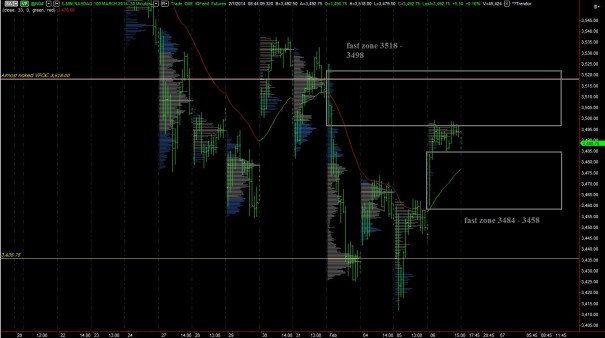

The NASDAQ has been rotating higher all evening, a drift which suggests buyers have been initiating exposure through the night. I am writing as we come into the 8:30am employment data. The overnight volume profile print shows three distinct distributions, each growing in size as price appreciated. The third and final distribution has a VPOC of 3505.25. Price is currently trading above yesterday’s range and value, suggesting the market is opening out of balance. Price is careening lower on the employment data and we are currently trading in the slippery levels we trended up during yesterday’s trade.

Price is all over the place right now.

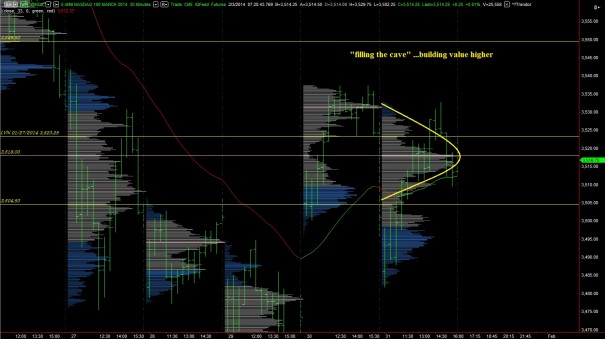

The intermediate term control has reverted back to balance after yesterday’s short squeeze, where buyers pressed higher all morning and then held value near the highs. This type of profile suggests the early action was dynamic enough to trigger short covering, but the afternoon buying activity was not dynamic enough to press a second discovery higher. Instead we formed a distribution on top of a thin profile, a capital letter-P. The market was likely waiting for the employment data before moving elsewhere.

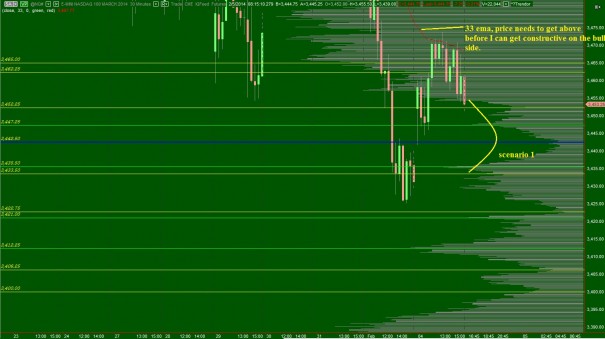

Usually a short squeeze is a temporary market phenomena, and the intermediate term will reassert itself soon after. Therefore I have carefully built the profile which highlights intermediate term balance. It’s crowded with reference points suggesting it is aged and ready to pop. See below:

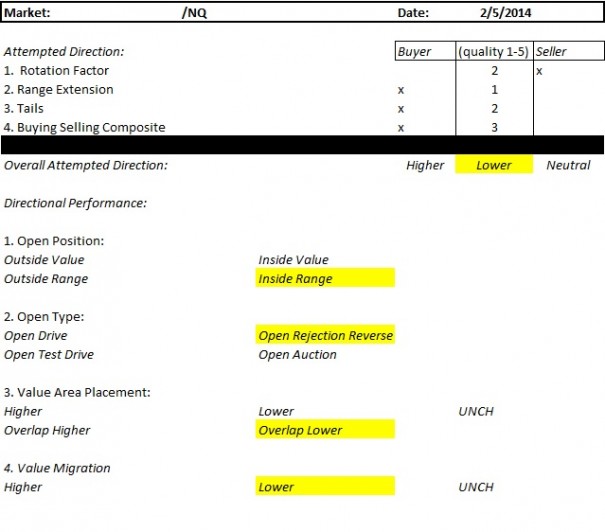

Let’s run through controls:

Long term – buyers unless weekly close < 4000 on $COMPQ

Intermediate term – balance (see relevant levels above)

Yesterday – buyers, but a temporary phenomena known as a short squeeze, sellers can continue lower on it.

Overnight – violent indecision, slight downward bias post employment data

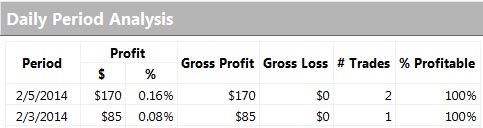

These are risky conditions. I will be watching the first hour of trade before taking action, unless I am pressed to stop out any existing longs. Here are the daily volume profiles, for your reference:

Comments »