Equity futures gapped lower overnight displaying strong follow through on yesterday’s trend day. As the USA comes online the S&P is down nearly 10 points and the NASDAQ about 20. We have an hour until the cash session begins to recapture some of this downward progress but this is otherwise known as a pro gap. Essentially that means the risk is elevated beyond a level most retail traders can handle in the event they attempt to fade the move and close the overnight gap.

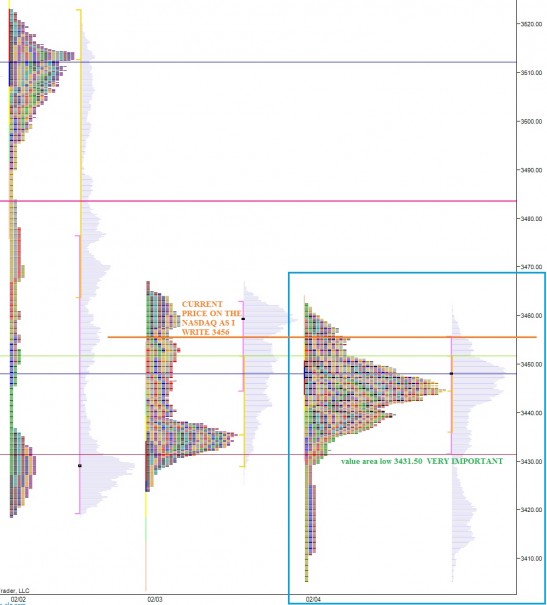

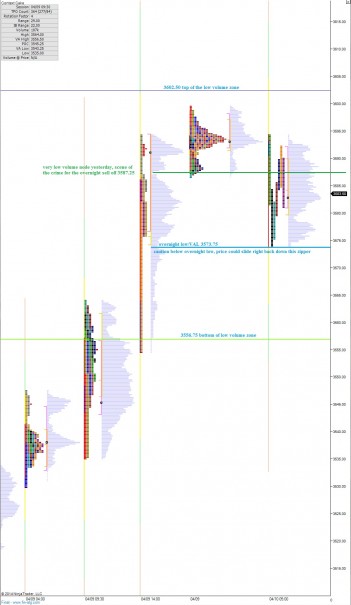

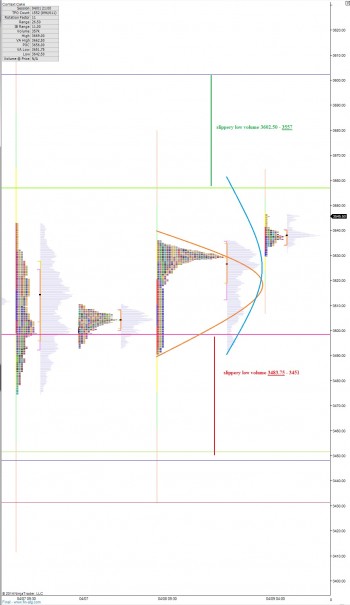

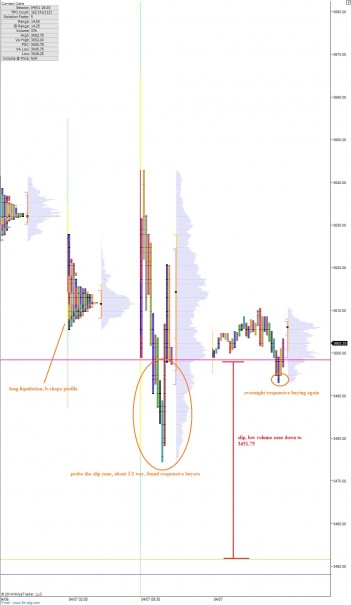

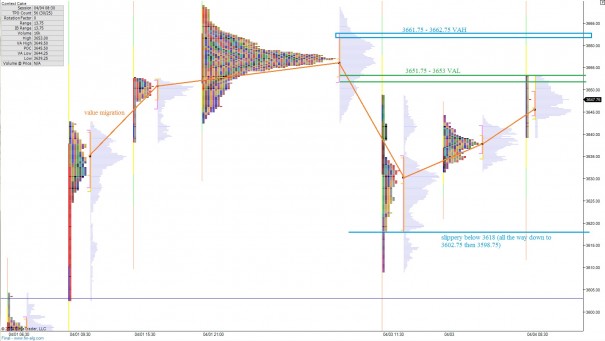

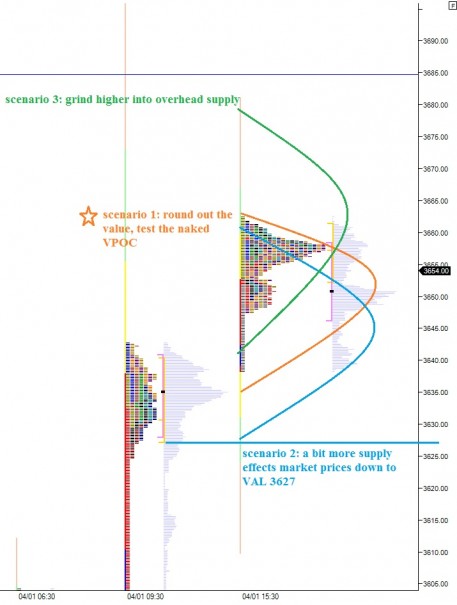

I am of the opinion that with the right tools we can formulate a sound method of participating in this gap, and the most important tool today is market profile. On Wednesday morning, I highlighted two key price zones which tell the story on the NASDAQ. One was a low volume price zone above. We traded ALMOST the entire range of that upper zone before stalling and being rejected out. Auction logic would suggest a move to the lower end of this bracket to see if buyers possess the same conviction they had down here. This takes us to February 4th, a rather interesting day. Have a look:

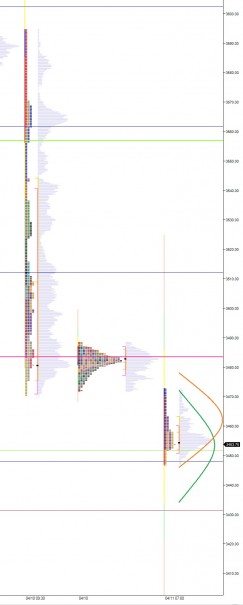

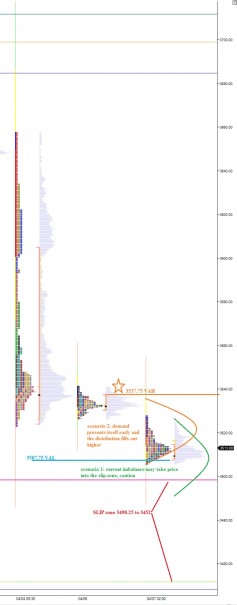

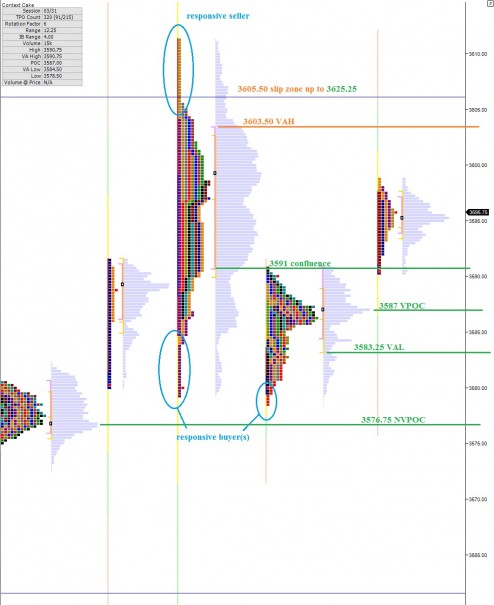

I won’t get too deep into observation of the above except to say this type of well defined profile structure is VERY useful for leaning on. I will look to buy as close to the value area low at 3431.50 as possible. Here’s the current market profile picture:

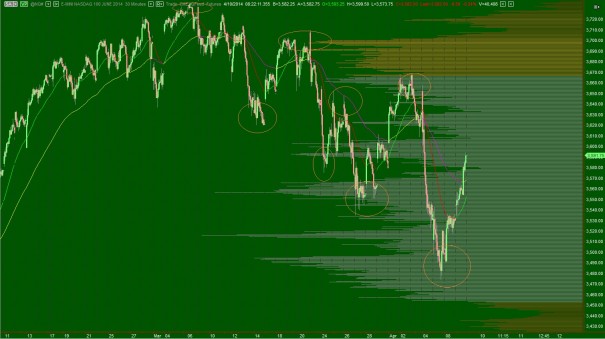

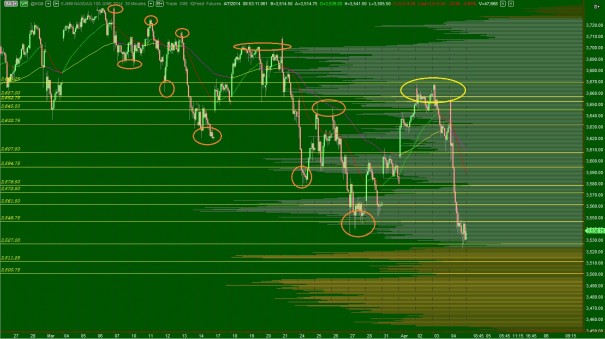

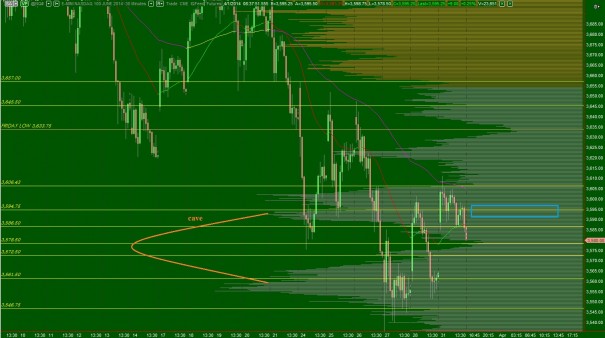

The intermediate timeframe auction is in clear seller control. They have this timeframe locked into a pattern of lower highs and lower lows. I have highlighted a few very interesting low volume nodes we are coming into this morning on my volume composite:

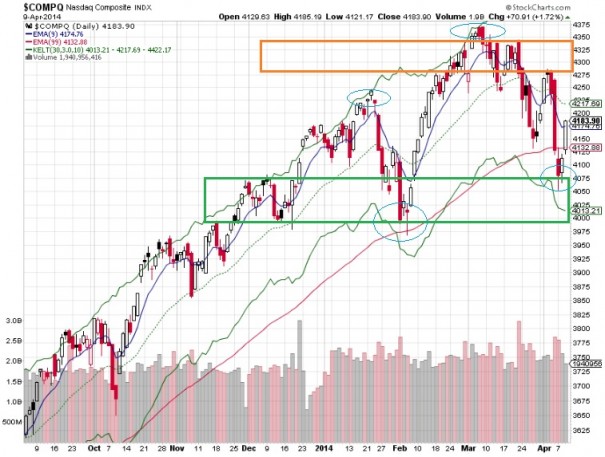

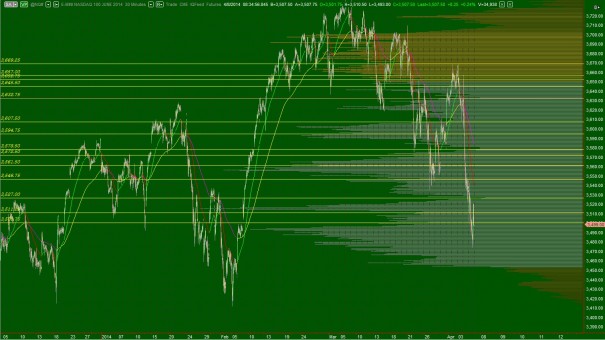

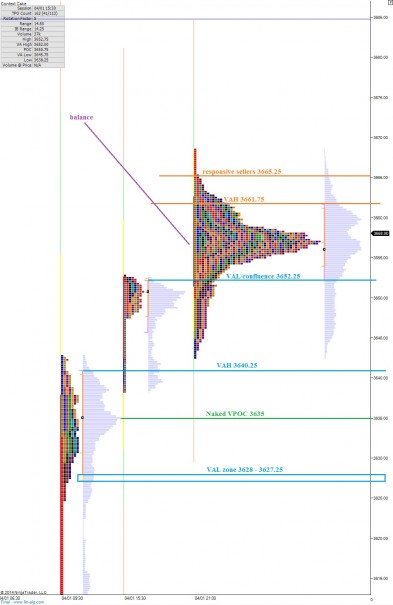

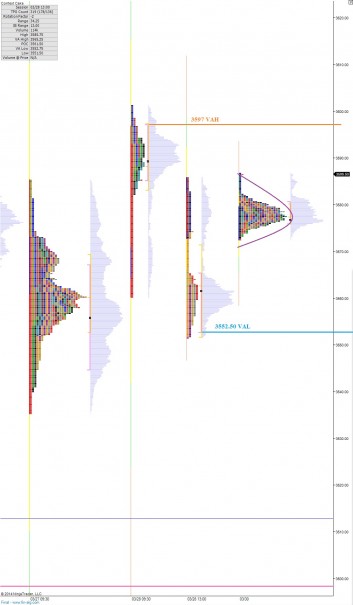

Finally, the long term auction. On the daily I show balance with sellers still pressing. But on the weekly, there is something keeping me on the buy side, a squiggly line. We may overshoot this reference point, given the markets current velocity, but I am leaning on this level nonetheless until we make a clean break:

Comments »