In typical fashion I’m rushing around with way to much to do. Thus, I have not been able to complete my “model portfolio” yet. Instead I have made a basic one on Google, so that you may continue to watch the madness that is my trading. Today I shorted STP and JOSB on the open. They are both “epic shorts” (no Tommy Bahama), and stupid companies to boot. Seriously though, any retailer that provides you with more free merchandise than you are buying in the first place has an egregious business model. Those two and my DDD short are leading the way for my book today. The dip and pop in NFLX and AAPL, respectively, has me thinking of either cutting them loose or adding to both.

I am very tempted to buy YHOO or some calls into earnings, but I have things to do that require me to be away from my computer and TV, so I will not. However, if their numbers are good, I will probably be looking to go long on the open tomorrow. Did I mention I love earnings season? The trades can go very badly too, see my FB put trade into earnings last quarter, painful. I am perfecting my technique though.

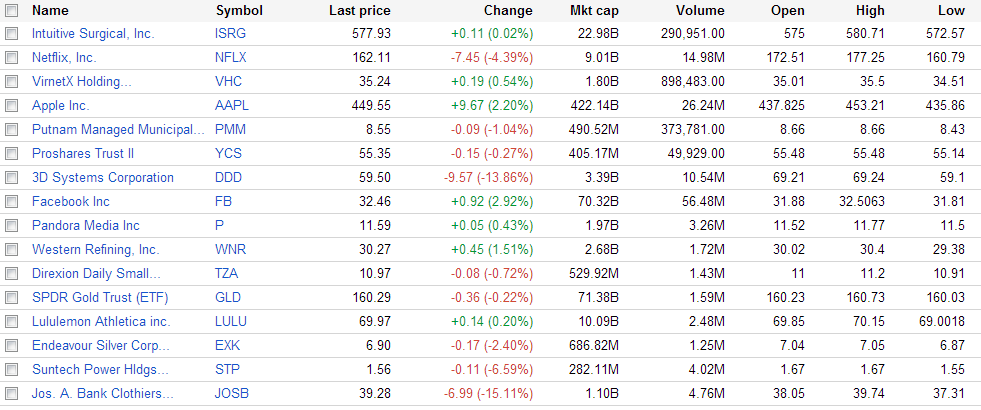

Here’s a basic watchlist of my holdings. Note: AAPL, DDD, STP, and JOSB are shorts, P is a short through puts, and ISRG is long through calls.

7 Responses to “Step Up to the Plate, Pal”

elizamae

Unless you have the same positions that I did the last time I used Google finance (which, from the looks of it was June 2011), then no, the link does not work for me.

Rhino

PISS, wait one over.

Raul3

What happened to your AVI Rhino? Google jack that too?

Rhino

Fuck, yeah apparently as it is linked to that email. BASTARDES!!!

Rhino

Fixed it

Jack

Could you go into your strategy/philosophy on earnings?

Chess always preaches how its hard to get and edge since stocks can go down big on great earnings, it makes no sense. So he stays away.

I see it has worked out great recently for u, but curious on how u view them.

Rhino

Yes, I’ll drop one tonight on the topic.