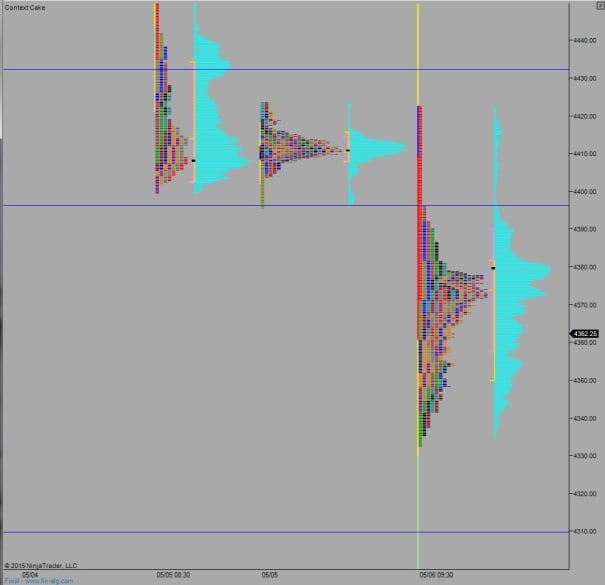

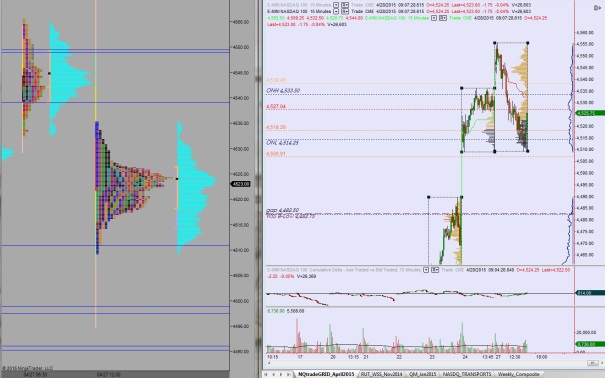

Nasdaq futures are steaming higher premarket. Price was up nearly 10 handles on the session ahead of the Nonfarm Payroll data and continued higher after. The big surprise in the data was the 85k revision to last month’s figure making it that much worse—perhaps easing investors’ concern The Fed will raise short term interest rates soon. A big bounce in construction helped today’s number. Overall the news was interpreted as positive.

Also on the docket today is the Baker Hughes Rig count at 1pm.

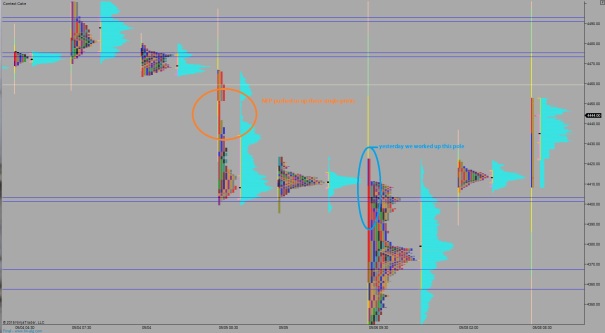

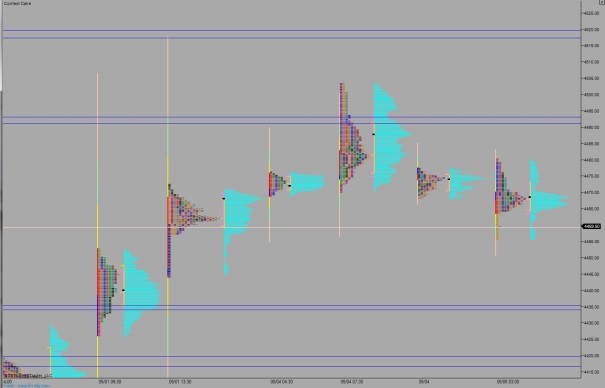

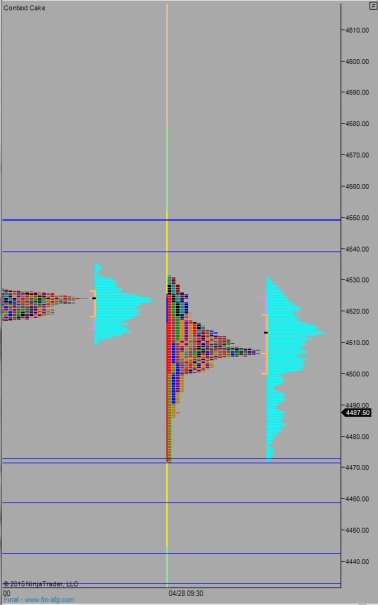

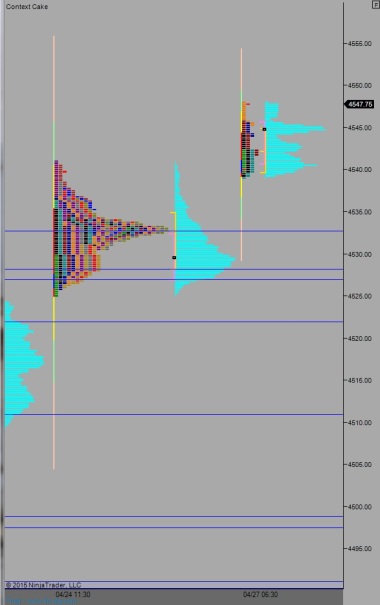

Big moves tend to occur where market profile shows a thin history. We call these areas zippers or single prints. In the instances where a large set of single prints is above, I like to think of it like a pole or rope. I was discussing this feature yesterday on twitter, and you can still slightly see it, though it has been partially filled in. See below:

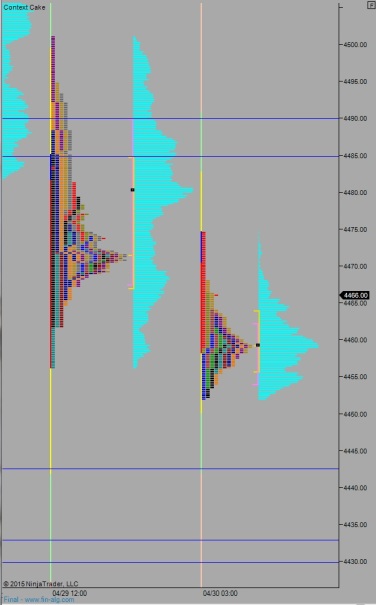

Heading into today, my primary expectation is for sellers to work into the reaction move and test down to 4433 before finding buyers and choppy, two way trade ensues.

Hypo 2 is a gap and go higher, a strong surge at the open morphs into a slow grind up to 4474. If sellers no show here then we continue to 4491.25.

Hypo 3 is return to NFP “crime scene” 4412 and two way trade enses.

Hypo 4 blow through pre NFP mark 4412 and test the lower balance at 4400.

Levels are pictured above.

Comments »