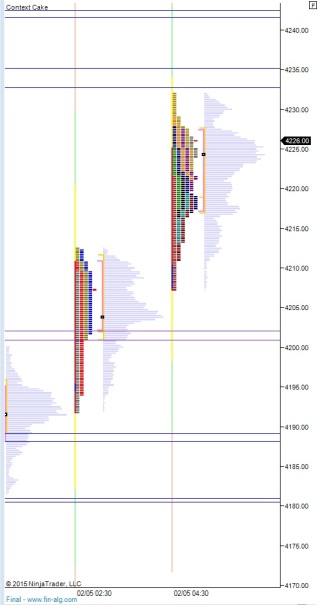

Nasdaq futures are lower as we head into US cash open on a normal amount of volume. Range is also normal but entirely to the downside. The overnight session has a slight trendiness to it. The session opened right where we closed Friday and quickly moved lower. The action took us back to Wednesday’s open gap at 4204.25.

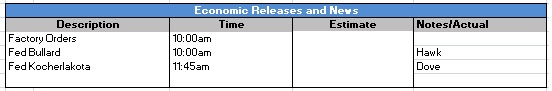

The economic calendar is quiet to start the week. We have a report on Labor Market Conditions out at 10am which is likely a low impact announcement. We also have Fed’s Powell speaking in Washington right at 4pm regarding the audit proposal. Lowes and Masco are both trading higher in the pre-market after reporting earnings. It will be interesting to see how this affects the weak charts on KBH and BZH.

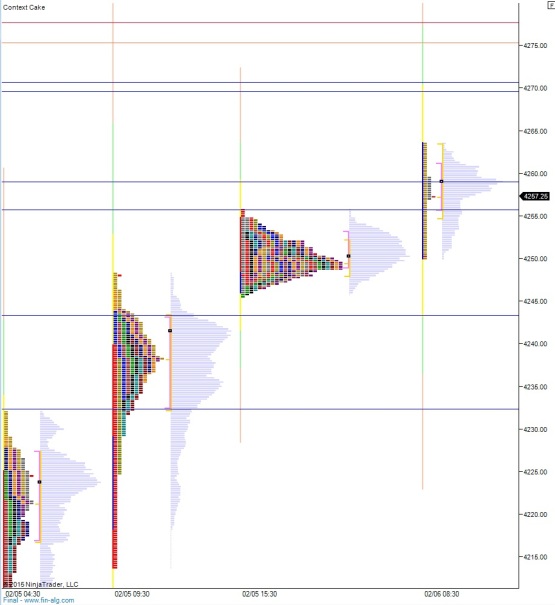

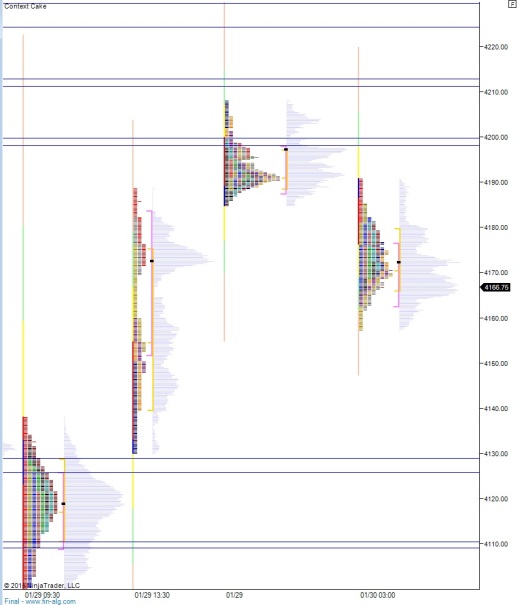

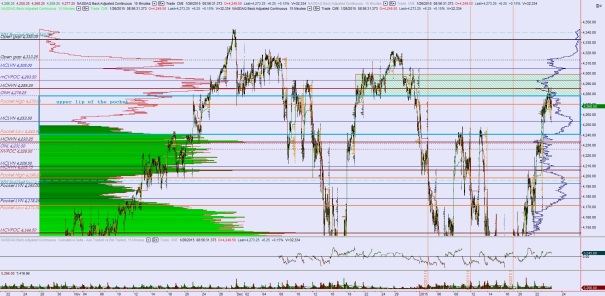

Last week we traded just below our prior swing lower before a sharp buyer stepped in and reversed the auction. We spent the rest of the week exploring higher—eventually reaching upward to the top-end of our intermediate term range. There we found responsive sellers during Friday’s session when price went range extension up, flagged and then fell through the range resulting in a neutral day.

My primary expectation this morning is for buyers to push into the overnight inventory and work up to 4214.50. This is a short term pivot that will give clarity to the morning. If sellers cannot defend in this area then we head higher for a full gap fill to 4230.50 then target the MCHVN at 4233.25 and continue to a stretch target of 4245.75. However, if sellers do defend at 4214.50 then we continue working lower to test Wednesday’s low 4191.25 and target the mCVPOC at 4178.75. Here I would expect to see signs of responsive buying.

Hypo 2 is we drive lower off the gap down and tag 4178.75 early, find responsive buyers who cannot reclaim Wednesday’s range low around 4191.25 and we see anther leg lower down to test Tuesday’s low 4166.50.

Hypo 3 is a robust push higher which fills the overnight gap to 4230.50 early and overshoots it, then another big leg higher up to 4248.75.

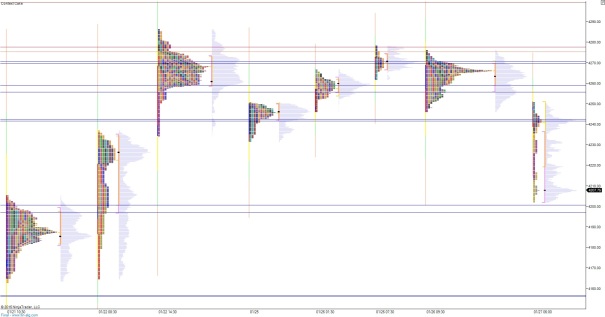

These levels are highlighted on the following charts:

Comments »