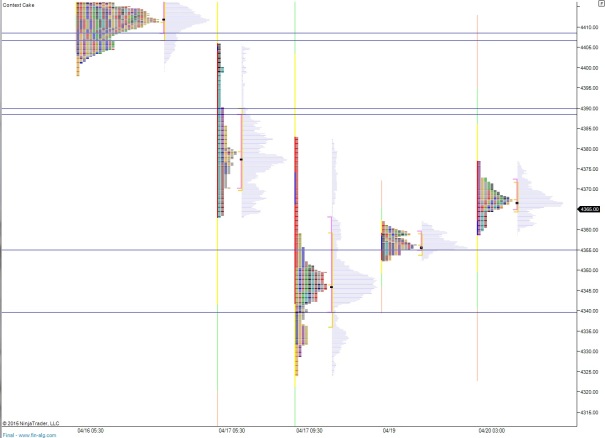

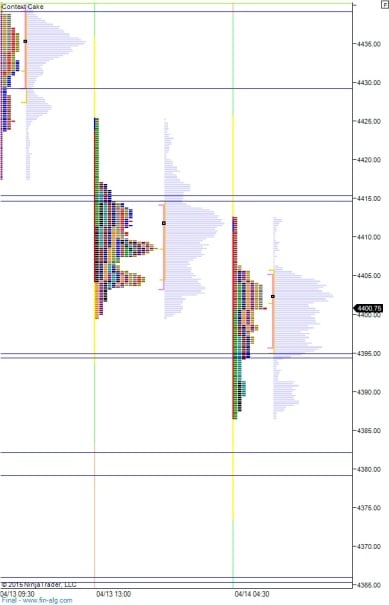

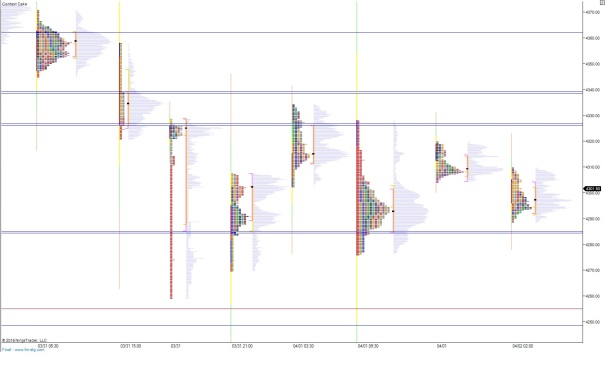

Range is a touch above first sigma overnight on normal volume as we head into a fresh week. Friday the market opened to a pro gap down and the selling continued throughout most the session. By about 2:30pm however we formed a decent looking excess low and the auction showed early signs of changing direction.

Yesterday the Chinese announced a reduction to their reserve ratio. It led to choppy trade in Shanghai but has seen a favorable reaction in US markets. The economic calendar is quiet today. At 8:30am we had Chicago Fed National Activity which did not generate a reaction from the market. At 9:45 there are some details coming out of the ECB regarding their QE purchases.

Morgan Stanley is trading higher in the pre-market after reporting earnings and after the close attention will be on Big Blue (IBM) as they report their first quarter results.

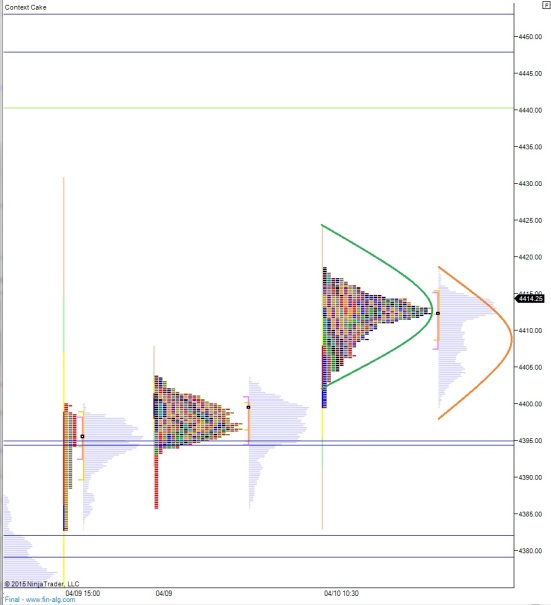

We are currently set to open inside the fast liquidation zone from Friday. Opening in this thin zone and the fact we are at much different prices then Friday’s close mean we are likely to see other time frame active on the open.

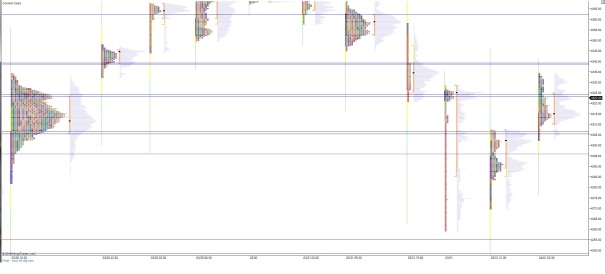

Heading into today, my primary expectation is for sellers to push into the overnight inventory and test down to 4355. From here I will look for buyers to come in and work higher for the session, targeting 4388.50.

Hypo 2 is buyers push off the open and find responsive selling up near 4388.50 and two way trade ensues.

Hypo 3 is sellers work down through overnight now 4348.75 and continue to 4339.75 before finding responsive buying.

Hypo 4 is a drive higher, up through 4390 with a stretch target of 4406.75.

Levels are highlighted below:

Comments »