My portfolio continues to eroded with each wave of selling. The upward progress made in the NASDAQ was not reflected in my portfolio, a basket of high spec technology. Instead today’s theme was energy and hourly reminders that Dick Costello has no plans to sell any Twitter shares.

I sold some RVLT today, thinking earnings were on deck. It appears however that was not the case.

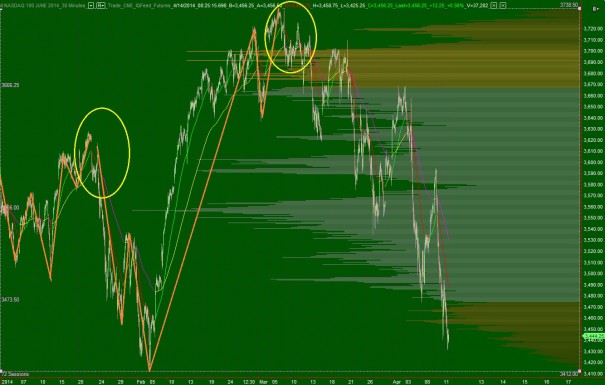

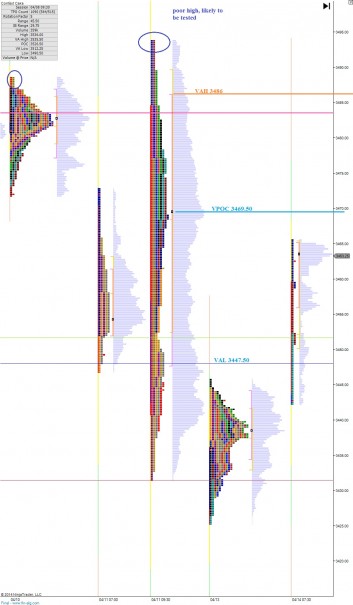

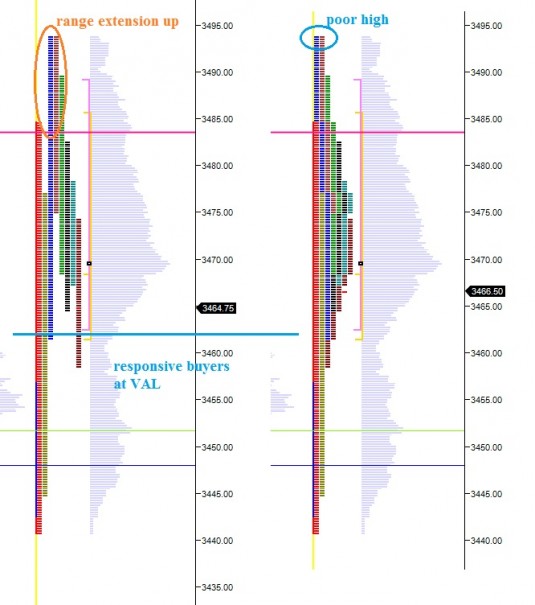

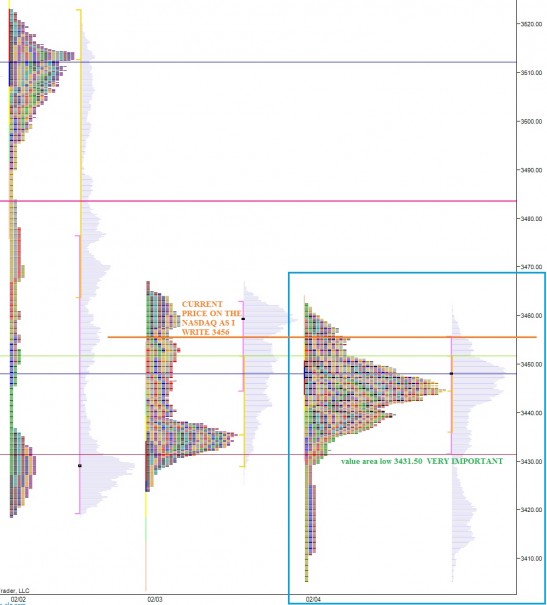

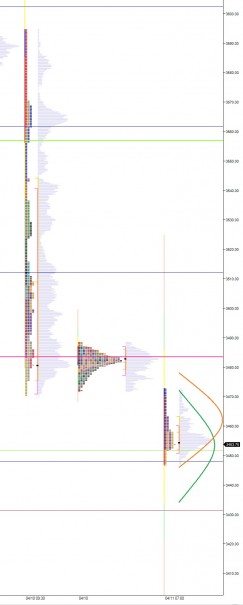

A few pieces of the market caught my attention today. First is ONVO which was absolutely crushed today. They are liquidating any 3D printing company as if each was a flaming bag of garbage. As far as sentiment goes, these stocks are incredibly unpopular to the point of excess. Does society no longer stand to benefit from the prospects of 3D printing? I still sense there is something of a breakthrough near for this industry. Second was the neutral print on both the NASDAQ and the S&P. We saw legitimate buying interest today. Perhaps it was the fair weather of the weekend creating a sense of optimism or the illustrious glow of the blood moon. Regardless, we are seeing signs of buyers down here at a potential bracket low for a very large range. Range trade would be a welcomed change for me to unleash my algorithm.

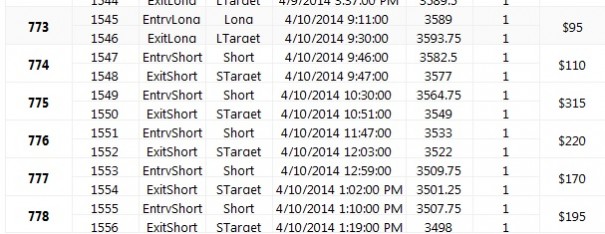

I spent most of the day working out the kinks in my algorithm. I am nearly ready to unleash him back into the marketplace. Futures trading can be stressful if you let it. Often times this is due to position sizes that are too large and stops that are too tight. Testing, lots of testing, can reveal where your stops should be. Then once the conditions merit a given algo, turn it on and let the entry automatically happen. At this point I can adjust targets and stops to logical price levels and mainly stay out of the way.

In summary, we may be entering a trading range here, but that may just be the thoughts of a hopeful optimist.

Comments »