Looks Boolish:

Comments »Keep an Eye on The Aggressive Bull

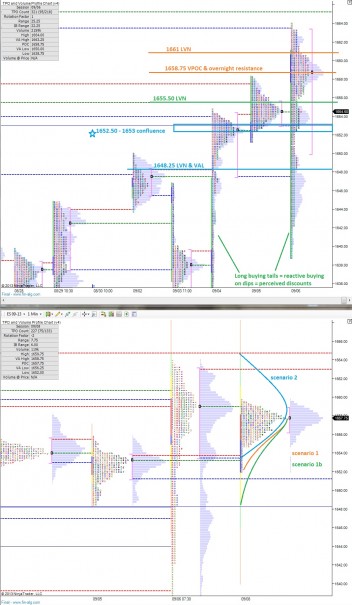

Hello and good morning. The globex session spanning from Sunday evening and into the early hour of Monday has been a quiet one, stable, and without much by the way of new developments. The S&P printed a nice bell curve distribution overnight within the upper 1/3 of Friday’s range.

Both Friday and Wednesday left the very visible footprints of reactive buyers. These show up as long buying tails. We often speak about the big money being away during the summer, which is debatable, but last week certainly saw signs of heavy money flow. Whether it was due to the new month or the pros coming back to work, I’m not certain.

What I do know is if we see the market trade back below these buying tails this week, that is going to put all of that aggressive reactive buying under water. If price sustains above the buying tails, we may see a bit of confidence returning to the market. The buying tails are key piece of information to measure sentiment against early this week.

I’ve highlighted several areas of opportunity on the following market profile chart. I’m particularly interested in the confluence of support nearby from 1652.50 – 1653. If the market cannot sustain trade above these levels today, the reactive buying on Friday comes into question as we enter the thin volume portion of the profile. My expectation is for buyers to hold near these levels.

Comments »

Full Position Synopsis

Into the weekend I would like to very briefly run down my portfolio holdings and the reasoning behind each. This information is coming off the rip after a long week. Thus any thing with a flimsy justification may need to go.

Here we go, from largest to smallest holding:

Cash – I have 20 percent of my book sitting cash. I’m eager to deploy it on the long side

SKF – I’m using a three year volume profile chart to view BRK/B, WFC, GS, C, etc. and I see a great volume pocket below prices. Plus they’ve broken down off their respective highs and are printing tight bear flags. The overall market is on unstable footing and I want some levered short exposure.

RVLT – Yes, it’s my largest long holding and currently the bane of my stock existence. It earned largest ranking when I blew out my YGE and YELP shares this week. They were my prior biggies. The stock is trading worse than a bag of dicks at a hot dog eating contest. There are no buyers and presumably a few large sellers cashing in on the 600% plus move that took place up unto the day I bought the stock. The business model is stronger than ever, the shift in focus from consumer products to large scale retrofits is brilliant, and the investor population is still very shortsighted on the opportunity in lighting. I still love this name, and I plan to cost average in through several quarters.

AIXG – My German LED company. I love LED technology and I see this company as a beneficiary in Europe due to their energy awareness. The stock has been dead money for months and I continue to hold. Nothing has changed here, but this consolidation has excellent potential energy.

END – Huge short interest, oil exploration, and a hot chart.

CREE – Same as RVLT and AIXG, I want these names until incandescent and HID bulbs die. I’ve been in since January, why exit now?

TRLA – I love their app and use it constantly, the chart looks great, Zillow has been a beast, value added to realty pros, and Le Fly is in the name.

CLF – Tight consolidation, looks like it wants to rip and if it doesn’t the risk is really low. OA went YOLO on it this week too, although it never moved so that may have been a small loss.

FB – Marky Mark and the poke crew are getting it done. Holding

LO – Blu eCigs and menthol cigarrets won’t actually get banned. Interest rates need to stop rising, it’s making the coupon less attractive.

F – Still a strong chart and a nice product line. This is a patriot long still kicking around my port since the 4th of July

IMMR – haptics are way underutilized by porn. I think the porn industry will drive growth here 😉 Also, a Le Fly favorite.

USO – I should still be large but I took a bunch of scales on the way up. I almost sold it all. Look, that would have been really dumb.

O – it too pays a large coupon which is losing allure with bond rates rising. I traded my favorite reversal pattern really well in here with a large position. The locked in gains dipped my cost basis way down here. So I’m basically break even on the idea, waiting to collect some coupon.

That’s my holdings. I’m interested in a few other names, like SFM and GOGO, but will wait until next week to act (obviously).

Have a great weekend everyone,

Raul

Comments »Week 1 Future Trading Performace

Well it was a modest week of making money, until today. In two quick swooshes the market took back my gains and more resulting in a losing week. In my defense and in the defense of my cycles, this was a rough week to get started for the following reasons:

1. Holiday shortened week

2. Wednesday never once pulled back

3. Thursday (yesterday) was a freakishly quiet, like five in one hundred occurance

4. Today was a news driven monster truck rally

What’s interesting to note is this week’s losses did not damage my ego whatsoever, where I normally feel a bit aloof and edgy. I think it’s because I’m sticking to my well laid plans. The laws of large numbers will kick in next week, and I should recapture most, if not all of these losses.

All that being said, I lost money my first week live trading Bossram Alpha. It only had one losing week backtesting from March 1 – present…go figure.

Before commissions, Bossram lost $675.00 and Elroi, the jackass helper robot lost $25.00 aka outperformed me this week by losing less money.

As a result, 10k has nearly become nine.

With more screen time, days like these will be some of the best of the year. For now, they’re modestly priced classes in humility and market skill.

Comments »

The Overplay for the Underlay

Well how about that morning /ES session? Quite the contrast to yesterday and the paint drying we were subjected to.

I had a great little scalp long at the open. Then I engaged Bossram even though I wanted to see a test of yesterday’s VAH first. I adhered to Bossram. It took a loss on the long side, then it engaged short, and took a loss on the short side.

The bad news is I took 2 losses in a row trading Bossram, the good news is they trades were fully plan compliant, and could have been much worse had I not adhered to the plan.

Typically, it goes on a huge win streak at this point, so the key is to continue to engage. But probabilities are probabilities, every trade is a coin toss.

Elroi scored one short for 1.75 handles and is currently taking heat in another short.

Onto my portfolio:

I sold some scraps out of my book, remaining runners in YELP, BBRY, and YGE. I also bought more SKF. Whether or not that trade works out is very much still debatable.

No reason to be down on these losses or saying adios to my winners, it’s time to dig my heels in.

Comments »

Mind The Value Migration

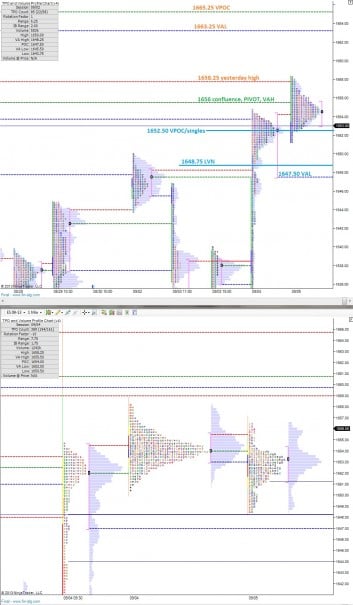

We want to keep an eye on the migration of value, especially now when we’re trying to decipher whether the most recent strength will sputter out, offering a quality short entry, or whether the market is taking a short pause, a wall of worry moment if you will, before continuing higher.

Last night’s session was nearly as balanced as what we observed yesterday morning, although much less docile, printing nearly an eight handle range. Initially the S&P was weak into the late evening, but a bid came in near the European open and we moved back into the upper quadrant of yesterday’s action. We have some important data coming out in a bit from the NFP that could get us moving. The key take away from the current profile is where we set value relative to yesterday’s session. The value did move slightly lower, but still within the value area from yesterday, showing little has changed in terms of market perception, and the momentum is still in the bull’s court. Again, this could either change or strengthen post NFP.

I’ve highlighted a few areas I’ll be looking for trades and the above observations on the following market profile charts:

Comments »A Complete Rundown of Today

I had a flat tire when I woke.

The markets took a pause for the most part today and although a calm, balanced day should be high on your expectations following a trend day today was borderline absurd. The first hour of trade is referred to as the initial balance. The probability of taking out neither the high nor the low during a day session is less than five percent over the last five years of data.

Today we witnessed a tape so benign it was special. I took a long at 10:30 AM, missed my profitable exit around 3pm, and scratched the trade break even at 3:10pm. You wouldn’t believe the frustration that trade produced. I mean, I look at a stock trade like RVLT, slowly bleeding the lifeblood from my person, like a particularly pestering mosquito. Eventually winter comes and it freezes and dies. But each /ES position carries a marginal value over $30,000…which is why I like my gratification instant. My algo, Elroi was dormant today. I expected as much since Elroi thrives in high velocity conditions. Bossram put me on the right side of the opening bell and I extracted 1.5 handles.

I beat my head against the urinal wall then ate several hummus treats.

I had quite the laugh when I saw my boss for the first time today and, I kid you not, he was wearing a full Canadian tuxedo. It was so majestic. The only wardrobe piece missing was a mystical wolf tee shirt. He also wasn’t rocking the official Canadian belt buckle. Needless to say, it was a clear omen from the stock gods and I sold the majority of my BBRY long. I’ve kept a 1/3 runner in case Wayne Gretzky makes a surprise move onto the board of directors.

The wires are reporting AMBA in fact beat expectations, as was written in these halls for months by our fearless leader, Senor Tropicana. As you know, I exited the position yesterday, but I’m still bullish on the name. The GoPro is as cool as RedBull these days.

I slapped on a pretty sizable SKF position into the bell. It seems in slight haste in hindsight, but I had just untethered myself from the /ES and found the action excessively befuddling. Therefore I thought it prudent first to sell one of my longs. But I looked at all of them, the little rug rats, and I couldn’t part ways with any. So I tossed on the SKF hedge.

I sold a little bit of YGE but I’m keeping a small piece just in case it keeps going.

I took nearly a full size position in CLF early on, it looks hot.

Time to go home.

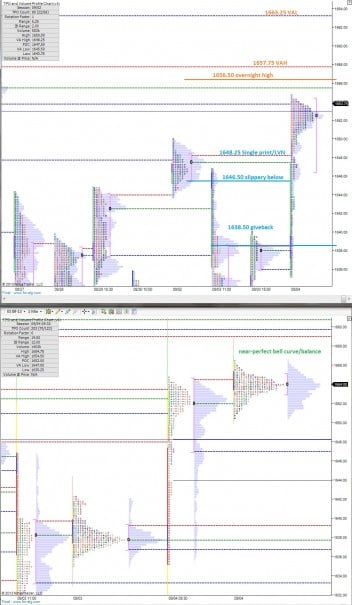

Comments »Near Perfect Balance Overnight

Yesterday’s action in the S&P was successful in closing last week’s gap lower, but we’re still trading lower then where we came into the market at the beginning of last week. As a result we’re coming into some overhead resistance on the profiles where I expect to see active sellers (overhead supply).

Keep in mind however, if we’re seeing buy flow continue to drive the market, expectations may change.

The overnight session shows a near-perfect balance which leaves little in the way of clues to potential scenarios today. We did take out the RTH high from yesterday overnight, but the action was met with selling. Mostly the overnight session reflects a healthy overnight digestion of the move higher.

It’s going to be interesting to see if the buyers can hold these levels, particularly 1650, the swing low once the market finally rotated lower late yesterday afternoon. I’ve highlighted some levels I’ll be monitoring for trades on the following market profile charts:

Comments »On The Offensive

The S&P traded in a silly manner today, pressing higher without much by the way of a rotation lower. The action had the strong scent of big money sloshing around, it smells like chemicals. We finally rotated lower in the last half hour of trade, but not quite enough to allow me entry on the long side.

For the day I was up 1.5 trading discretionary using the Bossram cycle, and Elroi was down 1 handle. Most of that vertical movement was untradeable with my toolbox.

It became clear early on I wouldn’t have much action in the /ES so I turned my focus to the stocks. For some reason, likely the lower leverage, I’m much more careless with my entries. I identified a quality entry point in BBRY today, but with the broad markets busting through resistance with ease I rushed my entry. The trade ended up working out so far, but unnecessary risk was taken. That’s the over analytic, slightly perturbed me talking about BBRY.

I’ve seen this daily chart pattern play out 100s of times: a stock is in a long trend, by long I mean months, quarters, or years. Then it makes a sharp move higher (or lower) to a reference point, like the 9ema. Then it throws down some price action that forms a letter ‘N’. You buy that setup. You buy that setup every time. That was the case in BBRY today. Having Cool Hand Luke aka #voodooshark aka RaginCajun as your wingman makes the trade even easier. This evening I’ll be donning a Canadian belt buckle at the local grocery, and tomorrow a full Canadian tuxedo, regardless of the heat or itinerary. Please refer to me as Drake, the name of all Canadian men. That’s the long hair don’t care me talking about smacking BBRY around.

Sometimes a beautiful woman sullies her entire appearance by lacking confidence. Take 20 minutes to practice your posture and enjoy the confidence it brings you. Raul writes for the ladies.

I scored big wins in YGE, YELP, BBRY, AIXG, and TRLA today.

FB, USO, and END lagged. Meanwhile, RVLT was beaten over the head with a sack of nickels. They need to land some big retrofits and blow the news out on the wires. I have to stick with this name. You probably shouldn’t. This isn’t some hot sexy trade, like you all crave so rabidly. This is a cold, passive aggressive relationship that will eventually fruit into something beautiful after several months of therapy. At that point things will warm up. Until then it’s the highs and lows of mood swings and recovery. It’s a long way, to the top, if you want to rock and roll.

I added to RVLT today.

http://youtu.be/pNHLobxZsHA

Comments »An e-Mini LoL

I have to chuckle at the Bossram Alpha cycle today. It had me short at the open, and I didn’t like it one bit. Yet BOSSRAM stayed true to its name, ramming out a 1.5 handle profit on a short.

It was the only /ES trade so far today.

ELROI is clearly smarter than I am because I wanted to put a short on at 1647.50 but since I’ve pigeonholed all discretionary trading to conform to the Bossram Alpha cycle I only looked for Elroi to engage. It looked like the type of situation Elroi loves to engage, yet Elroi did not, in fact engage. I have to go over the code and see what threshold kept Elroi out. In the meantime, I’m proud of my little helper robot for laying off the tape and not taking the fade.

+1.5 on the session. That is all.

Comments »