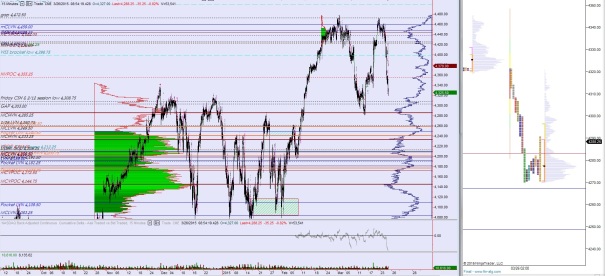

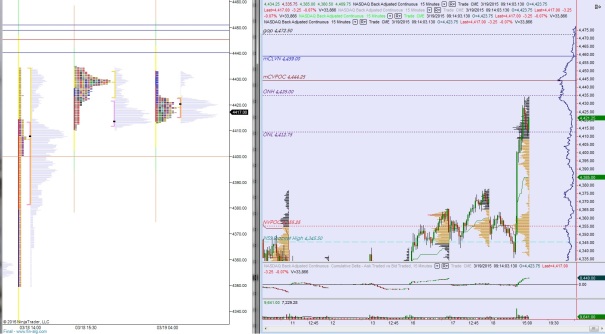

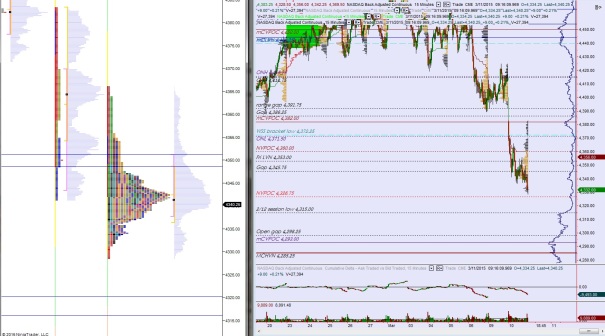

Nasdaq futures are set to gap up this Monday after trading an abnormal 50 point range during globex. Around 8pm buyers started working, and just before 11pm a large stop-run style push worked through. The move held though some 2-way action and ahead of the European markets opening it went on a secondary rally before finding sellers right as Euro markets opened.

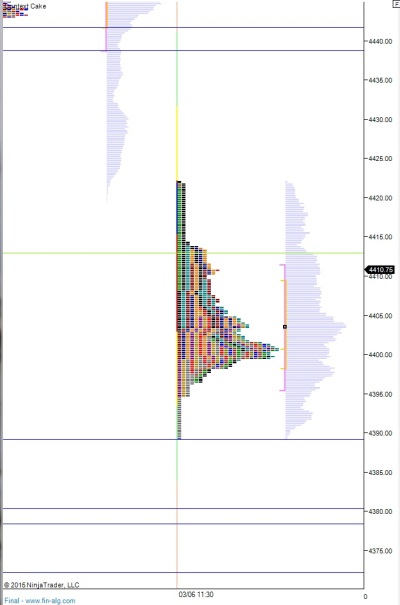

Price is set to open inside the afternoon value zone formed last Wednesday during the trend lower. On both sides of this distribution the action can accelerate. Thus today carries an elevated risk:reward.

At 8:30am we had Personal Spending/Consumption data and saw a muted reaction. At 10am Pending Home Sales are out, and keep in mind we have German Unemployment stats out tonight.

Heading into today, my primary expectation is for sellers to work into this overnight inventory. Look for a struggle at 4338.75 but sellers manage to take out that area and work to 4323.

Hypo 2 is buyers sustain trade above 4338 and continue working higher. If they can take out overnight high 4367.50 then look for a push up through 4381 to run up the thin area to 4397.

Hypo 3 is we stick in a range between 4360 and 4340 (unlikely).

Levels:

Comments »