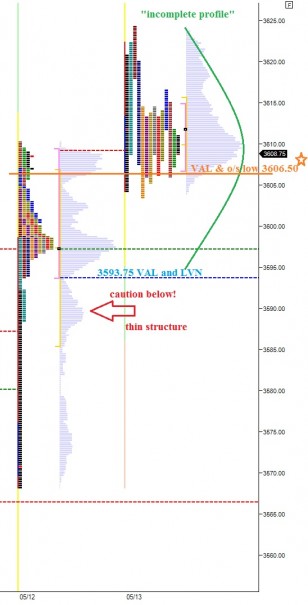

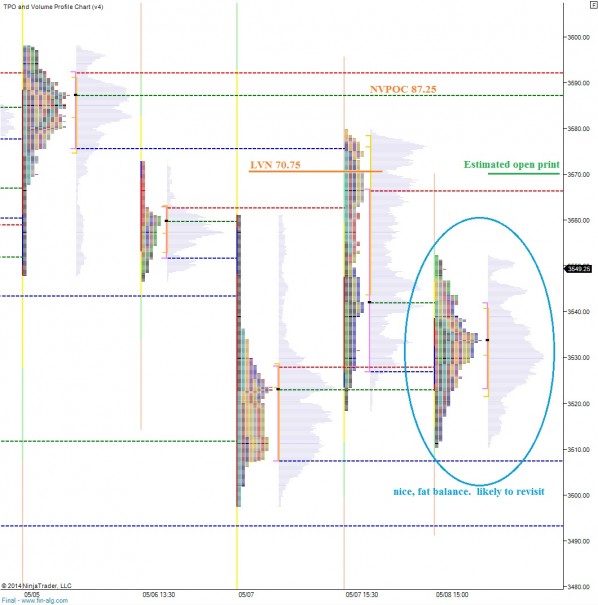

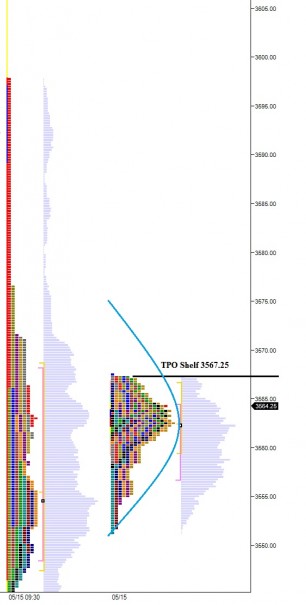

We are coming into Friday with the NASDAQ basically flat on the week after a strong gap-and-go higher Monday. The overnight session was balanced and our profile print left an interesting shelf up above at 3567.25. This type of incomplete profile gives us a big clue early on. The market will most likely spill over the shelf which could take price to some interesting levels early on. Of course, if the shelf holds, that odd behavior would tell us the market is in the firm grip of seller control on the short term. See below:

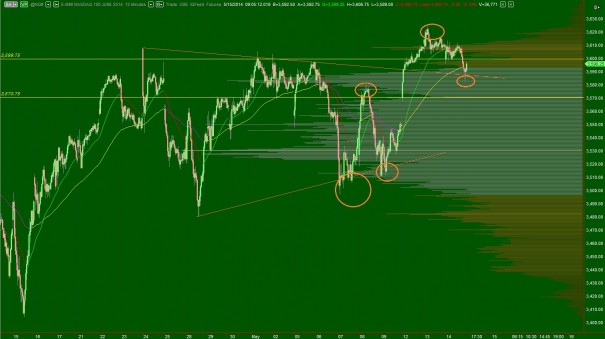

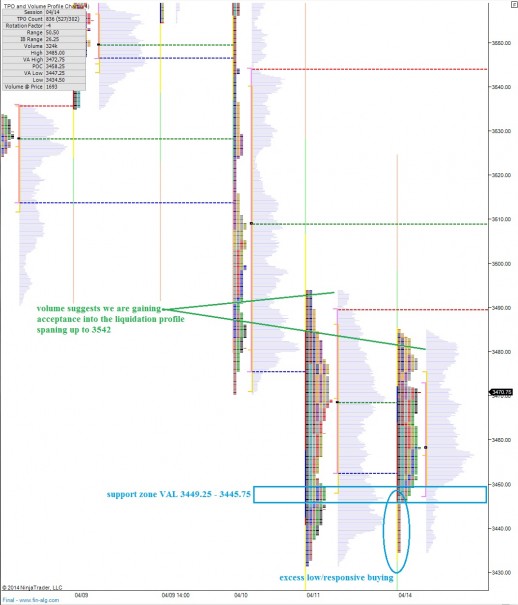

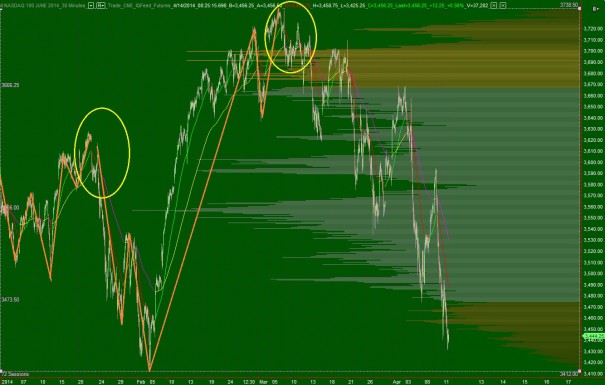

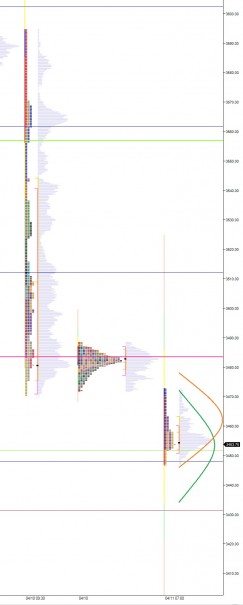

The intermediate term continues to hang on the balance despite a valiant attempt to escape from buyers. There was a thin market profile print yesterday, a zipper, which price slid right down through. However, the intermediate term remains balanced. I have noted only the lowest of low volume nodes to keep the noise level low on this chart. See below:

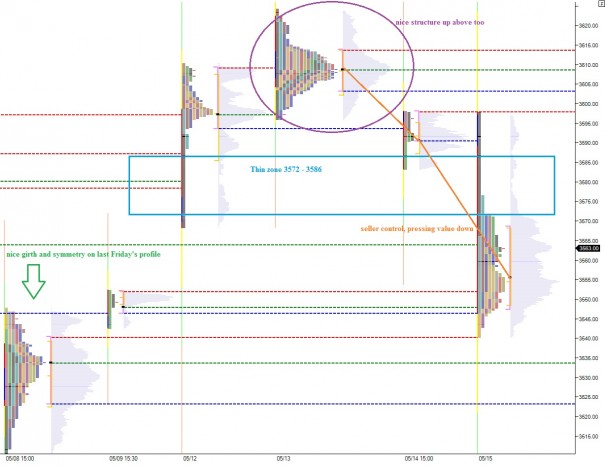

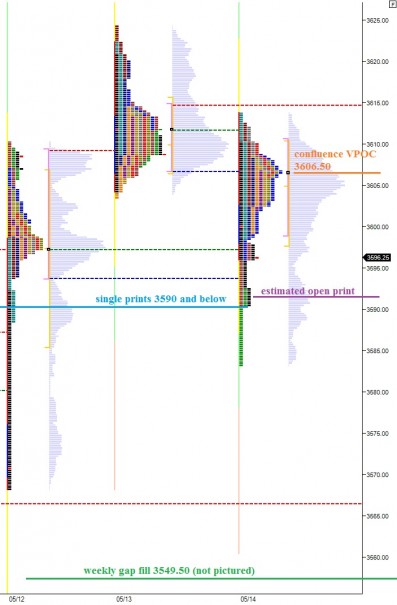

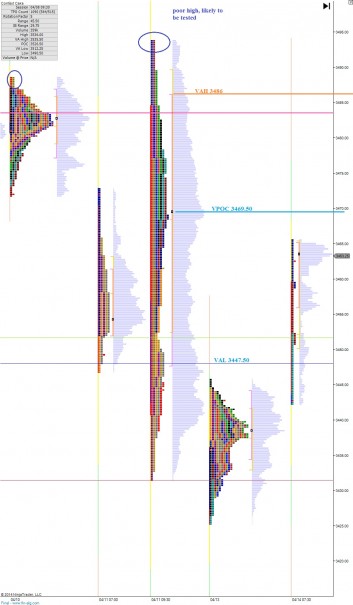

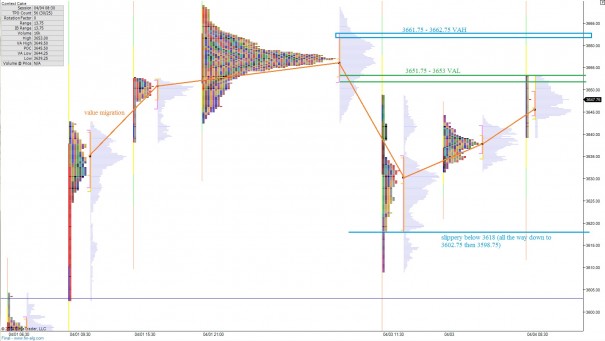

Sellers took control on the short term during regular trading hours, despite our shelf action mentioned above. On the short term, sellers successfully dictated price lower and value followed, pressing and closing the weekly gap we printed Monday and stopping precisely at last Friday’s value area high. I expected this fat, well established profile to be revisited as these types of profiles exude a strong gravitational pull in times of mean revision. The key today is whether we can hold yesterday’s low which coincides with the value area high from Friday. If not, we are likely to trade through the value area. On the upside, the market can zip right up the thin profile just like it zipped down it yesterday. The action is thin from 3572 – 3586. The a break of the shelf mentioned above may take price into this thin region. I have highlighted these two interesting contextual pieces below on the market profile:

Comments »