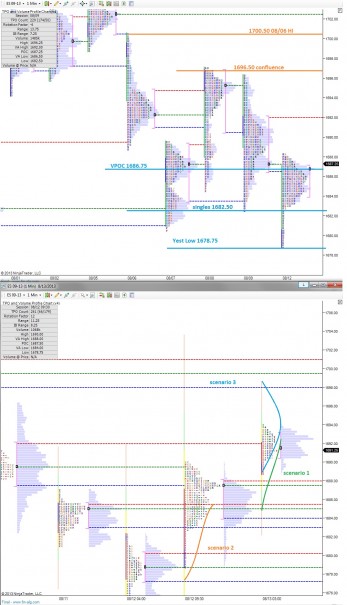

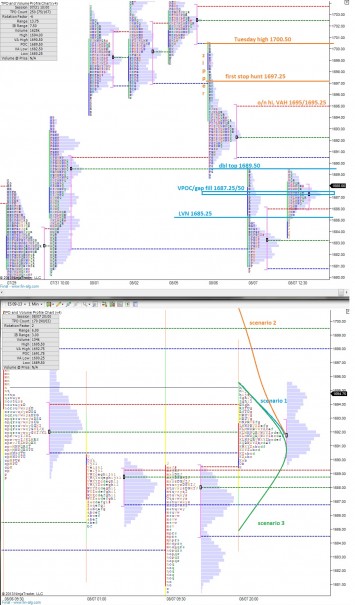

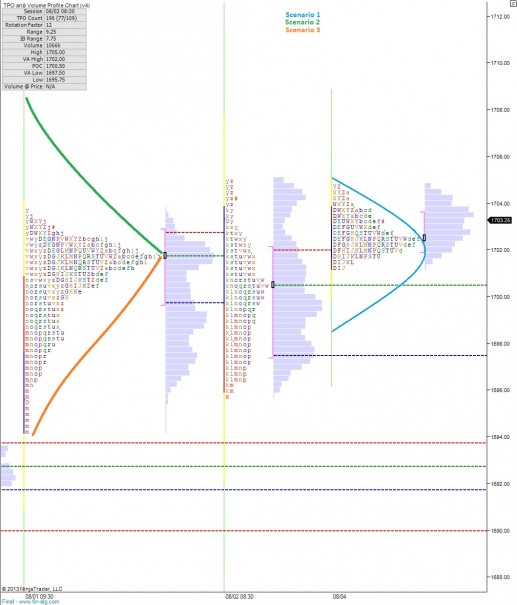

The market drifted lower overnight, not accomplishing much, but setting a higher low: the third in a series of higher lows since the market sold off Sunday night. The momentum to the upside isn’t nearly as enthusiastic as we’ve seen throughout the year. Instead it’s a bit more lethargic with price making a higher-high by only two ticks on the last trough-to-peak move.

The moves are also violent and with a smack of indecision, offering large chop often 10 handles wide.

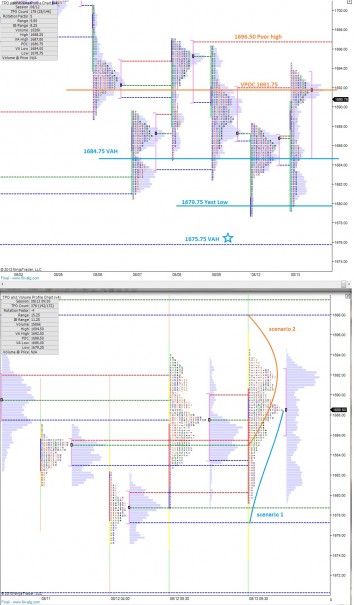

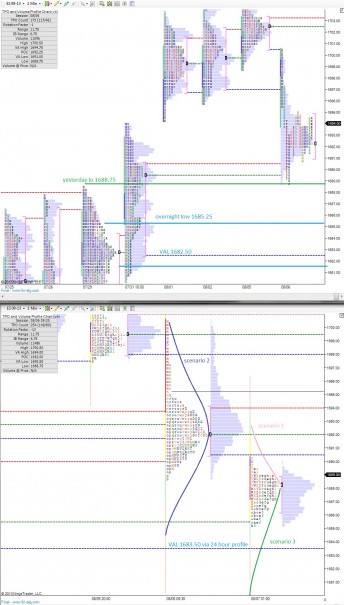

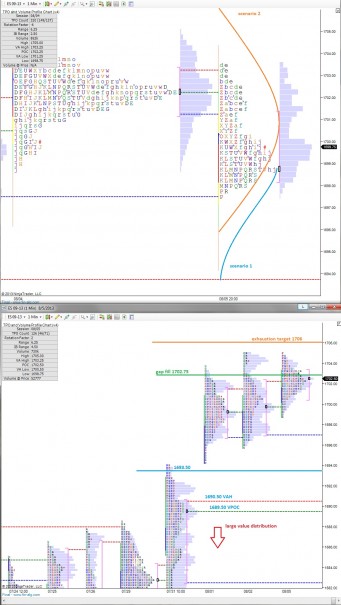

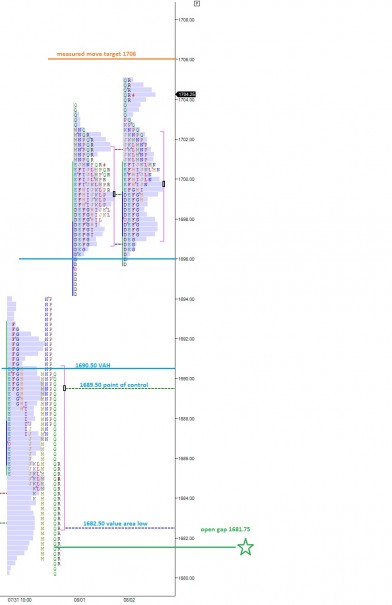

I don’t have much directional conviction currently, but I’ve highlighted some key levels that may give us insight as the day progresses in the following market profile chart. Sustaining trade over yesterday’s VPOC at 1691.75 would mark good progress for the buyers. Conversely, taking out yesterday’s value area low at 1684.75 sets us up for scenario 2 on the below 24-hour market profile:

Comments »