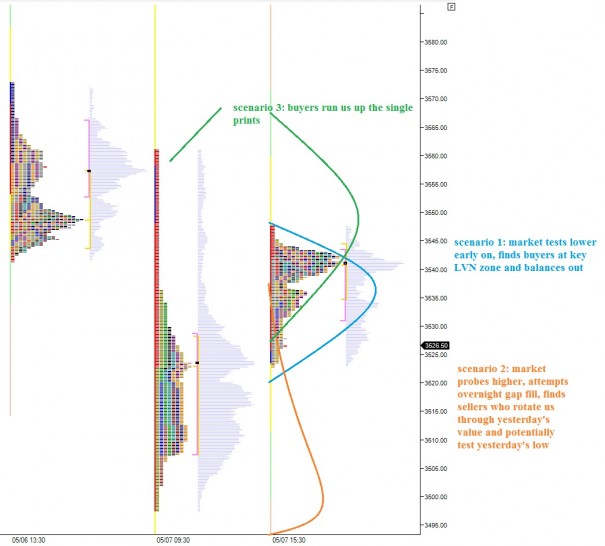

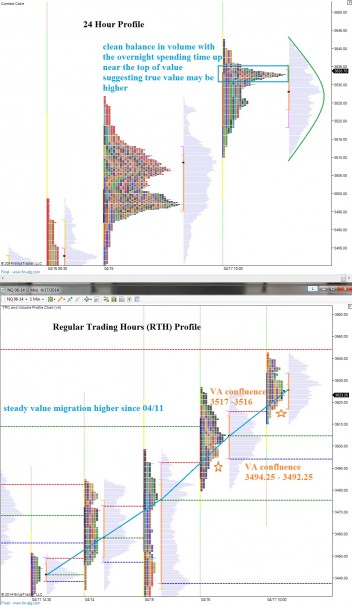

Nasdaq futures traded mostly flat and balanced overnight until some early morning selling pushed us a touch lower. As a result, the overnight profile shows two distinct volume distributions. We have Flash PMI data at 9:45 and New Home Sales at 10:00 as well as some major Dow components reporting earnings before the bell. Perhaps the most sensitive announcements pertaining to the Nasdaq come out after market close today, including earnings from Apple and Facebook.

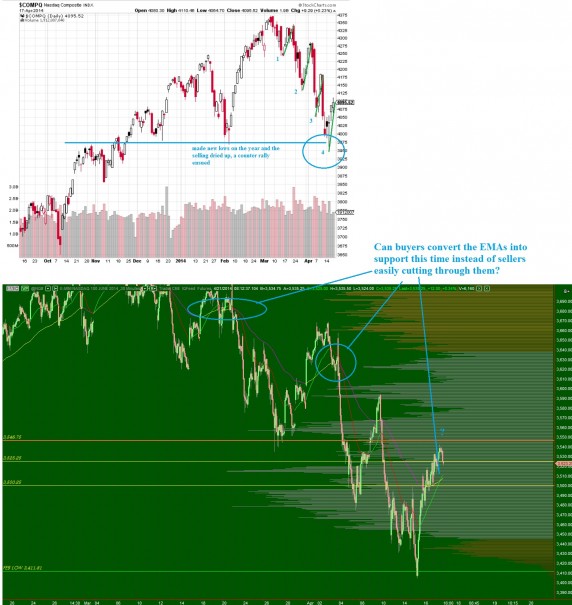

What I attempt to do with a long term chart is speed read the context of the market long term and use the information for broad strokes of risk analysis. Essentially, my vision is for the long term auction to come into balanced, bracketed trade. This is something that has not really happened since mid 2012. We are roughly above the middle or mean of this bracket, which makes risk of holding longs greater. This still is occurring inside a very long term uptrend so I give the upside a slight benefit of the doubt:

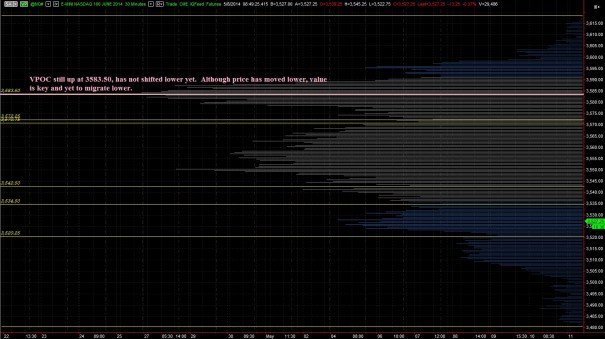

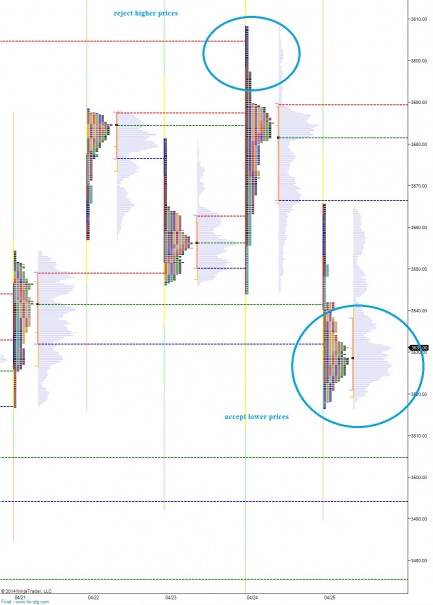

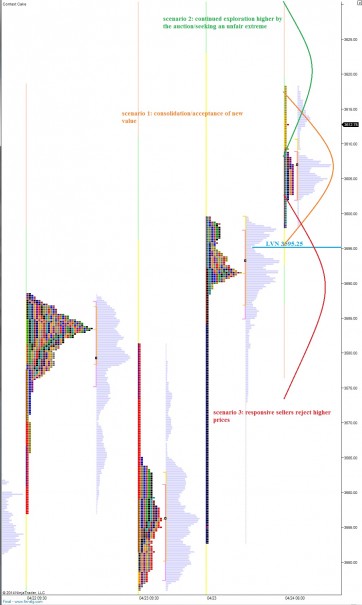

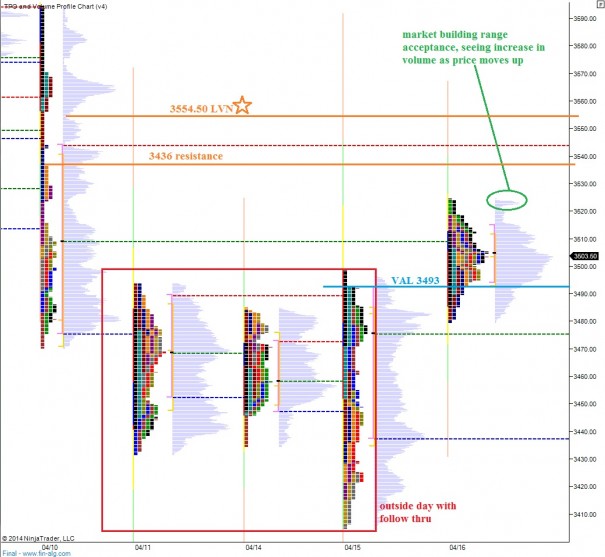

On the intermediate term, my goal is to determine who is in control and when we may see a new intermediate term change. Right now the buyers are in control of the intermediate term. They are pressing prices higher since tax day. We have come close to exceeding the prior swing high and the possibility exists that buyers can remain in control, further driving prices higher. However, I took the stance yesterday that we may be nearing another inflection point and I made a few adjustments to my portfolio. Yet buyers remain in control of the intermediate term swing, see below:

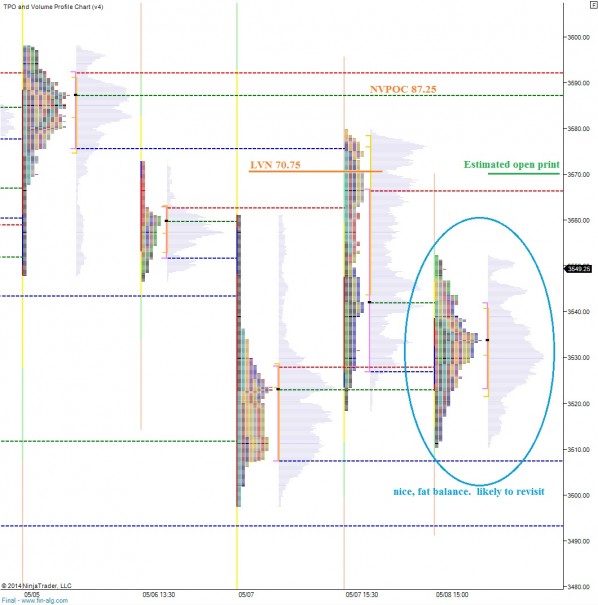

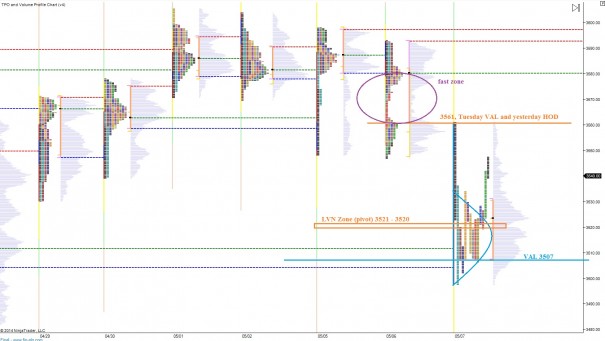

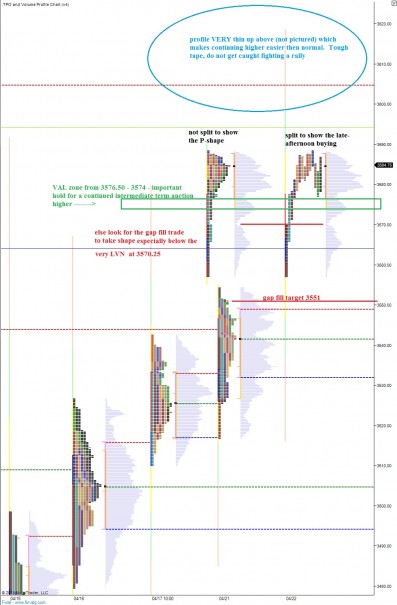

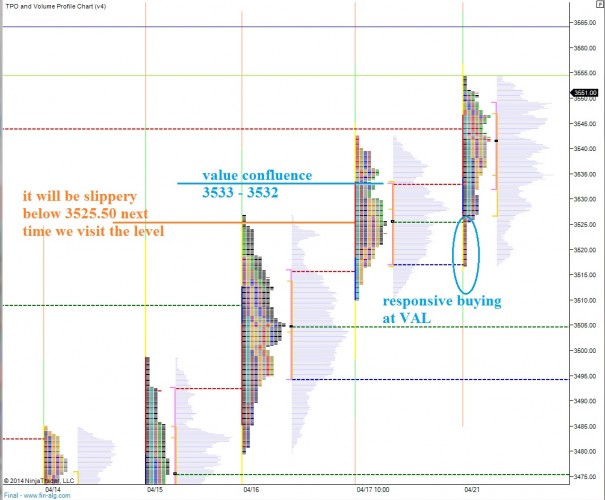

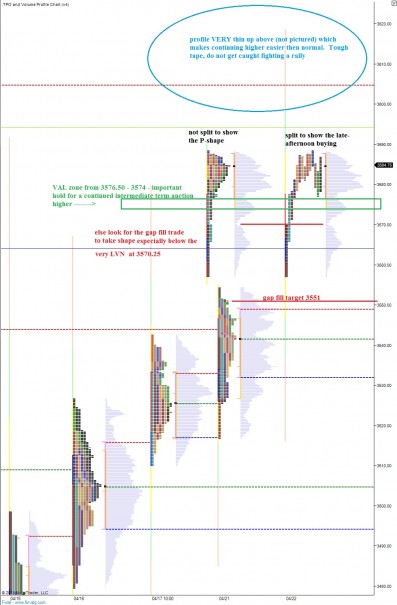

We use the short term auctions to gauge the continuation of the auction, always looking for signs of aging like overlapping value or opposing wicks (responsive selling) or sloppy distributions of volume within the profiles. Yesterday exhibited strong buyer control but also displayed a few interesting signs. We formed a P-shaped profile which suggests a short squeeze erupted early on but new, initiative buyers were not strong enough to continue pressing the value higher. In context, their passiveness in the afternoon makes sense; we made a ton of progress via a gap higher and a strong morning drive. Buying at this point became difficult. Yet, we did see some buyers dipping their toes in as another rotation did develop late in the day. Overall, buyers still in control also by closing out the day near the highs. This auction is likely to continue higher in the short term, especially if yesterday’s value area low holds as support. Otherwise, the gap fill trade may kick in. See below:

Comments »