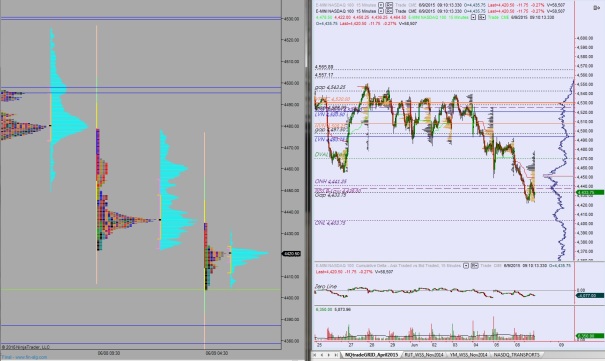

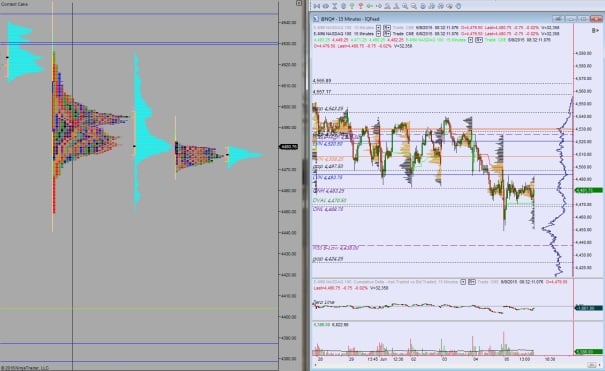

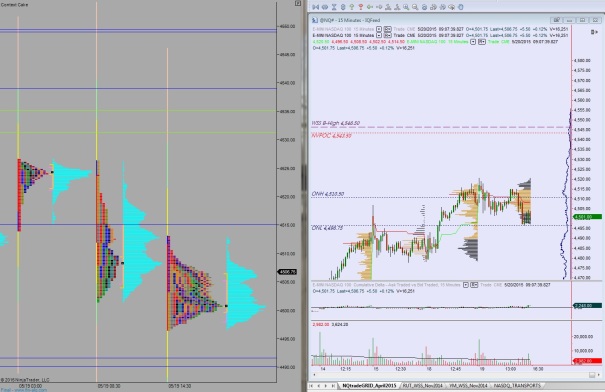

Nasdaq futures are lower heading into Tuesday on above average range and volume. The session was dominated by sellers who took out yesterday’s session low and continued pushing lower, well into the range from 05/12.

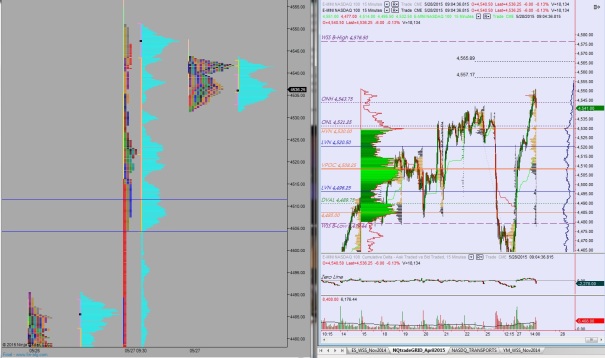

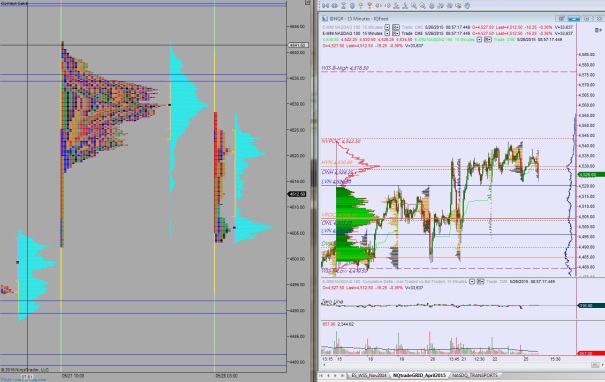

Scheduled Economic events aren’t the likely catalyst to this selling. It appears to be related to the ongoing discussions between Germany and Greece. Today is another quiet economic day for the US—at 10am we have Wholesale Inventories.

Yesterday we came into the week gap down and proceeded to push lower for most of the session. Price travelled down into the 5/13 range and closed an open gap we had down there before finding responsive buyers. The strong rotation off the low was faded into the bell and led to continuing sell flow overnight.

The higher time frame action resulted in some ugly profile prints above, and it will be interesting to navigate these footprints, to say the least.

Heading into today, my primary expectation is for buyers to push into the overnight inventory and close the gap up to 4433.75. Look for buyers to continue higher to take out overnight high 4441.25 and test the 4450 mark.

Hypo 2 sellers push off the open, take out overnight low 4403.75. Look for responsive buyers form 4387.75 – 4379.

Comments »