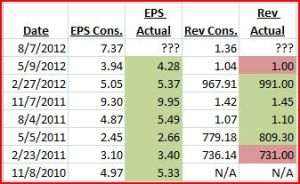

Priceline reports 8/7 after market. Looking at prior 7 earnings we can see that PCLN has a history of beating EPS and revenue with the 2 revenue misses being narrowly missed compared to the beats verse the consensus.

Competitors TRIP and EXPE have already reported with both moving in opposite directions (EXPE up and TRIP down). Both companies were cautious going forward marking weakness in Europe. Along with mostly beating expectations, PCLN has had a history of raising or maintaining guidance so if they cite weakness and lower guidance I believe shares will take a sizeable hit.

The next table shows the moves after earnings with other data I use to look forward for an expected move.

From this data I like to take the average Augen StDev move (1min after the open after earnings release) and multiply it times the StDev move before earnings. In this case:

- 2.78 * 15.31 = 42.56 is my expected point move based on prior price action and volatility movements into earnings and this is what I will use to structure an options trade (preferred being verticals, butterflies, iron condors, and ratio spreads).

Also looking at this, we have some higher Augen StDev moves as high as 5.94 and mostly above 4. I will use this to measure some extreme moves:

- 5 (splitting between 5 & 6) * 15.31 = 76.55

This would be an extreme move representing a 11.5% move which would trump any other move with only one being close (8/4/2011 saw 11.23% move). But as stated above, if they miss or the forward guidance disappoints then I believe this number is achievable.

The next table shows implied volatility (IV) moves and looks at the ATM straddle to see what the option market is pricing (I prefer to use the bid for purposes of the worse possible fill). On the far right the green cells represent a win selling the straddle and the red cells represent a loss)

The above data tells me the following:

- the ATM Call IV into earnings is the lowest we’ve seen (subject to change tomorrow)

- the straddle bid is 2nd highest we’ve seen, implying that the options market is currently pricing in over a $51 dollar move

- there has not been favorability in buying/selling the straddle

- 11/8/2010 straddle sale was a close win with a 8.34% move with ATM volatility at 101%

- 2/27/2012 straddle sale was a loss on a 7.31% move with ATM volatility at 78.76%

- With current ATM at 77.05% I believe selling volatility for a non-directional trade would be disadvantageous, so I will be looking for a directional trade.

Now I will look at the chart for price targets.

Priceline has some nice whole number support and resistance levels which I have labeled at (note these are general areas and not to the dollar):

- 550 – breakout point from prior range (not shown on chart)

- 600 – gap support area

- 625 – gap from 2/27/2012 earnings, acted as support level

- 680 – resistance area of current range

- 700 – resistance area & where Upper Band of 3rd St Dev Bollinger Band comes in

With the information that I have I am looking to take on a directionally bearish position into earnings taking advantage of a volatility drop.

Trade idea: Long the Weekly Aug 610/630/650 Put Butterfly, currently 2.15.

The risk profile below shows the trade after the earnings release with what I believe the trade will look like taking into account time and volatility drop. Even though on average the ATM call has dropped 68.17% (noted above) I chose to use a drop of 35% due to what I noticed in recent trades. When there has been a large move, in this case expected over 40pts, there tends to be a bid in volatility causing it not to drop as much. I tested other dates and the drop was around 30-40%, so I used 35% in this case. Remember this all approximations and what to expect. I also am showing two other butterflies, one 10 points lower and the other an upside with selling the 700 calls (both being 20-wide).

The price slices show expected breakevens after the release, at expiration, and at current price 663.93.

Note on the price chart the highlighted Blue Box. These are my containment levels after the release to which I believe the trade would still be at breakeven or slightly above after the release and the trade could be taken off or kept depending on intraday price action.

PCLN does have a fairly wide option spread so if you do put this trade on you will have to come of the mid-price more than usual. One technique I like to use with the thinkorswim platform utilizes the hash marks on the order tab. I found if I go to that first hash mark (where blue arrow is pointing) I have a better chance of getting a good fill in a quicker amount of time. In this case instead of getting the trade at 2.15 it would be 2.55, which I would still have no problem entering at.

All data used comes from StreetInsider.com and features within the thinkorswim platform. Not all data is completely accurate as I sometimes round the IV percentages but nothing to where the results would be extremely skewed. Also all data is used for approximations and nothing is guaranteed. This is to show the reader my personal thought process going into an earnings trade and what I look at and the data I can use to structure a trade. Unfortunately all the time used to structure a trade can still result in a complete loss.

Please note that going into earnings a trade structured like this should be taken only if you are willing to lose 100% of your investment. These trades are considered high risk and should only compromise a small amount of your overall portfolio.

18 Responses to “Earnings Trade Idea: Priceline $PCLN”

Scott Bleier

This is a useful analysis. This stock tends to move 50 points at a clip so you will either be very very right or wrong.

We’ll be watching…

redman59

Thanks Scott, yes was concentrating on a 40-50pt range move, will enter in trade tomorrow hoping it keeps around current price so can get a fill around the trade mentioned, but may even pick the other bearish butterfly 10pts lower.

Bill

Awesome post. Why not take the upside trade also. Amount on trade is small and as usual we are expecting a 40 to 50 point move either way

redman59

Thanks Bill appreciate it. That’s a reason why I also showed the Call-side butterfly on the risk profile and I may take both a bear/bull position into earnings.

I thought I would highlight the side to where my bias is, being bearish in this case. But overall I agree with your thought and would have no problem taking a both-ways trade.

bill

Thanks. I did put in a butterfly it sat out there all day without any fill

I had a bearish and bullish side.

I had 640/620/600 for 1.50 did not get the fill ask was 3.50

similar with call side.did not get a fill.

Let me know if oyu got a fill.

redman59

Bill, I actually put the same trade on in that I rolled down 10 strikes from what I had in the post.

I’m not sure what the ask was but the mid-price was 2.40 at the time and I put in a order at 2.50, filled right away (which isn’t really a good sign IMO) at 11:37:08 EST. So I came up over $100 from where you tried to get filled.

I would try again tomorrow but you will have to come up from where you tried to get filled. PCLN option prices jump around especially into earnings with IV fluctuations so its hard to get a handle on what a great fill is but I would suggest watching for a 10-15min or so after the first 30 minutes of trading to get an idea and then come up from the mid-price by at least 0.10.

I wasn’t really thrilled with my fill but around that 2.20 – 2.60 seemed to be the most stable area for the 640/620/600 Put Fly. Also make sure to use Day orders and not GTC.

bill

Did you also enter a call butterfly.Are you just leaning towards the bearish put options??

redman59

I decided to just go with the put options and leave the call side alone.

bill

Thanks ..I finally got a fill at 2.34. I am wondering does the type of order make a difference. Earlier I was trying with GTC order and later I switched to DAY order..

Also INCASE it moves in our favor how do you plan to exit out of the trade.

redman59

Bill,

Yes it does make a difference with LMT/DAY or GTC order. If the market maker see the DAY order he will fill that first (in most situations) as they know it will expire at end of day. With GTC order they know that is the price that you want at anytime and it won’t cancel at end of day and they can fill it at anytime when it favors them most.

Glad you mentioned IN CASE because with these earnings plays 100% loss is always a possibility and why I play with low amount of portfolio. But if the move does occur in our favor I plan on taking off half right away and then will set some targets based on intraday action for the rest of play but will raise second half to B/E. If only playing 1 spread I see where it lands on the chart and have some predetermined exit points, but remember not to get greedy, if you’re happy with the hopeful profit just take off and move on.

Sorry for the delay response here, had to attend some things during mid-day.

bill

we did bet on correct direction but looks like it is down more than what we want. its now down to 586

redman59

Yeah huge move and beyond expectations, current move is one of the largest yet in history of PCLN with last bigger one going back 2 years. I would love a test of 200sma just above 600 by weeks end.

We’ll have to see where it is in the morning but overall a move beyond expectations. Another trade I like to do for earnings with a directional bias is the Broken Wing Butterfly which would have been a great trade here….but coulda woulda shoulda

bill

When you get some time please explain how to do broken wing one side butterfly

redman59

A Broken Wing Butterfly basically rolls in one side that your bias is towards. Example you and I had the 600/620/640 Fly on, so since we had a short bias we would roll up the 600 strike so the Fly could be a (610 or 615) /620/640. The Fly wouldn’t be an equidistant 20 wide Fly.

The downside to this is that it is more margin intensive and requires a higher debit but plus side is that the stock could keep going lower past that low strike (ie 610 or 615) and the trade would still be a profit.

In this specific case Monday morning the 610/620/640 Fly (so broken wing as I bought the 610 vs the 600) was going for around 3.75 or so but PCLN could have gone as low as it wanted and the return would have been around +60% or so.

Bill

How do you get out of this trade do you need to reverse everything by weekend or just let it die. Iam with IB not sure how to undo the butterfly.its probably total loss.

redman59

Bill, yes you could just take off the whole position for a loss or ride it out until expiration for some “hopeful” gains or a complete loss. You should just be able to put in an opposite order to close it. Definitely sucks but that’s why I only use a small percentage of capital as I went into the trade willing to accept a 100% loss.

This one definitely exceeded my expectations and I thought I was being aggressive with the Fly we took centering it -60pts below. It was definitely the hype stock AH and today.

Despite the loss hopefully you were able to see the thought process that goes into the trade and the willingness to accept the risk.

Bill

If the price is below 600 by Friday do we need to close the trade or it’s automatically closed. My point is why spend commission on closing the trade if I don’t make anything on it.

redman59

Yes Bill you will need to close the trade as all the strikes are in the money and I am with the understanding that you don’t want to be assigned PCLN stock , so closing the trade is the right move.