The overnight markets were relatively solid for most of the session, but as USA comes online we are seeing selling pressure on the tape. The sell flow started at 7:30am and swiftly brought prices to new overnight lows and back to the bottom end of yesterday’s value area on both the S&P 500 and NASDAQ indices.

As I write, the markets are becoming oversold on a very short term horizon although given the velocity of this selling we may see follow though lower. The economic calendar is busy today including ADP employment data and International Trade numbers.

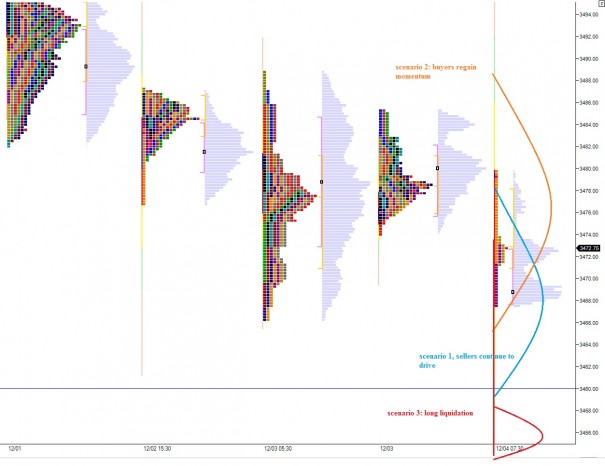

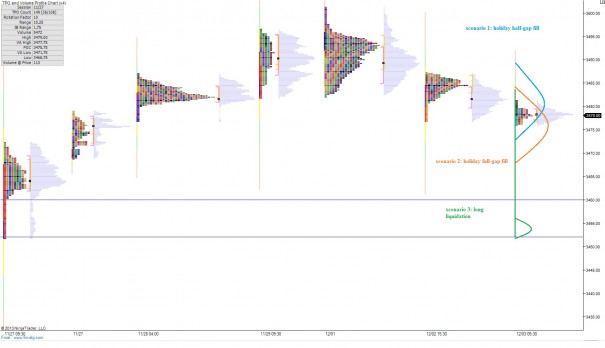

Putting all of that aside, we are coming into Wednesday and the sellers continue to retain control of the short-term auction. They gained control on Monday, showed follow though and initiative action Tuesday, and overnight they are again in control. This is all taking place in an aged long term auction controlled by buyers.

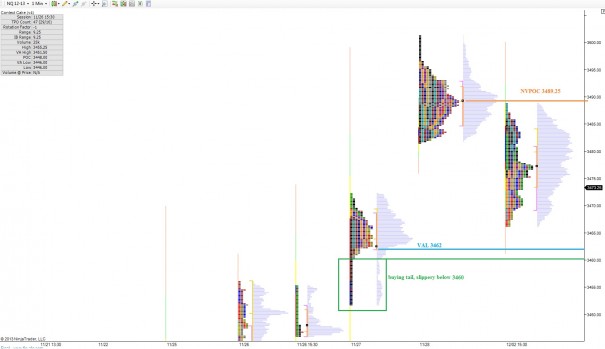

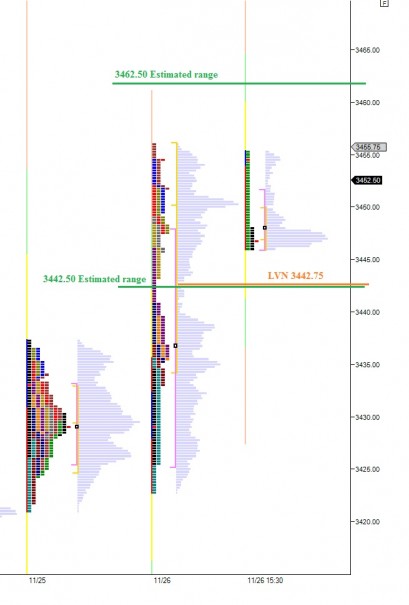

Focusing on the NASDAQ futures via /NQ, it will be interesting to see if the buyers can come in early on and work though this overnight gap. Buyers will be targeting a gap fill to 3475.25 and perhaps yesterdays VPOC at 3480. If buyers can turn momentum around, we have upside targets of 3484.25 (VAH) and 3489.25 (upper most distributions NVPOC).

If sellers continue to build on their momentum, they will look to trade through last Wednesday’s range and target the value area low at 3462. Not too far below this price is a string of single prints which indicates a strong buyer was present at the levels. Should that same buyer not present herself on a retest, it would suggest a shift in sentiment and downside action could accelerate.

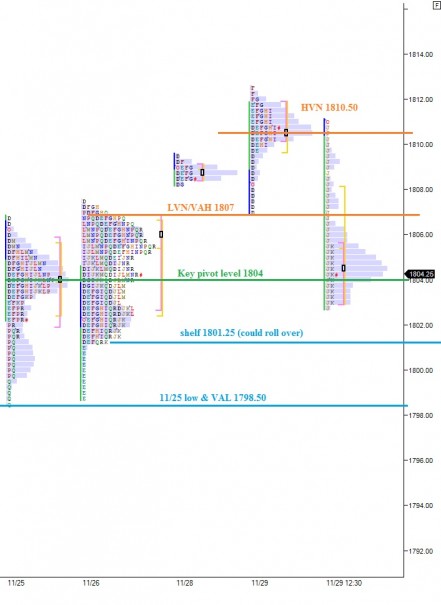

I have highlighted these levels on the following market profile chart:

Comments »