Nasdaq futures are higher to start the week after a weak close on Friday. The market found a bid at an interesting level, 4180.25, just a few ticks above the midpoint/LVN of the volume pocket we entered during Friday’s close. The range is just beyond 1st sigma suggesting an elevated risk environment and volume is running high 1st sigma as well.

Just before the open the Industrial/Manufacturing Production data is coming out and shortly after the open at 10am the NAHB Hosing Market Index. More housing data is due out later in the week but the highest impact news comes Wednesday when both the Bank of England and the US Federal Reserve will be releasing minutes, employment, economic projections, and rate decisions.

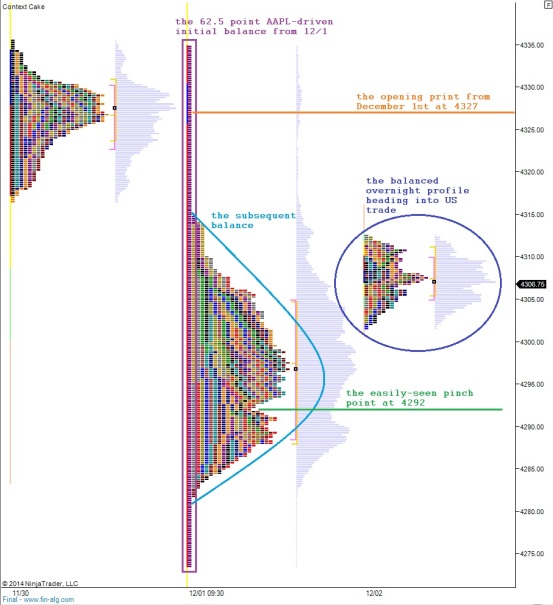

Last Friday, after printing an abnormally wide initial balance (52.5 points) during the first hour of trade, prices spent most of the session churning inside the wide range. Then, in the final hour and fifteen minutes the market sold off sharply. The move carried into last night’s globex for a short bit before reversing higher.

Prices of crude oil are still drawing the attention of macro players and a rally overnight in the commodity is being at least partially attributed to the strength in equity indices.

Early on I am looking for sellers to press into the overnight inventory. Whether those sellers are able to take prices below 4200 will be telling early on. Initially I will be looking for signs of buyers at these levels who work higher toward overnight high 4227 and ultimately target Friday’s VPOC at 4231.

Secondary hypothesis is for sellers to accelerate below 4200 and target overnight low 4180.25 which opens us to the idea of continuing to explore lower prices especially below 4179.

Third hypo is a strong buying move to test the weak high up at 4251.25.

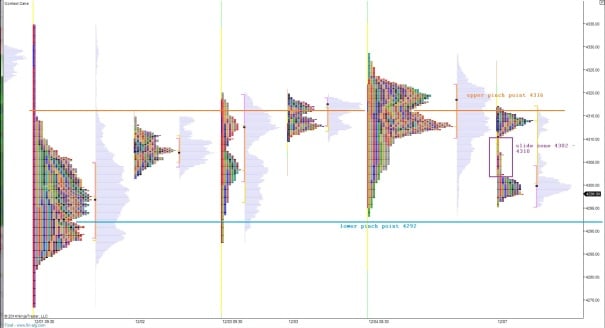

I have highlighted the levels mentioned on the following volume profile chart:

Comments »