The index futures went for a rip yesterday evening, for a detailed rundown of “the why” check out @chessNwine’s coverage of the event.

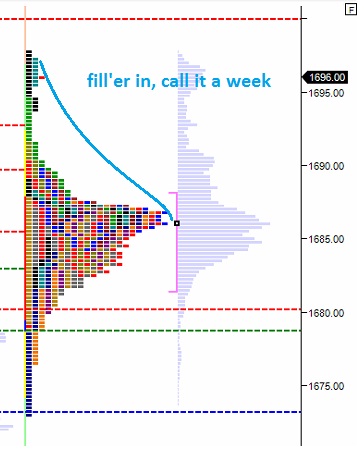

Since then we have mostly faded lower, in a rather gentle manner as the stock market continues its complacency in the face of the dramatic events unfolding in Washington DC. AS the early AM strolls on, the sellers are making an earnest attempt to get momentum back in their favor and with a decent push soon they could regain control. I suspect sellers will push the gap fill trade down to 1692.25 before we see what is next for the market.

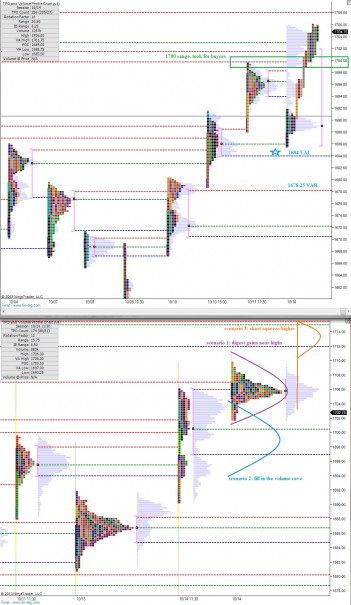

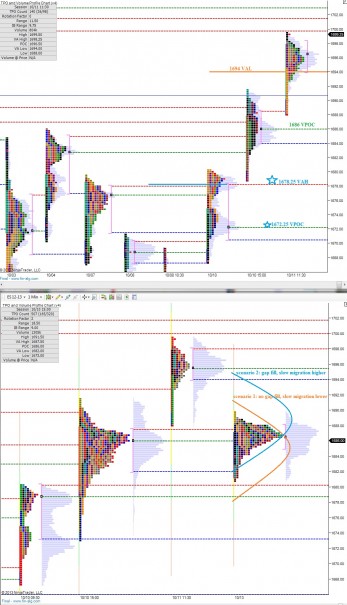

The overnight profile suggests balance and acceptance which is a solid sign of the longs given the velocity in which we returned to these elevated levels. However, should we fall out of balance, the prices below look slippery and fast.

Yesterday’s RTH printed a “neutral day” with range extension on both sides of the initial balance. It settled lower suggesting the sellers had more control of the auction. These neutral prints tend to occur near inflection points so it is important to not overly discount the power of the sellers here.

I have highlighted key price levels and a few potential scenarios on the following market profile charts:

Comments »