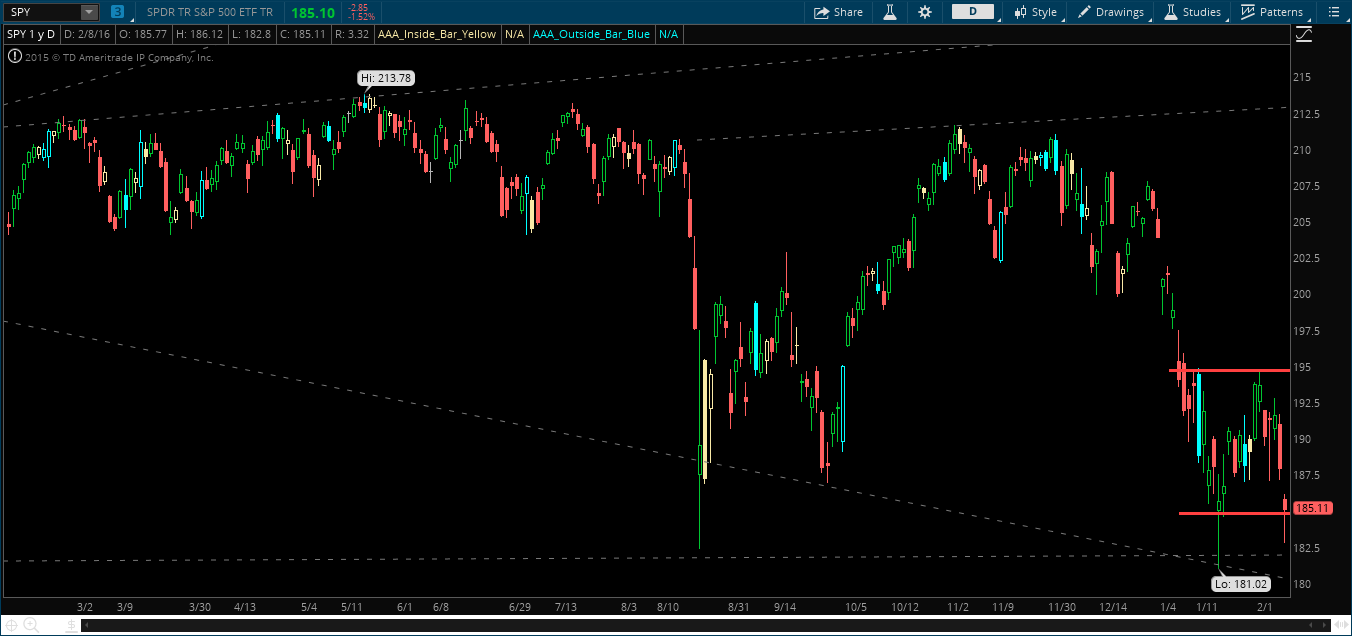

The market is in a range-bound mess and it’s killing traders.

But why?

Well, for starters most (shitty) traders are trying to buy the breakout move.

Newflash: in a range-bound market, you better be buying the low-end of the range, otherwise you’re the guy top-ticking any rally.

Granted, we may expand this range to the downside. But our risk/reward into today wasn’t worth pressing short.

That being said, is it time to buy??

As I posted over the weekend, we have to keep our eyes on Oil and Gold.

So far, Oil took out last weeks lows and popped back into the range, so the jury is still out. Gold hit our high end target of 114, so safe to see we may see a pull back here — does that mean equities can rally? Possibly.

With the daily hammer candle in SPY this could be the first signal to start testing longs. IBB has hit our low end target of 245 today, so a bounce is possible. FAS and the banks briefly tagged the 17 handle, taking out the February lows momentarily and limped higher into the close. The transports actually closed higher than we opened today, a positive sign into the rest of the week.

All in all I think it’s safe to put risk on the long side, keep your stops tight. If you’re right and we do rally back to the top end of the range (195), you’ll be the one making it rain this weekend.

If you enjoy the content at iBankCoin, please follow us on Twitter