Nasdaq futures were already operating on slightly above average volume ahead of the 8:30am GPD release. Prices were up ahead of the data and saw a slight selling reaction to the inline numbers. There is also news of Bill Gross leaving Pimco for Janus Capital. Since the news came out we have seen selling accelerate a bit and the news has also served as a disruption to the overall bond market.

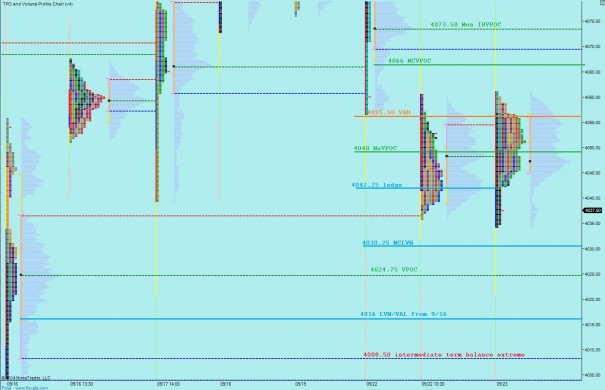

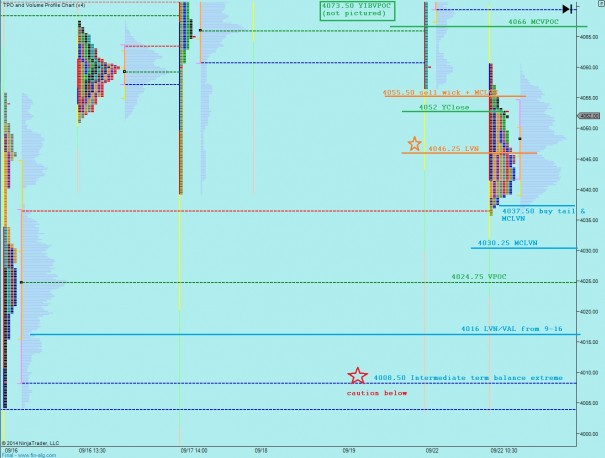

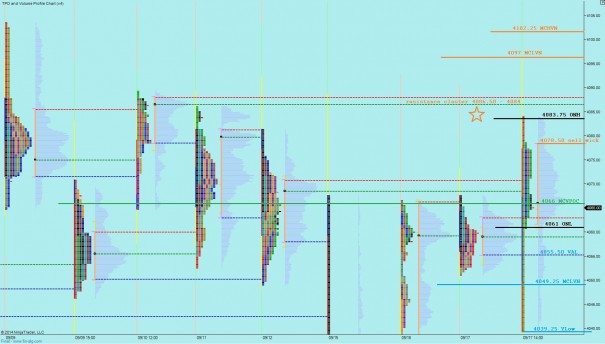

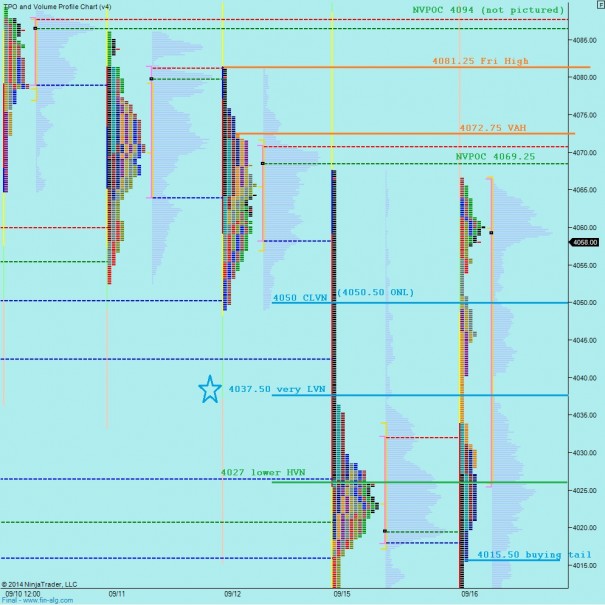

Yesterday the sellers made enough progress on the Nasdaq to call intermediate term balance into question. The boundaries of intermediate term balance as well as any bracketed-type trade are always a bit grey, meaning you cannot assign a fixed price level to them. Instead we can use volume profile to see if activity dries up as we enter the extreme territory. Also of importance is the price action leading into the extreme. This move lower started with a failed auction, an attempt to make new highs where activity quickly evaporated followed by a fast move in the opposite direction. It then printed a lower high and lower low suggesting multiple day seller control. This balance is going on 30 sessions old. Once they become this mature the likelihood of leaving them to explore new prices is elevated. In summary, we are at risk of starting a discovery process lower. I have highlighted these observations and more on the following intermediate term market profile:

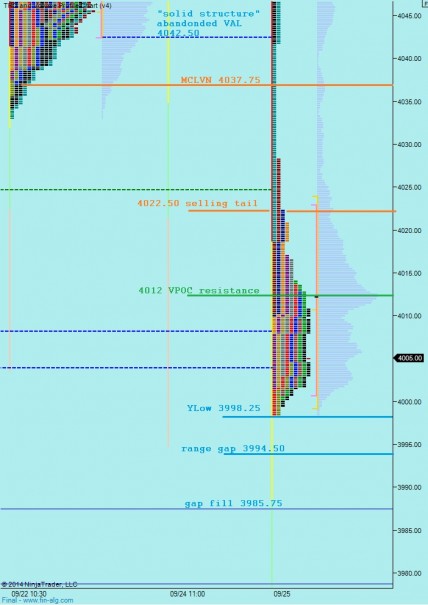

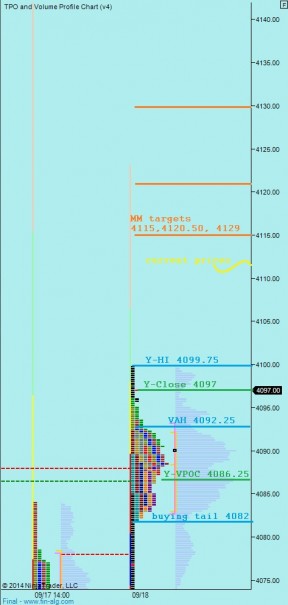

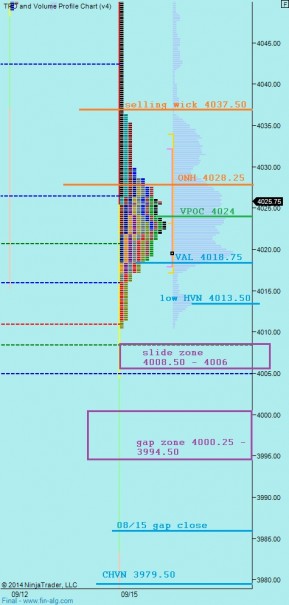

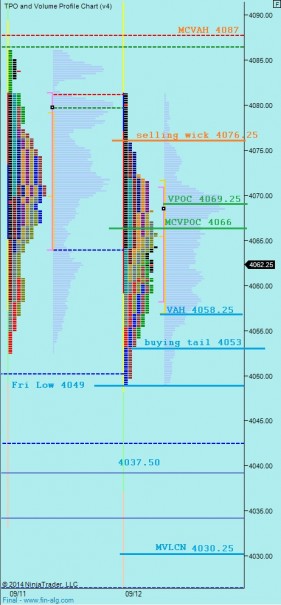

I have noted short term price levels on the following market profile chart. Note also, barely visible in the top left of the chart is the “solid structure” I discussed yesterday. This multiple day support foundation was obliterated yesterday and is out of normal upside range as of our current premarket prices. See below:

Comments »