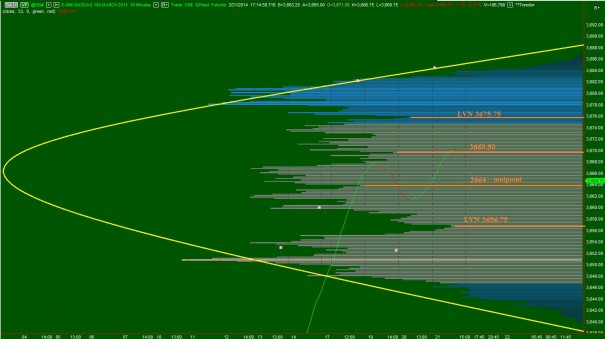

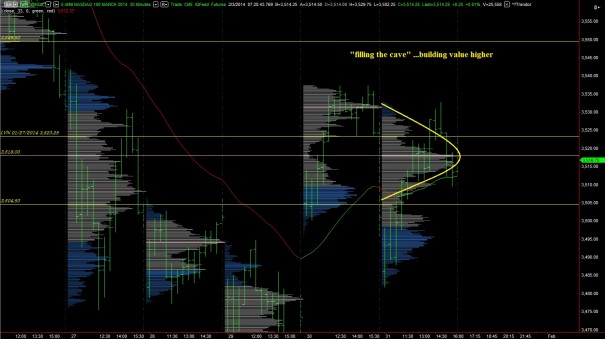

Yesterday was a strong day for the NASDAQ index, a day marked by aggressive other timeframe (long term) participation. We really dial down in these morning context reports to wrap our mind around the context of the marketplace. We focus on the NASDAQ because most of the high flying momentum stocks reside within it. As important as the short term timeframes are to our daily decision process, we always have to keep sight of the big picture. The long term auction is still buyer controlled. This can be seen as a series of higher highs and lows on the daily COMPQ chart. The long term buyer is now tasked with making a new swing high, otherwise the long term auction may come into balance.

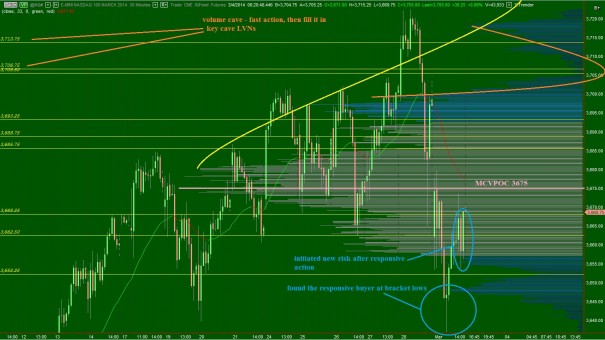

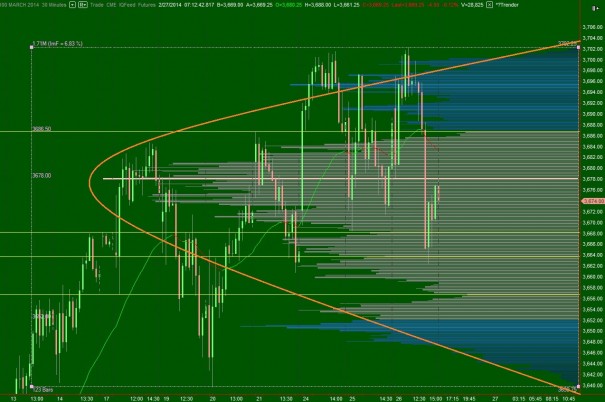

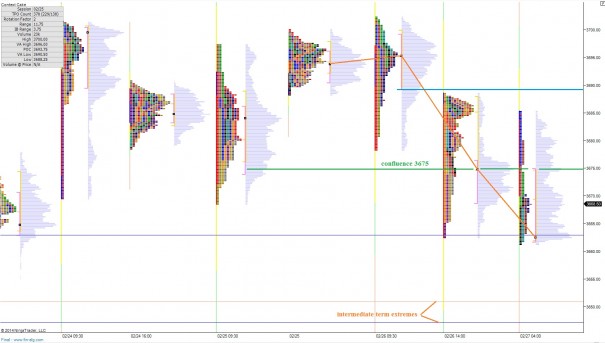

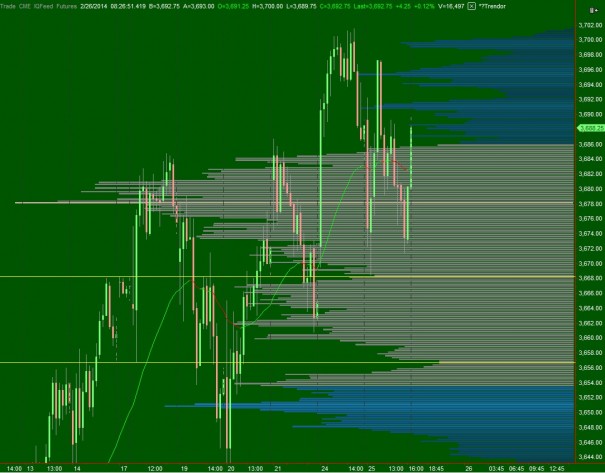

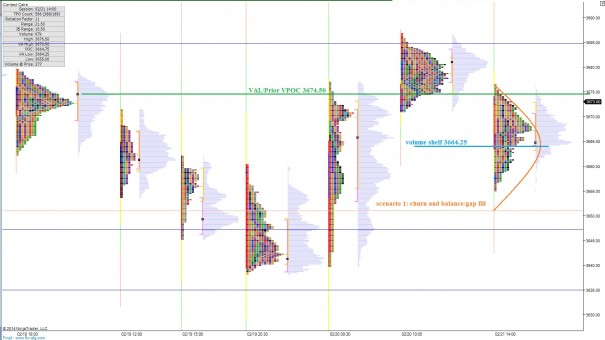

The intermediate term timeframe is balanced. The strong move yesterday was dynamic enough to push sellers out from their controlling position. We are however nearing a price zone where I have some expectation of selling. Price is pushing up into the bottom of our uppermost balance distribution which dates back to February 13th, a day when Ben Bernanke gave the market a final push before leaving his post. As participants are made whole, we may see supply coming into the market. I have highlighted some key price levels on the following volume profile composite:

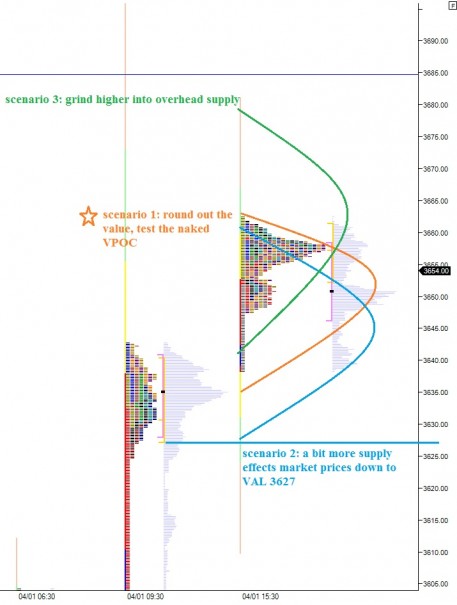

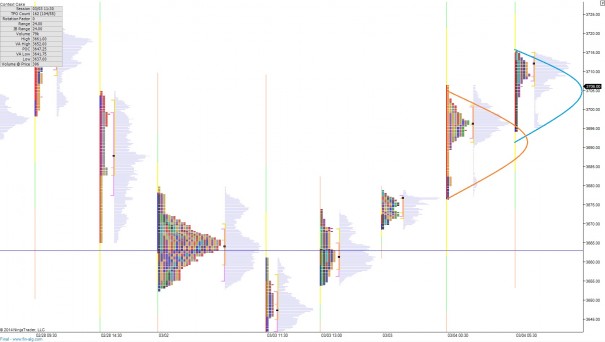

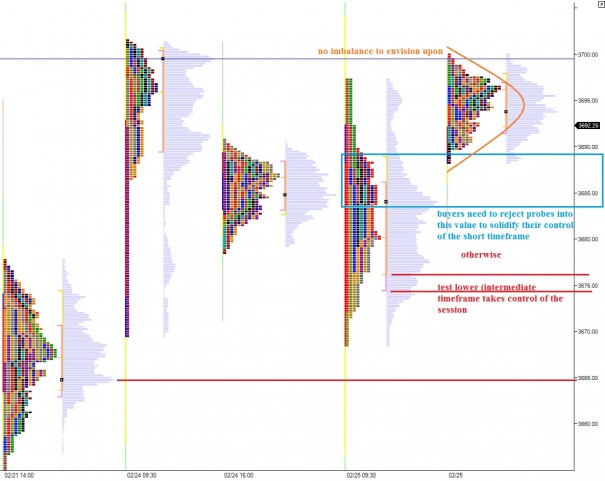

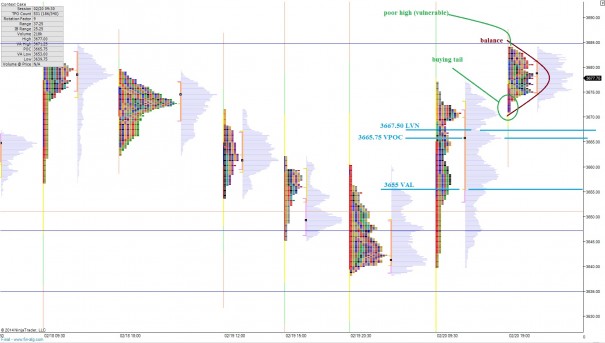

The short term auction is buyer controlled. This can be seen as value progressing higher over the prior few profiles. It can also be seen as a lack of overlapping value areas which tells us the buying force is dynamic enough to keep value on the move. However, our current profile which includes part of yesterday afternoon’s rally and all of the globex session presents a slight imbalance. From this imbalance, I envision some downside early on. I have highlighted this scenario, as well as a few other observations on the following market profile chart:

Comments »