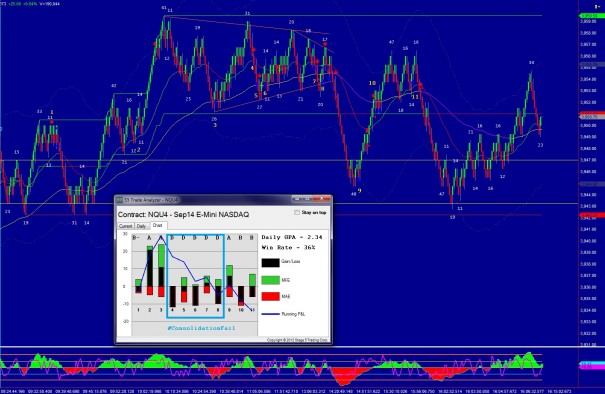

Nasdaq futures are up a few points on the globex session after a quiet morning on the economic front. Whether or not Hari Raya Puasa sees lower volume than a normal session is something to consider today. We also have PMI Service flash at 9:45, Pending Home Sales Index at 10, and Dallas Fed at 10:30.

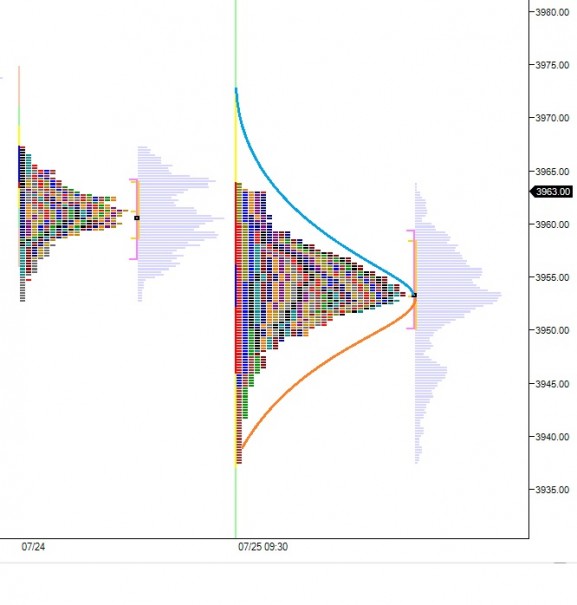

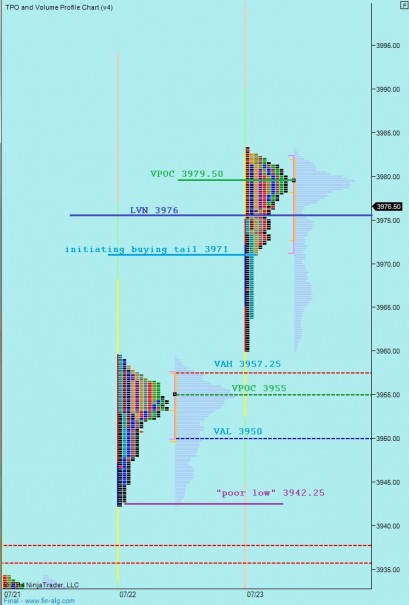

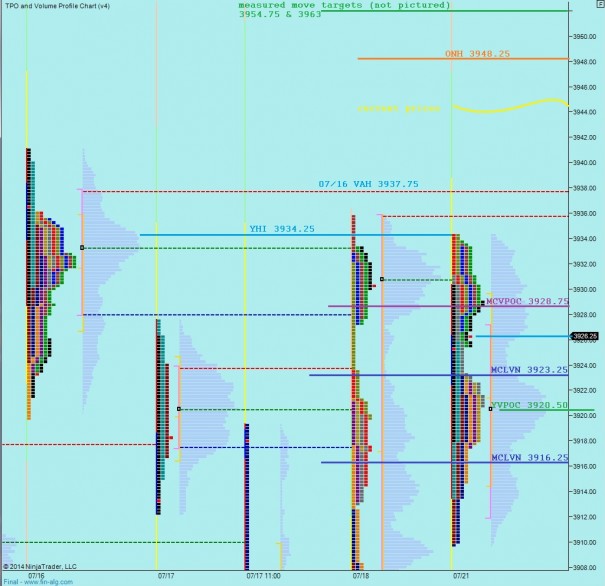

The overnight session saw a few large rotations in both directions, but the brunt of the action was seen pushing higher. The index put in a fairly durable low around 7pm before exploring higher into the early morning. We are now lingering up near the high of the session as the USA comes online. The net globex profile has a slight skew which could resolve itself in a few ways, see below:

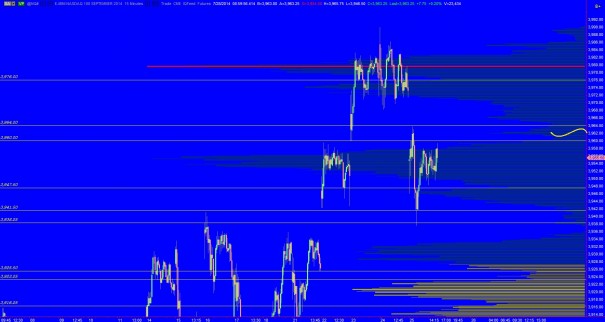

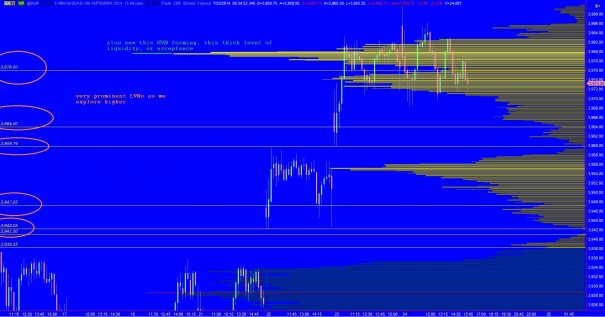

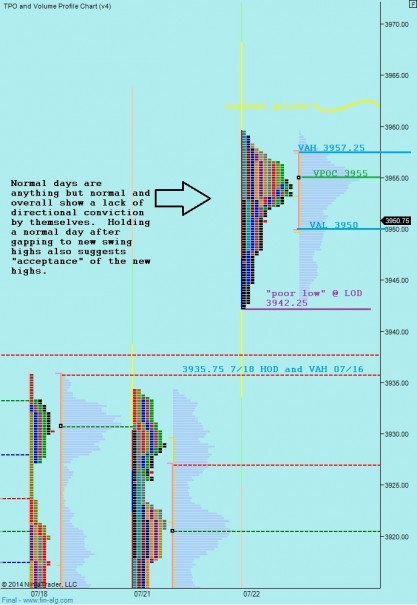

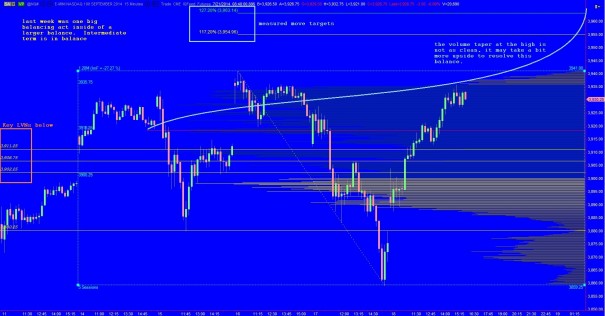

We started to break intermediate term balance last week and explore higher. However it seems the market is trying to not allow this, and as a result the intermediate term has become a bit of a mess. This is actually a good thing, it affirms the idea of an out of balance marketplace and provides some very prominent low volume nodes as signposts as we trade. However, if the intermediate term participants continue their activity this week, then we might see an uptick in volatility. I have highlighted the key nodes below:

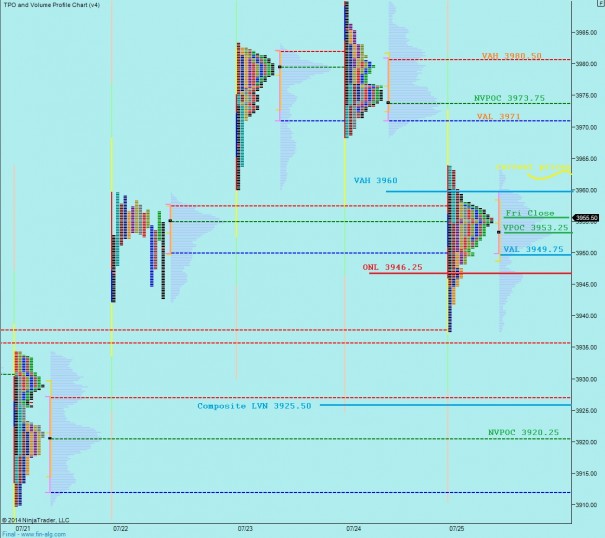

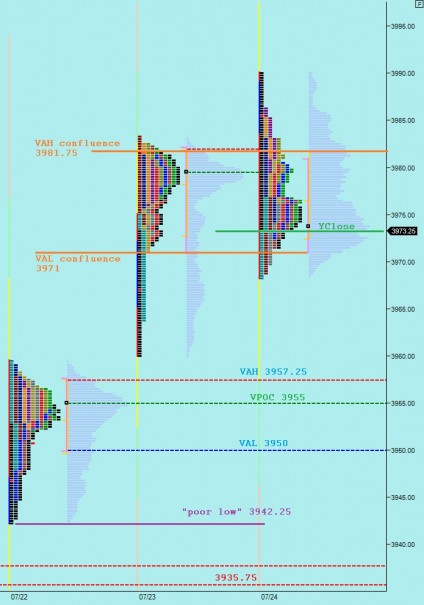

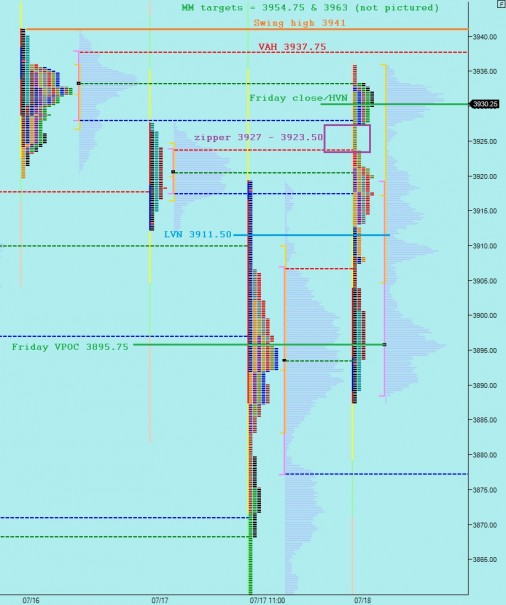

On the below market profile chart, I present the levels I will be watching as we start the week:

Comments »