The Nasdaq 100 index houses the absolute finest in growth and risk stocks. It includes the largest domestic and international non-financial securities listen on The Nasdaq Stock Market based on market capitalization. Some of the big dogs are AAPL, FB, AMZN, BIDU, CSCO, MSFT, CMCSA, GILD, GMCR, QCOM, INTC, and YHOO. For the full list of symbols involved, check out the link below:

http://www.nasdaq.com/quotes/nasdaq-100-stocks.aspx?col=4&dir=D

This index has some shades of value stocks in it, but for the most part these are massive, promising, growth companies. When money flows into the index it suggests our market participants has a taste for popular, big timer, growth. We could expect the lazy mutual fund managers to put down their cheese platters and stop schmoozing for a few minutes to enter their fresh AUM (assets under management) into the market at the start of the month, and as traders we sit around eagerly searching for these gluttonous flows of money. The last few months they have been sort of weak, perhaps because people are either pulling some money away from the markets or not contributing their average allotment.

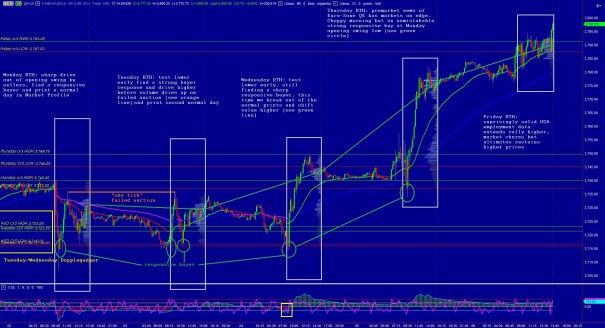

However, Thursday morning a huge unknown was removed from the market. Everyone worries about the Euro-Zone and usually we make a big story about their odd economy. However, they are taking the path of the United States, the path of free money and it has become very normal, almost an expectation of participants. These actions are what EVERYONE is watching, and MOST OF THE TIME they lead to higher equity prices. The employment data on Friday was a cherry on top, by no means a necessary to persuading the money into the market.

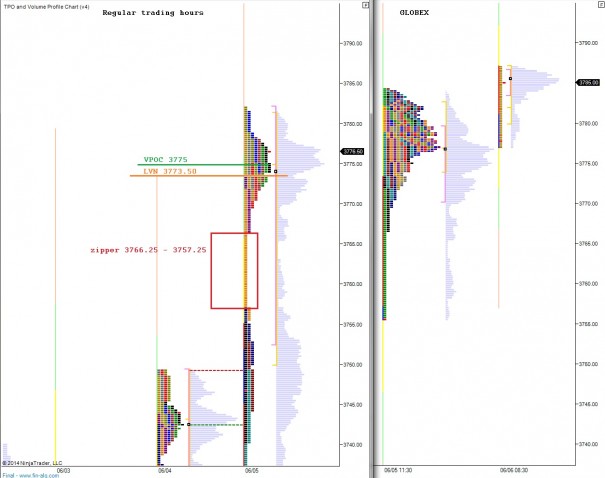

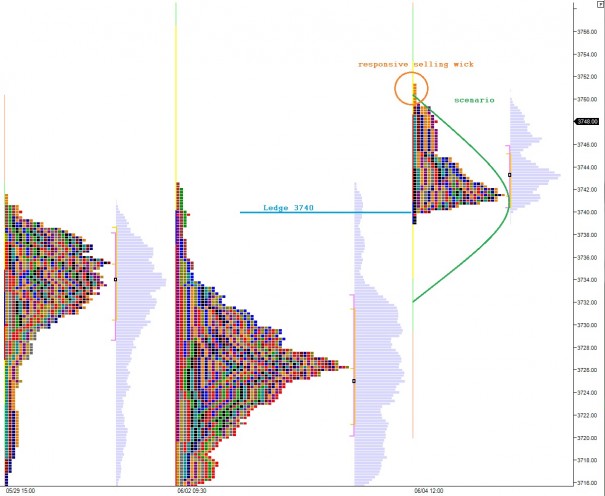

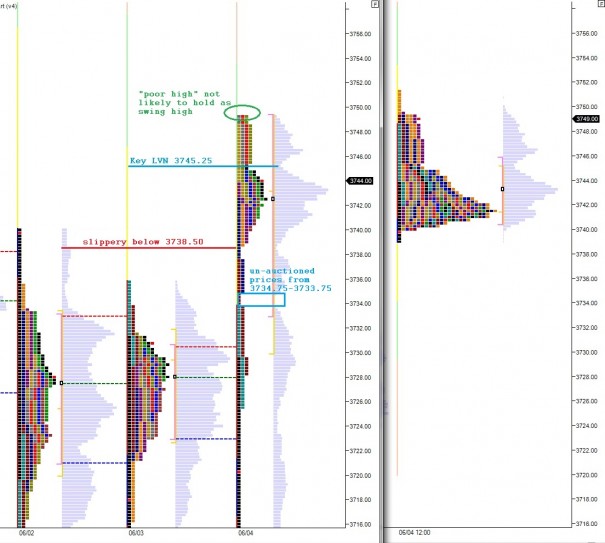

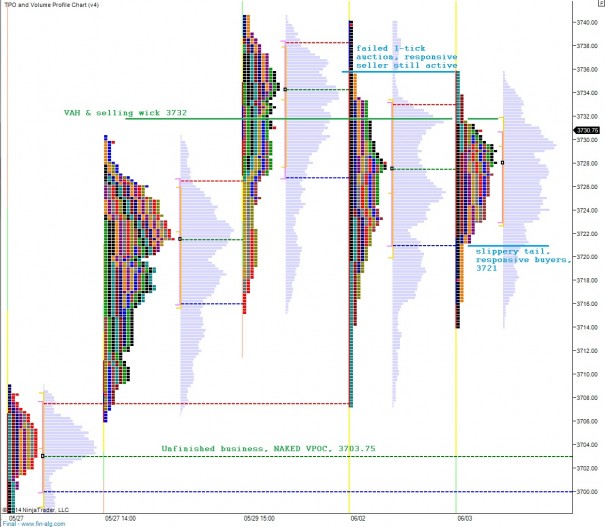

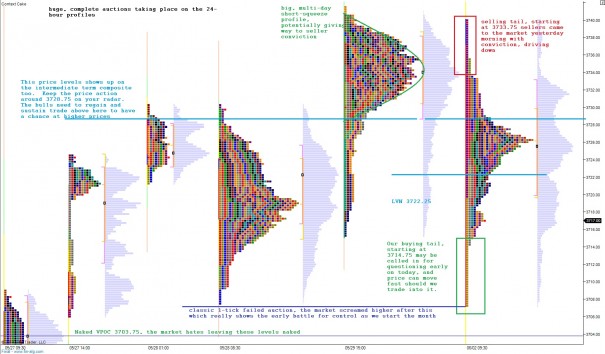

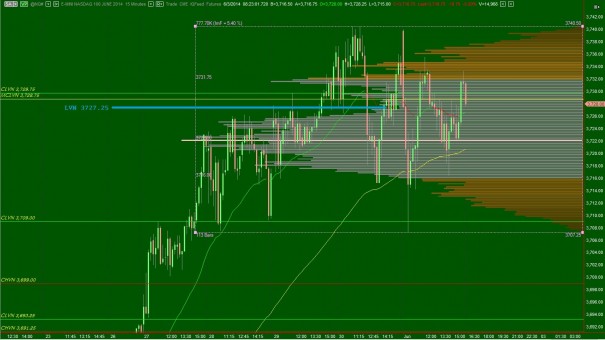

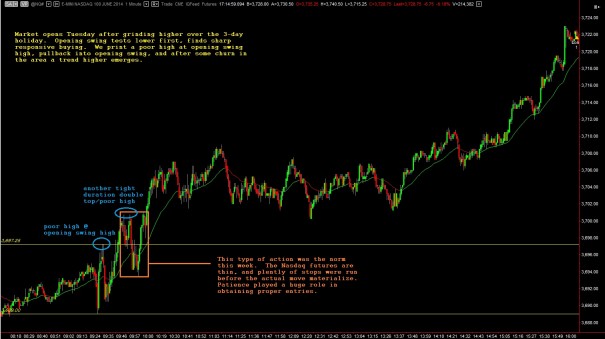

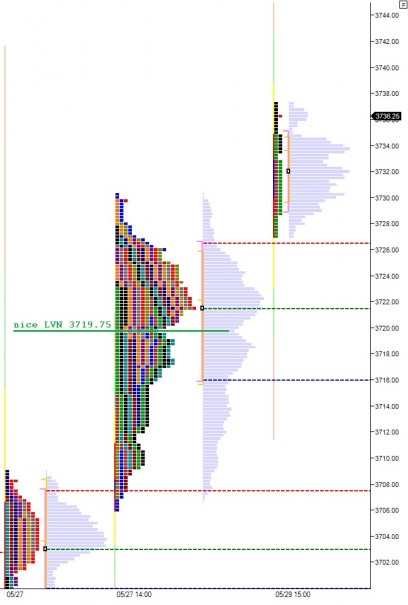

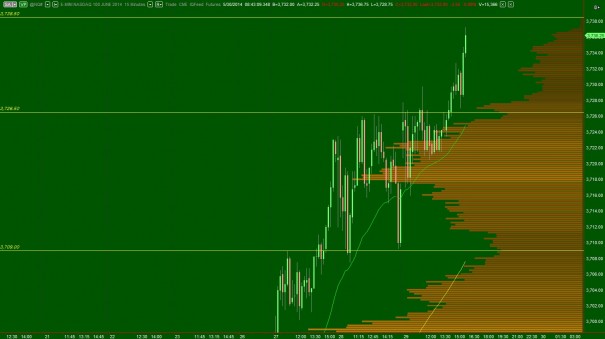

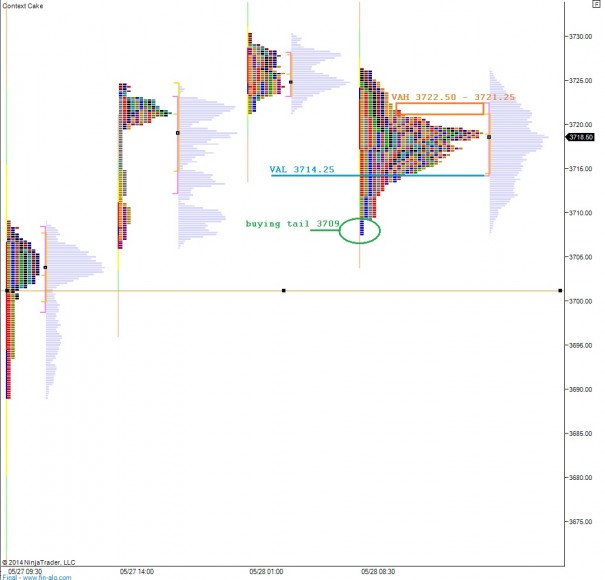

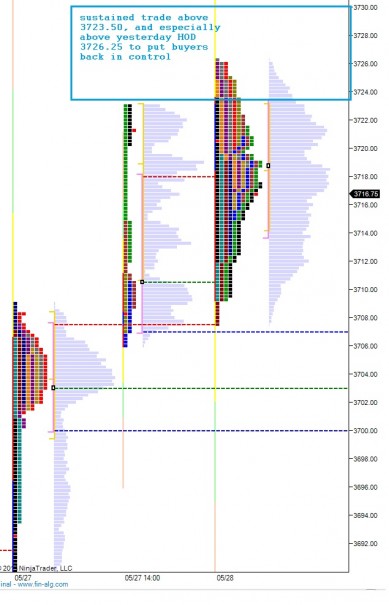

Anyhow, that is my view of the current investment conditions. This is speculation based upon what I hear people who I consider wise to the game focusing most intently upon. I like to focus intently on the auction. And without further adieu, I want to show you what a strong auction with fresh buyers coming into the marketplace looks like. See below:

Comments »