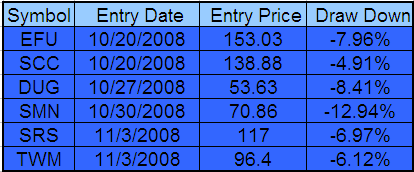

Above are the 6 most recent losing trades from the Big Bamboo system. I’ve included the maximum drawdown incurred for each trade.

As I mentioned in a previous post, with volatility more than doubling in October, the stops that worked well in backtesting should probably be doubled as well. This would take our optimum 4% stop and increase it to 8%.

Indeed, an 8% stop would have changed 3 of the six losing trades into winners (I’m not going to count EFU since it was so close to 8%).

As I know that some of you are taking at least some of these signals, I would recommend that you do not use the 4% stop until volatility decreases. I have not decided yet whether I will alter the system to use an 8% stop in tracking future trades.

After examining these trades, I feel even better about the system. I am likely going to start trading it for real, by the rules, soon. If I do, I am leaning towards using a 10% stop.

Side note: Some of the entries listed above are different from the entries used in the Big Bamboo tracking spreadsheet. The opening prices used in tonight’s post came from a different data vendor. I left them unchanged, not matching all of the prices used in the tracking spreadsheet, to emphasize that in backtesting, having bomb-proof data with absolutely no errors is crucial. With the exception of EFU (off by almost 2 points, our listed open being $151.09), the difference was usually not more than .20 cents. The discrepancies were not great enough to render tonight’s analysis invalid.

Â

If you use a 10% stop, you’ve altered the system and changed the risk/reward characteristics of your trading. Might as well throw out your paper trading results.

Trader X, in the archives are the risk/reward characteristics of the 4, 6, and 8% stops.

The current volatility is certainly large, by historical measures. The trades I have tracked have avg. wins that are a good bit larger than what one would expect through backtesting. That is because with larger volatility comes the chance for larger wins. More volatility also means tight stops will be hit. Loosen the stops, and the larger than expected wins become attainable.

To handle the looser stop, position sizes are smaller, to keep 1% risk. The question is whether the reduced position size is large enough to capture the outstanding gains that the current market is providing. Or, is it better to keep tigher stops, stop out more often, but have a BIG position on when it does win.

Throw out the paper trading results? Why would I do that? I would just note on the spreadsheet when the stop % was adjusted. The methodology of the system, the entry and the exit, are sound. It would be ridiculous not to adapt a winning system to current unprecedented market conditions, so that it can win even more.

like I said the other day, the most sophistcated model couldn’t deal with all this political tripe. You should knock off like 4 of those loses. El bamboo grande will be punching off pony tails in no time!

Don’t you know that Panda BEARS eat bamboo !!!

this system kicks ass…

I’ve been “semi trading this” system, which I understand motifying it kind of eliminates the whole “system idea”, but this system seems so reliable, even when it has a steep decline, it manages to bounce back above the buy point it seems.

Basically I’ve been following the BUY reccomendation at my disgression, and only in 2 increments rather than all at once. I was starting to hate myself for not just following the system exactly when SMN was down in the low 60s after buying in he low 70s, but it was oversold so much when I first entered, that I was expecting a significant bounce once it finally did, so I stuck with it, not that I’d reccomend it to other people, but with the volitility like this, and the way the system is working, the trade seems too good to let yourself get shook.

Maybe I’m taking away the point of a system trade, but hey, it’s working very well.

Are you ever going to let us in on the “special sauce” that triggers the trades?

Is it something anyone can find,or is it a custom made indicator?

Hattery, I’m so glad it is working for you.

I think it has become obvious that the stops have to be loosened.

BHH and I are talking more and more about volatility stops, using ATR. I am going to spend more time discussing those in the future. If I get bored, I may go back and recreate the trades so far, with an ATR stop, to see what kind of different results would occur vs. the 4% stops.

The special sauce is an indicator that is fairly well-known, but has been modified.

I’d be curious on how much better the system would work in reverse.

as in shorting the opposite ETF.

So if it selects long SKF, you short UYG

If it selects long UYG, you short SKF.

Hattery, it would probably work. However, then you’d have to wonder when you’d exit? When the original signal crossed above RSI2 80? Or would the act of shorting it require a different exit?

A large part of me likes to keep it simple. However, I guess you could even split the trade between the long inverse and short the double long.

Gwar, I prefer to just let this thing run, through thick and thin, to see what happens.

Wood, I was thinking you’d watch the RSI 80.

But now I’m thinking about it, and it would be complicated and not effecient.

Lets say some inverse ETF and regular ETF are both priced at $100.

SRS $100 and URE $100

If you short 10 shares of URE, that currently takes $1000 to buy back.

Compared to someone who buys 10 SRS that’s $1000

Now if the underlying stocks go down 10%, URE might go down slightly more, so maybe it goes down 21%

and maybe SRS goes up 19%

so SRS is worth $119 1190. profit: $190

URE now cost $79 so to buy back costs 790. profit $210

All well and good, but what happens with another 10%?

SRS compounds the interest and goes to 141.61. to 1416.1 profit 416.1

The URE position declines from $79 to 62.41, your $790 turns to 624.1. profit 375

because of the way the exponential decay works, the gains cannot be as big, unless you make sure to keep your position at the buyback value of $1000 that you started with.

So in order to make the short out perform, you’d have to go from shorting $1000 worth of stock to $800, and then add onto your short so it would cost you $1000 to buy back again.

This would certainly complicate things, add in more brokerage fees, and be more work.

of course you are right to let it run it’s course. I’m just giving it a pat on the back. I’d like to have my own bamboo someday. Hopefully you’ll market it someday like the Ppt

Wood – you know me and my adaptive systems, have you considered backtesting a completely adaptive stop level so that you (a) don’t have to worry about manually adjusting it in the future and (b) know that the idea of moving the stop has been historically successful? michael

Michael, we are working right now on trying to test a completely adaptive stop level.

It is my understanding that a new release of Trader’s Studio will allow BHH to run tests, complete with position sizing, on that sort of thing.

However, O King O’Adaptation, I would love to hear your suggestions, advice, etc., as I had not really thought formally about adaptive systems until reading your blog.

One of the biggest problems is that there is only about 2 years worth of data for these ETFs. How did you overcome that limitation? Did you use a proxy of some sort?