The year is off to a bang over here in the club cadet casa de Raul, where I just so happen to be exhibiting the Midas touch in real time on these internets. Year-to-date, I am up a sultry 4.99% melting all surrounding snow as I walk, barefoot, down the arctic streets of Detroit.

4.99% has come so easy and may not seem too elegant, but consider too the fact that FSLR is one of the largest positions in my book and all the sudden WOW it is special. Typically, in the short history of Raul, a move like FSLR had today after being downgraded by Goldman would throw three weeks of performance in the back alley where five villain algorithms would slice them into thousandths and split their booty. Today instead I just watched FSLR meltdown, not adding, not puking, but instead with good sportsmanship. Three day rule is in effect on this position meaning, if selling abates these next three days I may add to my loser. If selling accelerates I will cut loss, and if buyers overreact I may sell into the bounce and take my interests elsewhere.

I took boss scales in YELP and C, and when paired with my Chinese lotto numbers LITB it was a pretty fluffy day.

I want TSLA. I was out of pocket this morning when my entry was on a silver platter. Now things become much greyer if you know what I mean. I still hold my longs from 10/31 and 11/08 with a cost basis at $144.10. Remember, my thought process on this trade has been we see $200 before $100. I am looking to take out my laser pen and add some juice to the name via call options because that’s how we roll in the future. We’re getting juiced, carefully, yah!

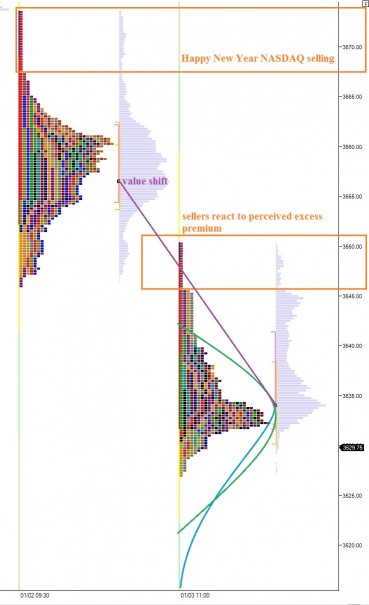

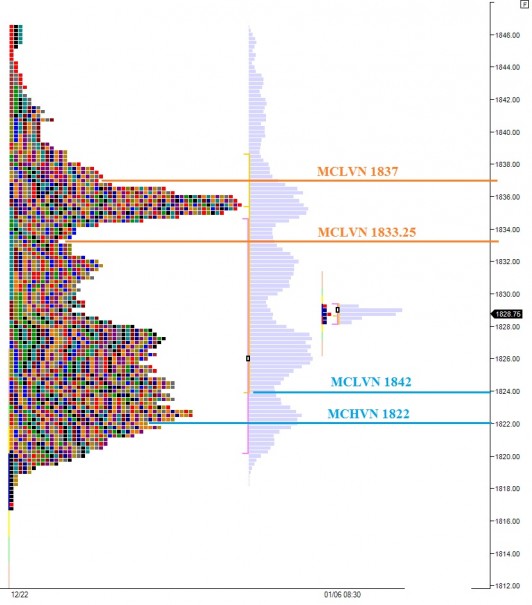

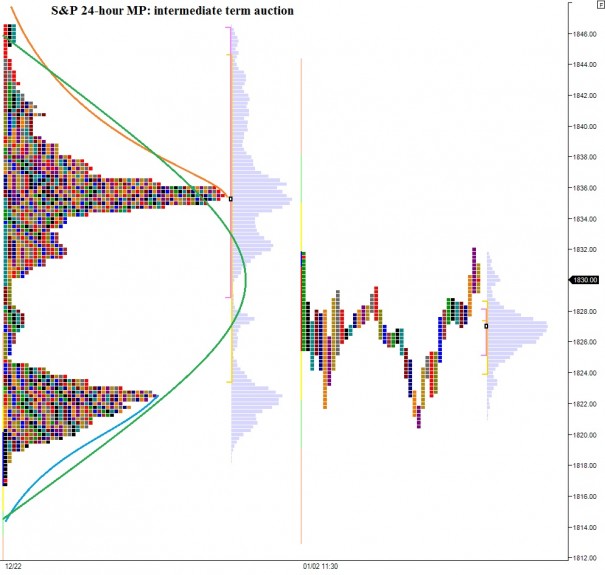

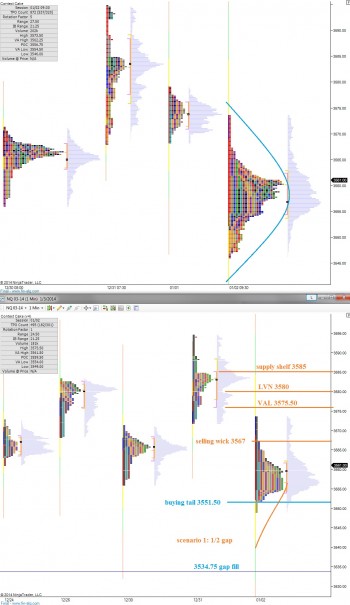

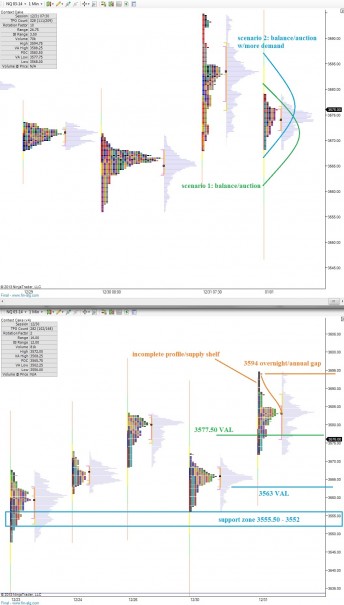

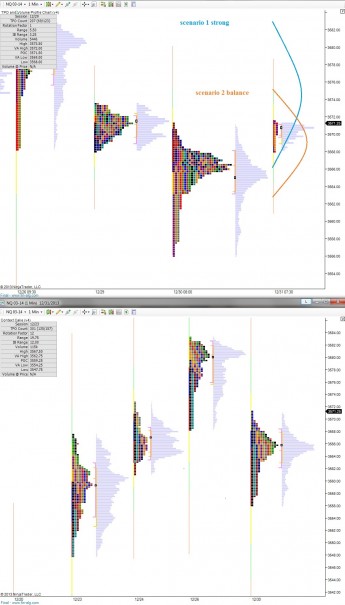

Finally, my wounded algos have been without food or water for days. My market profiles cut out every day yet Mirus futures refuses to admit the quantity of red gravy they have spilled on their servers. I am starting up an IQ feed tonight to get the algos back to firing signals, although they will not be auto executing until Mirus and Multicharts kiss and make up.

In the meantime, I like buying my favorite stock chart when I get a good market profile/order flow setup on the index boards. Correlations are through the floorboards and you get tons of bang for the buck with individual names. Option addict got me hip to this environment. I am working diligently to not get spoiled.

It will assuredly get harder this year to bank coin, but right now the market is in give mode. Trade accordingly.

Sincerest Regards,

Raul

Comments »