The [[SPY]] , from close of September 29th to today’s close, has lost 17.7%

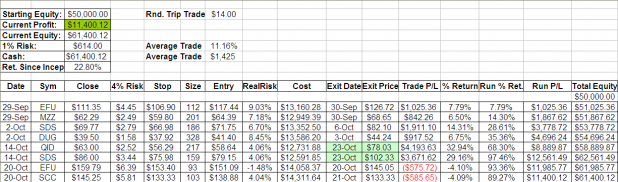

During this time, the Big Bamboo has earned 22.8%, and was only fully invested for one day, and only 75% invested for 2 total days.

[[QID]] and [[SDS]] were both closed at the open. Their closing prices and dates are highlighed in a pleasing lime green.

Statistics for Average Percentage Gain per Trade and Average Dollars Gained per Trade have been added to the spreadsheet.

I’m anxious to see if the system will continue its losing streak or if the latest trades were just a blip.

Shed, the system is great. Been watching closely.

Do you think any system can be trusted during market dislocations like we are experiencing?

Anyway, glad to see you are in cash. I have bad juju.

And the plot thickens… Can’t wait to see the next signal.

Wood,

May I make a suggestion…

Looking at EFU and SCC. If the signal was entered for an end of day purchase on Monday or Tuesday morning purchase, it would be up nearly 40% by now. Here is my theory, the normal flow of the market was thrown off by Bernanke’s speech to Congress on Monday. It is a unique event and we normally see a small rally on those days. As you see after the speech, the market resumed it’s normal course the following day.

Is there ANYWAY that once the system stops out at 4% loss that it can re-enter that position the following morning? It’s a bold thing to do, but my hunch says this would make up for the previous loss and be extremely profitable.

There’s companies where you can buy the stock and own more cash than it cost to buy the stock…

it’s rediculous.

Susan, the problem is, how do we model and test for an anomaly like Bernanke’s speech? Also, how would we test when to re-open a previously stopped out position? Maybe only re-open if it is stopped out the same day it is opened? I don’t know, but I know it would be really really hard to backtest that sort of strategy.

One way to deal with that sort of difficulty is to have tested varying levels of stops/position-sizing (which we have done).

If we assign a level of confidence to each stop level (high confidence of success to 4% stop, medium confidence to 6%, and low confidence to 8%) then it seems possible that we might be able to account for events such as Bernanke’s speech. If we thought Bernanke’s speech could introduce some noise into trading, we could assign a lower success multiple and choose a 6% or 8% stop (knowing that a 6% stop has a higher win/loss percentage than a 4%).

The only problem with this method is that introduces human biases into a mechanical system.

Also, what happens when a trade is already on and an event pops into view? Is the trade altered in terms of position-size and stops?

Anyway, very interesting line of thinking. I look forward to hearing

more of your thoughts on this.

***continued from message above.

Also, there are 2 new entry signals on the Big Bamboo for Monday. I should have a post up some time today detailing them.