Today, [[DUG]] threw the Big Bamboo a curve ball. It took a swing, and missed.

I bought some at the open and was filled at $53.84, which shows .33 slippage (.6%)Â from the listed open. I was stopped out, as was the system. I used a 6% stop (rather than the 4% being tracked)Â to give it some room. The volatility makes for challenging risk management. There are starting to be questions in the comments section about alternative stop strategies. I’ll try to get to that soon, in an upcoming post.

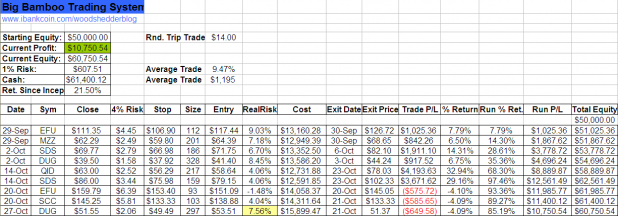

Note the yellow highlighted cell. Had a stop been set based on Friday’s close, the real risk of the trade would be almost double the expected risk due to the gap up. I cannot emphasize enough the importance of stops that automatically offset from a market order entry.Â

The loss on this trade was slightly more than the expected 1%.

No New Entry Signals for Tuesday

I trade like a gambling addict sometime.. the whole point of a system is supposed to prevent me from making decisions based on emotion, no?

LOL, but I ended up buying DUG twice today, one near the open after it diped, and one around 51 when it should have stopped out. I rode out the day anyways, proving to myself I’m sweet…

Although in the long run, it was a horrible decision, that I should’ve been punished for… but the market does weird things, confusing people, and training them to be compulsive gamblers… Turning the weak like me into the stupid labrats that continue to shock themselves to death by pressing the “button” that occasionally spits out food randomly, even though in the last 20 tries it hasn’t.

But I got food this time, and now I’m hungry for more, like a stupid labrat who should be dead, but somehow defies the odds.

I use TOS which has professional order entry like we’ve been talking. No problems with the previous orders, but this one was an instant scratch. My market on open filled @ 8:30:18 for $53.84. With a 4% stop below the trigger price, I was hit and a market order closed out 2 seconds later for 53.96

Any thoughts?

B-rad, I have no idea??? I guess, on a positive note, at least you scraped out a .10 gain!!! lol

Shed – 6% is a huge stop for me, especially in this market. I am keeping 1-2% as a rule. But then again I am a degenerate OTB guy too.

One critically important point that many people fail to realize is how much money one looses on a failed trade is completely unrelated to the stop size. That is the whole point of position sizing. If one is risking 1% if their portfolio on a 6% stop, you loose the same amount than if one is risking 1% of their portfolio on a 2% stop.

The issue is that the 2% stop will fail much more often so the win rate is higher on wider stop while risk/reward ratios are better on a tighter stop. The “better” option is far from clear. If one places a great deal of importance on being “right” more often(most people), a looser stop will provide that. If one can tolerate being “wrong” more, the better risk/reward ratios of a tighter stop will ultimately generate more money at the expense of a decreased win-rate and larger drawdowns/equity swings.

This is not complicated math but many people just don’t seem to ever connect the dots. Boomer, this is not directed at you specifically. Someone mentioned not using any stops at all. The problem with that is you are technically risking 100% of the position on each trade so risk/reward ratios are terrible and position sizing becomes completely decoupled from risk managment.

Good NYT column referencing Taleb:

The Behavioral Revolution

By DAVID BROOKS

Published: October 27, 2008

Roughly speaking, there are four steps to every decision. First, you perceive a situation. Then you think of possible courses of action. Then you calculate which course is in your best interest. Then you take the action…

http://www.nytimes.com/2008/10/28/opinion/28brooks.html?hp

B-rad:

First, I’m assuming you used a ‘1st trgs…’ order, with the first being a market order to buy, and the 2nd being a 4% stop from the trigger price, yeah?

I’ve had similar wild fills happen with market orders at the open with ToS…nowadays, if I want to buy at the open, I always put a time condition on the order as well…say submit the 1st order 1 minute after the open and put a delay of another minute on the 2nd order. Since you’re using a stop price from the trigger (1st order), this won’t have a detrimental effect on that but you might be able to avoid some of these egregious fills…

DPeezy,

Thanks for the info, I will certainly start doing that, it will only take a couple of extra seconds. Did you contact TOS at all about this?

Anyone else experience this w/ other brokers?

Nah…not only am I too lazy for that, I also figured I brought it on to myself by trying to trade illiquid options with market orders. Lesson learned.

looks like those stops are just fine… look at the systems gains when he lets it ride! a very acceptable ratio.

lookin good shed.