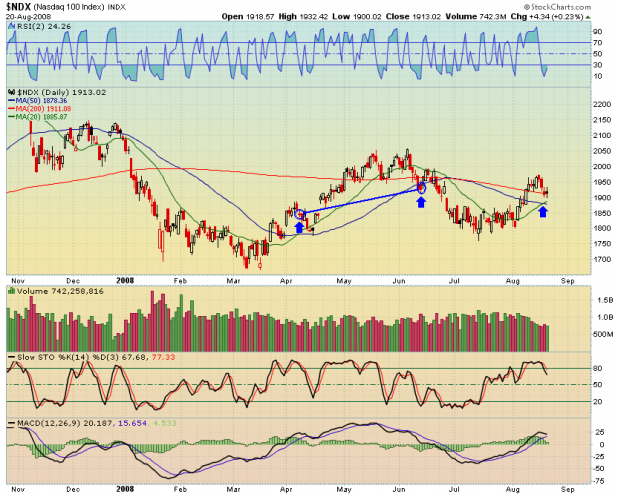

As noted in the previous post, the 20 day moving average is crossing over the 50 day average from beneath, on the NDX. This type of action can signal that an intermediate uptrend is underway.

I decided to test this cross to see what edge might exist, if any.

Rules:

1. Buy when the 20 day simple moving average crosses over the 50 day simple moving average from beneath.

2. Sell when price closes below the 50 day moving average.

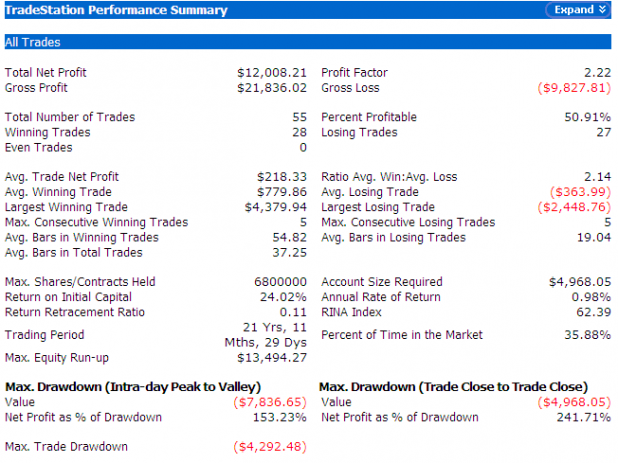

Results:

These results go back to 1985.

The percent profitable shows that this strategy is about equal to a coin flip, in terms of winning percentage. However, the average winner is twice the size of the average loser, so there is an edge there.

I am more interested in the length of the average losing trade. For this strategy, the average losing trade lasts 19 days. This suggests that unless the NDX reverses quickly this week and closes beneath the 50 day average, the current, somewhat bullish conditions may persist for a couple more weeks.

I added this chart for Gio. You can see that this trade set up in April and lasted through June (closing when price closed beneath the 50 day average), and was profitable. The last blue arrow shows the latest cross.

no one is reading this post.

Odd no?

Viz.

Hey wood, how about a chart? Some good ol fashioned excel chart to visualize this.

ws…

thanks for the info… great post…

Duane

This is a classic Turtle-style trading method.

Nice work Wood.

Lol Fly.

Thanks Wood, I don’t like this study though, 200 day is headed down fairly steeply.

Did you try running this study while also specifying whether the 200 day MA is pointing up or down? I would be interested to see the difference.

Thanks

I like your site.

hey pro…

great call so far… 1900 has been the trigger number for me since you posted info…

gb…

Great post, I very much like the content and I totally agree 100%. Keep up the awesome work, I am going to add this blog to my feedburner

All of our service plan offer you the preferred alternatives:

Greetings from Colorado! I’m bored at work so I decided to check out your site on my iphone during lunch break. I really like the info you provide here and can’t wait to take a look when I get home. I’m amazed at how quick your blog loaded on my cell phone .. I’m not even using WIFI, just 3G .. Anyways, awesome blog!