It has been months since the last time I published The Daily Breakout.

My gut reaction about today says that we have seen the first day of the best rally since the March-May rally. Since my systems are not giving any signals here, I’m going to have to make some discretionary purchases.

The following stocks are some of the ones I’ll be taking positions in. You might notice there are a variety of bottom, breakout, and pullback plays.

Technically speaking, across the indexes, today was beautiful. I feel strongly that today was a very powerful reversal. If you want a good look at why the reversal today has me so excited, take a look at the work WeeklyTA is doing over in the Peanut Gallery.

Apollo Group, Inc. [[APOL]]

ATR% 6.00

Bucyrus International, Inc. [[BUCY]]

ATR% 14.4

Dollar Tree, Inc. [[DLTR]]

ATR% 6.00

Hawaiian Electric Industries, Inc. [[HE]] This one is for Gio!

ATR% 4.1

LHC Group, Inc. [[LHCG]] One of my systems picked this one last night, as well as Almost Family, Inc. [[AFAM]] . It seemed like sure death to buy these on the open, so I didn’t. You win some and you lose some.

ATR% 6.5

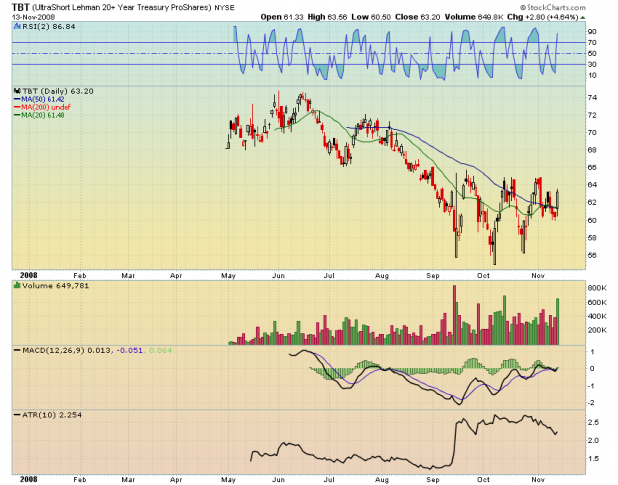

[[TBT]]

ATR% 3.5

I have listed the ATR% after each chart. This percentage is the volatility normalized so that each security can be compared to the other, in terms of volatility. To use this percentage, think about it this way. Buying 10K of BUCY and 10K and TBT is not equal, in terms of volatility. BUCY is more than 4x as volatile as TBT. If I want to keep my risk on each position to a certain percentage of equity, then I will have to set a larger stop on the more volatile issues. Therefore I would be buying fewer shares of BUCY in order to give it more room to move while still risking the same amount as on the other positions.

Thanks for the info.

Newbie Question – how do you compute the ATR?

ATR/close

Love TBT.

BTW:

I know you do not visit iBankCoin much, buy WeeklyTA is KOPG, not in the PG.

Woody,

nice post.

Nice work, good to see the technical breakouts back on the Woodshedder blog. BUCY & APOL & TBT looking the best to me…

Loving the picks.

It feels good to look at a damn breakout again without feeling like buying it is a hopeless proposition.

Fly, some simple logic for you.

A King lives in a castle, no? He lords over a geographic region, no?

lol…

two things – BUCY volume is fantastic

TBT – the price/MACD diveregence

lol…my geographic region is 3×1 inches.

BUCY – volume is fantastic, best out of all here

TBT – price/MACD divergence

PPT Stats on BUCY:

Debt/Equity 4

PEG Ratio 5

Price/Book 4

Price/Sales 5

Profit Margin 3

Sub Rosa 0.1

Final Score 4.35

PPT Recommendation: Strong Buy

Accumulation Distribution 3

Price Performance 1

Relative Strength 1

Volatility 3

Volume 3

Sub Rosa 0.3

Final Score 2.30

PPT Recommendation: Sell

Hybrid

3.16

Buy

BUCY is ranked #1 in its respective sector. Here are the others-

No. Ticker Technicals Fundamentals Hybrid Score Hybrid Change

1 BUCY 2.3 4.35 3.16 19.7%

2 AG 2 4.7 3.13 12.59%

3 ASTE 1.95 4.7 3.1 11.51%

4 JOYG 1.7 4.5 2.88 15.2%

5 VMI 1.75 4.35 2.85 15.38%

6 LNN 1.55 4.6 2.83 9.69%

7 CMCO 1.6 4.4 2.78 13.01%

8 MTW 1.3 4.8 2.77 6.54%

9 CAT 1.75 4.15 2.76 13.11%

10 TEX 1.4 4.5 2.7 6.72%

11 CNH 1.35 4.3 2.59 7.02%

12 DE 1.3 4.25 2.54 4.53%

13 CAE 1.7 3.3 2.38 8.18%

This is why I need the PPT. Now.

BUCY looks really good, but the options are ass-expensive. On the other hand, CAT or TEX or DE, with a very similar charts have lower IV and spreads.

I agree with your ‘gut reaction’.

Good stuff, Wood.

just a heads up: LHCG had some big insider sales last two weeks. AFAM too, though not as dramatic.

personally, i hate seeing insider sales in conjunction with 52wk highs.

Ike, I bought everything on the above list except for LHCG.

1.25 ATR stops.

mwhaha a woodshedder top

i totally wasn’t trying to be a wet napkin on that. i appreciate all the hard work you share.

=]

BUCY looks great! i’m buying on this dip.

Its funny you have GE on there. I was just discussing with some investors down here, thinking about going long.

oh yeah, GE pays a really good dividend. They have a monopoly on electricity here.

Ike, I didn’t take it that way at all. No worries!

Ooops. Not GE. I meant HE = Hawaiian Electric.

Mahaloz.

BUCY looks joozey.

Can JOYG be far behind (after it breaks that triangle?)?

_______

Okay wood, long BUCY here. what’s my stop? I dont know squat about ATRs.

Ditto on BUCY

Gio, my stop is set 4.51 beneath my entry, which would be a 1.25ATR stop.

Basically, this will give BUCY room to move its average daily movement, plus some wiggle room to keep the stop from being hit.

Nice bullish call. Maybe your charts are upside down? There is no such thing as a “system” for trading, unless it adapts to changing behavior/sentiment/conditions. You can trade a “method”, but stop wasting time looking for a system.

TBT 60.70 -2.50 -3.96%

LHCG 30.96 -1.89 -5.75%

HE 26.68 -0.87 -3.16%

DLTR 39.02 -0.98 -2.46%

APOL 68.02 -2.54 -3.60%

BUCY 25.67 0.67 2.66%

In my earlier post I do not mean to call Woodshedder “stupid” or deride his postings. He does good technical analysis. The point is mechanical systems will not work until the “black box” models can think. To this day no neural network, A.I. or any mechanical system can perform like a human brain and they are all destined to fail. Woodshedder’s best teaching is in the area of stops and money management. Those items will insure survival in any market.

Woodshedder:

Does today’s action change your breakout thinking?

Thanks for the suggested buy charts. I agree with Gio, BUCY looks good and managed to stay green.

TenDollarTommy, in your haste, you have erred, greatly.

Slow down. Take a look at my Covestor widget. Note that Covestor tracks my trades, in real-time. You might consider them audited, if that helps. Now, you will note via that beautiful equity curve that my systems have done very well. You may also want to check the rankings at Covestor, where you will find that I’m in the top 10, of over 10,000 traders.

The only trades tracked on Covestor are system generated

trades. Furthermore, I am trading systems which have adaptable components, which do adapt to market conditions. You might also want to read my posts on the Big Bamboo. There are adaptable components being developed for that system.

The failure is of the human brain, not of the system. Systems will out perform humans, time and time again. The reasons most systems fail is that humans over ride them due to their biases and psychology.

Last time I checked, 4 of the 6 systems I am trading were up over 100% for this year.

Finally, the purchases I made today were DISCRETIONARY, as I noted clearly in my post. That means they were not generated by any system.

So…maybe you want to retract some of your statements about systems?

Pinball, I was not happy about today. I was probably early with my breakouts, but hey, hindsight is 20/20. The biggest thing to keep in mind is to make sure that your risk is managed and is acceptable for your goals.

I’ll do a post this weekend and flesh out my thoughts a bit more clearly.

$10,

ouch. You were just bamboozled.