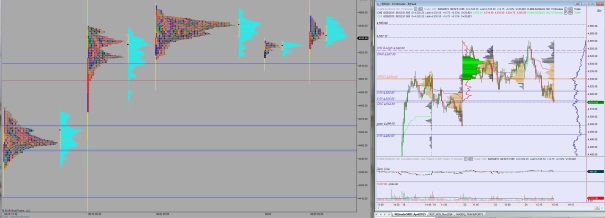

Markets pushed higher early this morning, and as we head into cash open price is entrenched in balance. Range is abnormally elevated on the overnight session and volume is close to abnormal too. The main feature of the overnight session is a 25 point rotation higher that hit right around 4am.

The Greek drama continues and at 7am Eurogroup Finance Ministers were set to meet. At 8:30am Initial/Continuing jobless claims data, as well as Personal Income/Spending data were out and the initial reaction to the news is some slight selling. Also on the docket today is Market Composit PMI at 9:45am and Nat Gas Storage data at 10:30am.

Yesterday we printed a neutral extreme day, and quite an interesting one. Price went up and took out the prior swing high and order flow dried up. We spent the rest of the session working lower and went out near the session low.

This action followed what has been a frustrating week for bears. We started Monday with a big gap up and sellers have struggled to fade it. Instead we are churning and accepting these higher prices.

The result is a well-defined value area that we can work with. It spans from 4545 – 4511. The more time we spend inside this balance, the more likely it is to resolve higher and in congruence with the higher time frame trend.

Heading into today, my primary expectation is for buyer to push on the open to target 4541. From there I will look for sellers to defend the high end of value and two-way trade to ensue.

Hypo 2 is sellers push into the overnight inventory and close the gap down to 4514.50, setting up a test of VAL 4511. Look for buyers and two-way trade to ensue.

Hypo 3 sellers close overnight gap early, selling pressure persists, and we push to test the century mark 4500. Look for a liquidation if we pierce the air pocket below 4498.50.

Hypo 4 strong buyers, push up through 4545 and continue on to test above yesterday HOD 4555.25 to target measured moves at 4557 and 4565.75.

Levels:

Comments »