Don’t Get Steamrolled

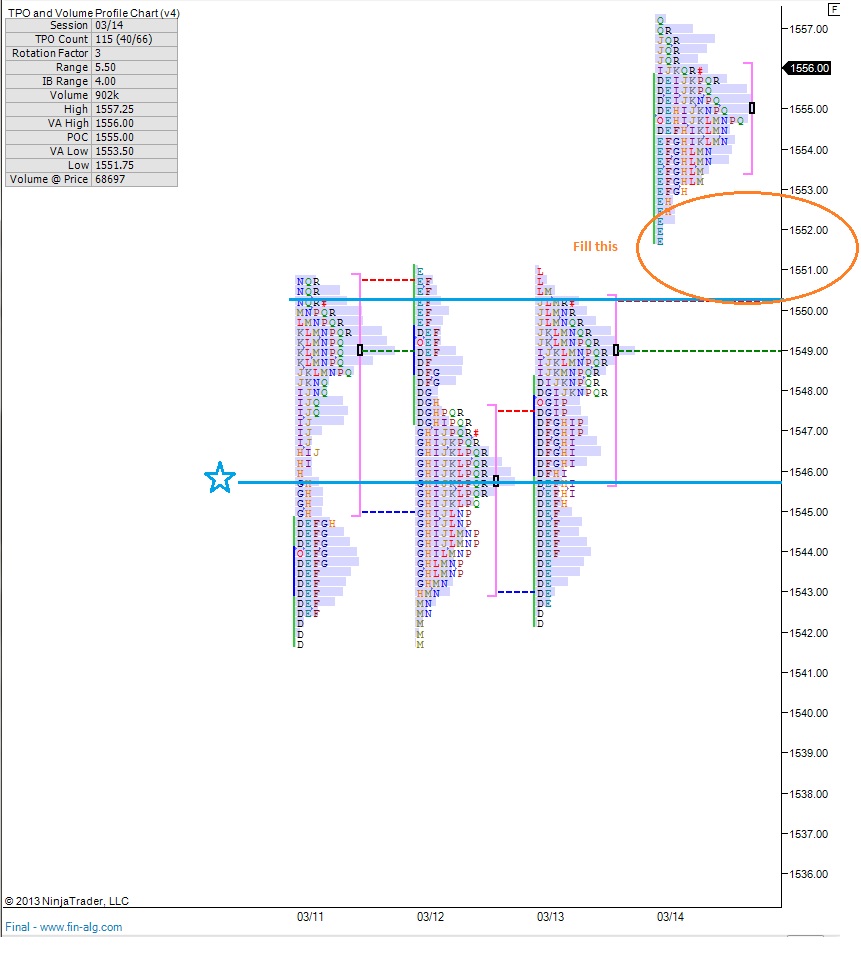

I’m looking for some responsive selling off the open, looking for sellers to present themselves at the 1552 level. However, the last two days and the erratic pumps higher show greater risk of being steamrolled if short. A caution long bias or cash are the best positions.

Batten Down The Hatches!

We’re heading into some stormy weather people. As I pen this piece the SPY is making new lows after a nasty thrust lower this AM. I used the pullback after the thrust to get large in SDS, a hedge of sorts.

As we pressed lower I stopped out of many names, including ANR, INVN, and morning initiated longs HOV and HUN. I sold them all.

My current longs are (by size):

CMG, TPX, F, ZNGA, CREE, RGLD, AWK, and Z

All together the above represent 42% of my holdings. Most are faring decently into this storm, but I swear no allegiance to any of the names and will cut any that get too loose.

You have to get big in a slowpoke like SDS for it to have any effectiveness. Right now it stands at an 18 percent position. That leaves me 30 percent in cash waiting for the next high probability trade.

Try to stay dry out there folks!

Comments »The Bull Foot(hoof)print

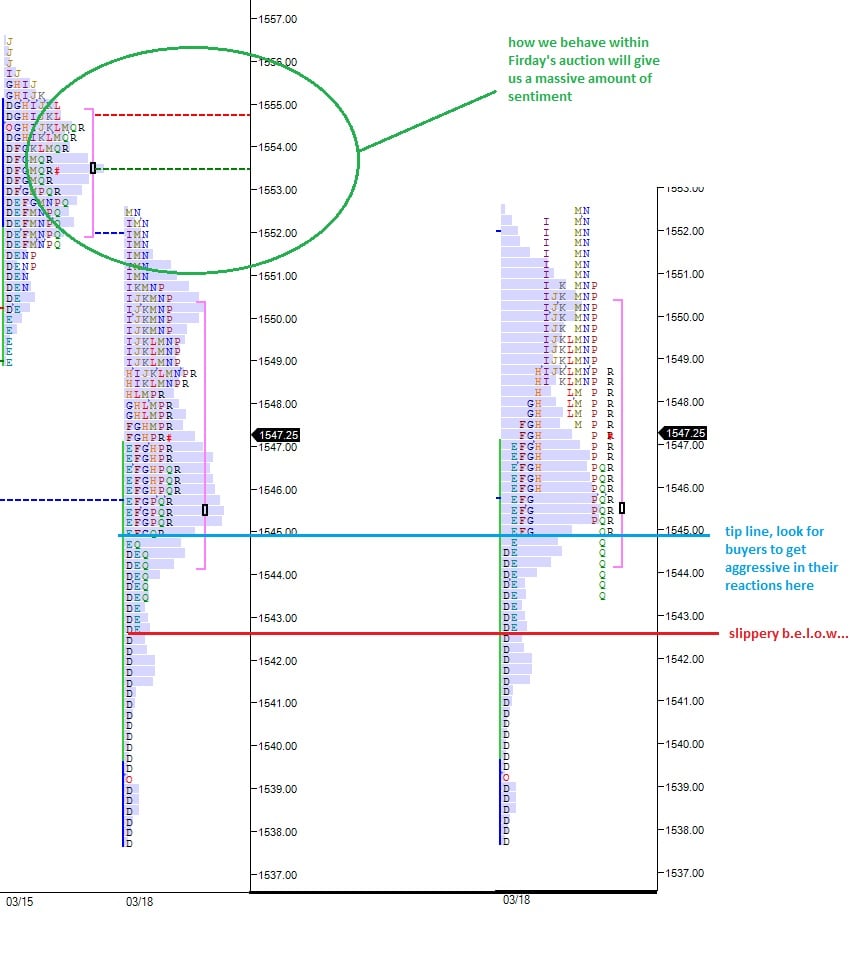

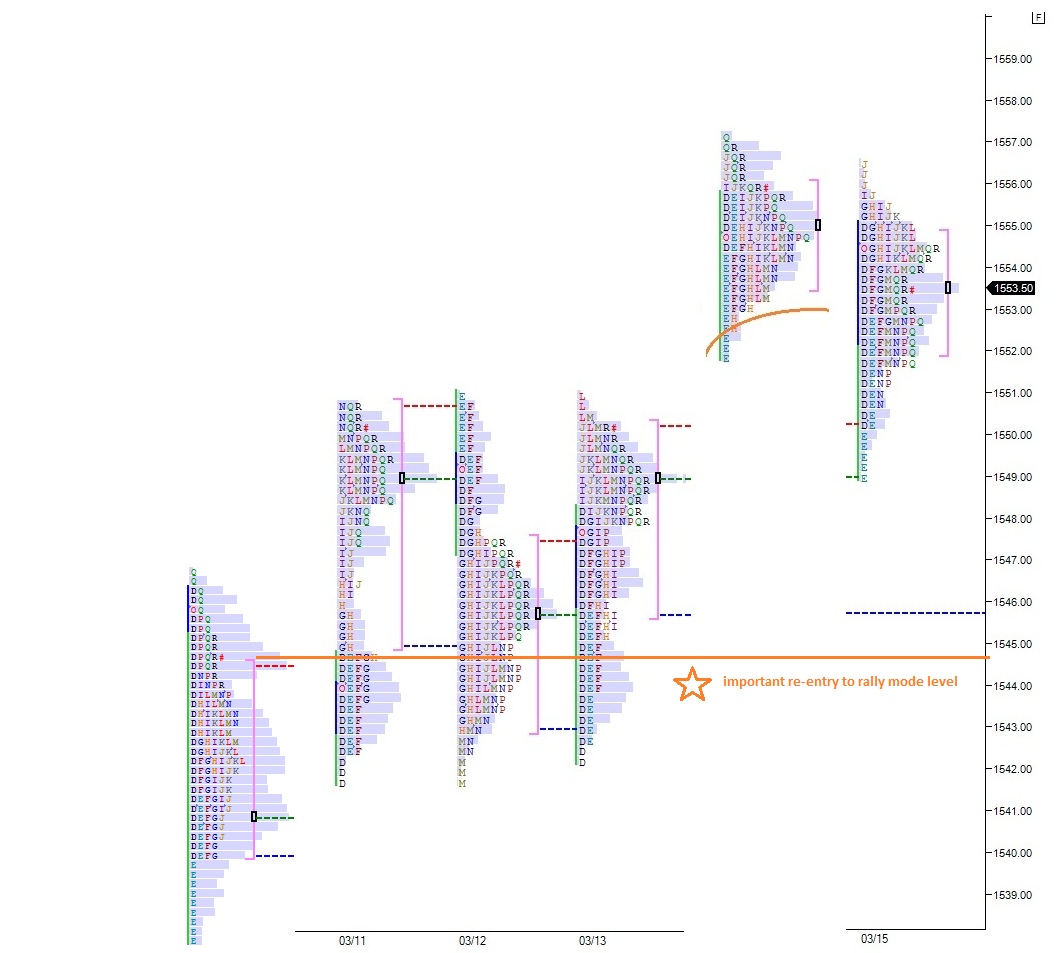

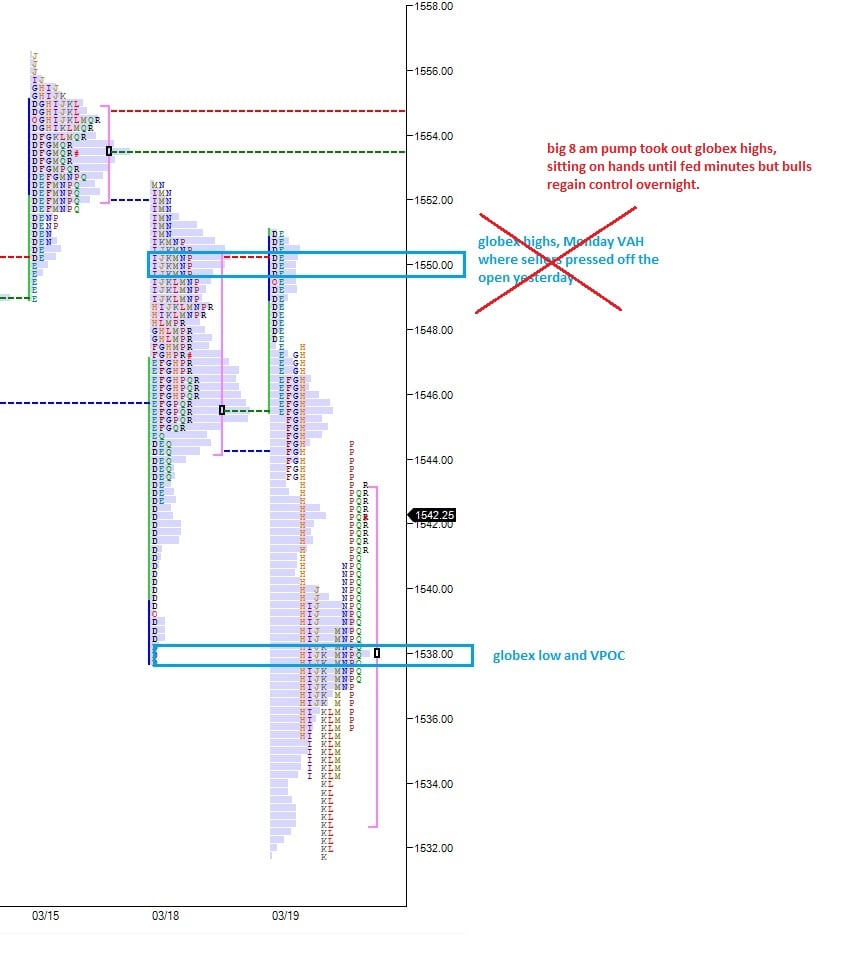

For me, the time when we’re trading within the range of a previous auction is where my edge is the sharpest. The reason being I can get close to the action and laser focus on where participants have made themselves known. With that in mind, and to tune out unnecessary noise, today I present only the previous two sessions of trade.

I’ve highlighted below what can only be described as an aggressive reaction by the buyers. They woke up Monday with the futures bouncing off their Sunday lows and they came to the market with buy orders. It wasn’t until we reached Friday’s value area low that the flow of sell orders was enough to stop the liquidity march higher. The afternoon attempt to dictate price lower by the sellers was shut down, and another aggressive buying reaction footprint was left on the profile.

Should the buyers not behave in the same manner at the levels highlighted below, that tells me something has changed. What has changed? Don’t care bro, something. The sentiment of the buyers has changed in a material way and they’re backing off their bids.

Up above, the sellers cleared were a greater force and stopped price in its tracks. Keep in mind, however, that this was after a 14 handle intraday rally. Today is a big POMO day with $2.75 – $3.50 billion in outright Treasury Coupon purchases (source: ZH). Should all that liquidity find its way into equities, we need to closely monitor price behavior within last Friday’s range and act accordingly.

Trade well, be water.

Comments »Another Day of Indecision

We continue to hover around the highs after a brief overnight scare of the European variety. Unlike the super intelligent bulls and bears who are confident on their directional conviction, I feel like a dark pool of water, waiting for the river to take me away.

I’ve embraced this uncertainty with a high cash position, currently hovering near 40 percent. I also put on a hedge Friday, in $SDS, it was a 15 percent position that I’ve taken down to 10 percent. I find hedges work best when they’re cashed out as soon as they’re in the money. Otherwise they just sort of evaporate away and then they’re an anchor in the port when the market sets sail.

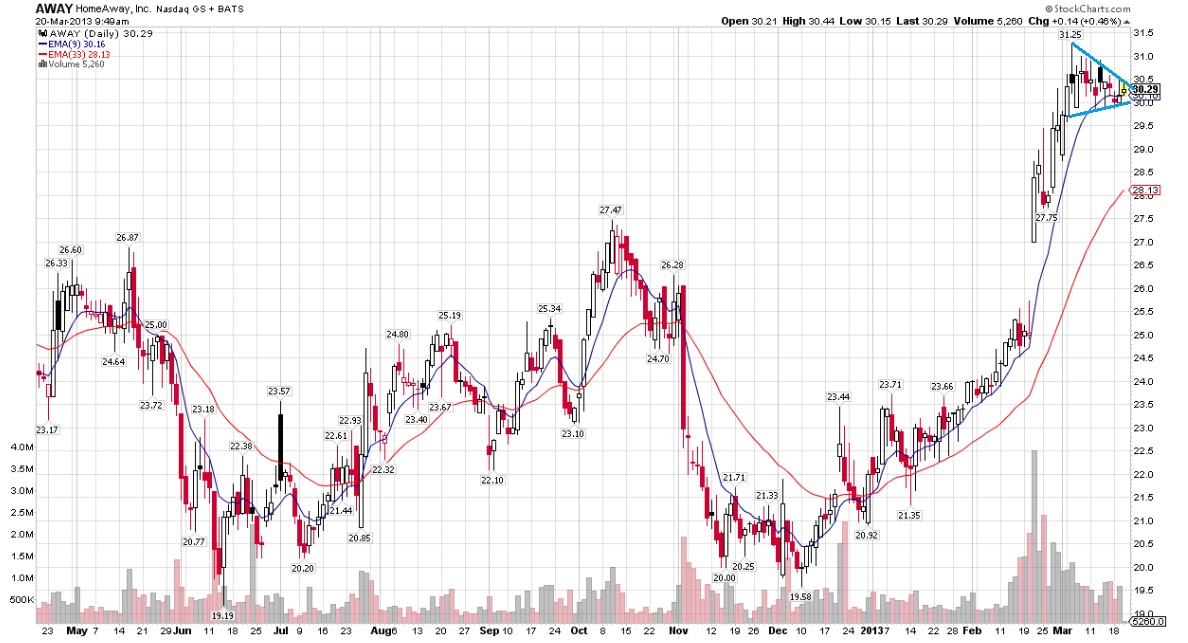

I sold out of CCJ and ANGI, both winners. I sold the former because the chart pattern is sloppy and I don’t want to be in sloppy charts in an indecisive-frothy market. ANGI was sold to lock in the huge gain and free up some money to rotate into my new position. What’s my new position?

It’s Ford! ‘merica

I like how quickly the stock rebounded this morning and where price currently resides on the daily chart. I have a few other names I’m stalking, but nothing screams ‘buy me’ like they were the last few months. Many setups are on pullback #3, which has the lower probability of success. Therefore I have to either pass on the setups, or apply a tighter risk management either through a tight stop or smaller position size.

Comments »Turbulance

We’re heading into some turbulence this week, with the S&P futures gapping down over ten handles. The overnight session saw price over 20 handles lower before buyers stepped in and stabilized price. Since around 2:30am (near the European open) we have seen the price of the index rebound 10 handles.

My profile is looking haggard because the contract data did not roll properly from March, so it may be a few sessions before it’s all cleaned up. However, I do see 1544.75 as a key level for bulls to recapture if they intend to assert control of the tape. Otherwise, I expect to see consolidation type trading where we recheck some past levels for significance (see if they become support).

Comments »Quick Trade Notes on New Long $INVN

This company’s components are showing up in a variety of new products including a badass new basketball that helps kids get their game up.

There hanging around inside Apple products too. That’s the backstory that had me stalking, then I finally got a decent spot to enter my long, check it out:

Comments »Morning Profile Annotations

Maverick Reengaging

It really is odd how only missing four days of market action and a weekend of study has me feeling weak handed. It’s no surprise most of the best never take vacations and are a constant fixture on the internet. So much happens in a minute.

Many incorporate a systematic approach to trading which allows for the monitoring of multiple markets and timeframes. Most of trade location and setup can be mechanical, but entry and exit are what can be more of an art.

I think I could travel freely so long as I have a reliable connection and travel during non-market hours. I like having reliable infrastructure so the plan is to keep within the boundaries of it while the market is open.

So now the important task is getting back into my stride. I have some charts I’m liking and I’m glad that I got very small on VHC before vacation. Had I left my stop in place I would have been out already, however, it wasn’t much better of a pricing then where we landed today. I’m not caring too much about this. It needs to be cut but I got distracted talking to a coworker as the market closed. Excuses, Excuses, it needs to be cut.

The real ace-in-the hole I have for getting caught up this weekend is ChessNwine’s Weekly Strategy Session. Believe me, this post is entirely without incentive. When it comes to premium products I keep the purse strings tight. I got a taste for the strategy session while I was interim blogger and I can say without doubt that it gets you where you need to be.

Plus, once I’m plugged back into the market I don’t necessarily need another strategy session. Chess understands this, and offers a onetime pricing option. Bravo good sir, I’ll take one, perhaps two or three.

I’ll be working on damage control tomorrow but I’ll be back full swing come Monday. Vai con dios amigos.

Comments »Slow Motion Decapitation

Today I’ve felt completely out of sorts. The markets are levitating above their highs, yet I’ve only mustered the courage to buy more CMG. Everything else, I’ve only stared at. I keep checking in on BBY aka Best Buy. This was my top pick going into the Super Bowl yet I sold it for a small loss. It’s been non-stop ripping ever since.

For a while today was just another episode of Raul’s portfolio makes new highs then VHC died. I have a tiny VHC position, I’m about to not have said position. Holy binary outcome, yes yes? The devastation of the name is enough to drop my portfolio by 30 basis points so I’m not exactly putting my head through sheet rock over here. Nevertheless, I am dissatisfied to be knocked clean off my high watermark.

I don’t want to short the indices because I have no signal telling me to do so, yet I’m not confident in many of my longs. Not even CREE. I’m sitting on several 20 percent gainers here and a huge cash pile and I feel like a stick in the mud. It could be this head cold I developed upon returning to the arctic north, or it could be I don’t have twitter running, or it really could be a hangover from being fired from iBC. I need to find some motivation.

I really don’t want a huge cash level, but it seems like the only option as my brain is currently on sabbatical.

Comments »