature=related

Cheese, favorite Pedro sign? I like the Virgin Sturgeon you see heading north. Also, the cows or were they sheep that used to turn on a motor and jump over the moon.

Did you see that link that was posted somewhere on iBC that discusses Obama’s mom working with Geithner’s dad back in the 80s? Nothing is an accident, or uncalculated.

Shed-

Nobody in the MSM will find this linkage, but if the school in Dillon, SC is so damn bad how did it produce the Fed Secretary????

I rest my case.

Favorite Pedro sign has to be the one telling me to turn around after I’ve passed it. That place is beyond a shithole. I give it 6 months to BK (sorry Pedro).

Yeah, the irony about Bernanke and Obama’s school story was not lost on me. I wonder if Bernanke is amused.

As for SOTB going BK, never underestimate the power of fireworks over immature men.

Shed-

True on the fireworks, they may pull the cart for awhile. Bernanke has to be laughing at much of the BS from Obama.

Served a low country boil to wife and some friends this evening. Time to pack it up for later, nothing like cold cob and shrimp for breakfast.

Figures Bernake is from SC. Just another plot by you confederates trying to boost crop prices and ruin yankee banks.

I like Danny’s idea – I hadn’t thought of that one but it makes sense.

The only problem I have with using the Z-Score is that it, as I use it, generally points to when there will be a reduction in earnings.

The other downside with the Z-Score is how it will handle 4.5 Sigmas.

Cuervo, for the Z score… think of it in terms of it measuring whether streaks of winning and losing trades are happening due to chance or whether they are demonstrating dependency. Some may call it the “runs test.”

Just to be clear, you have not published the actual formulas for this system right?

Thanks – G.

Gerry, the exit signal is simple: Close trade if RSI(2)>80.

The entry is proprietary.

There is a trend requirement for the system which I haven’t ever published formally, but I’m going to be discussing that aspect very soon, in an upcoming post.