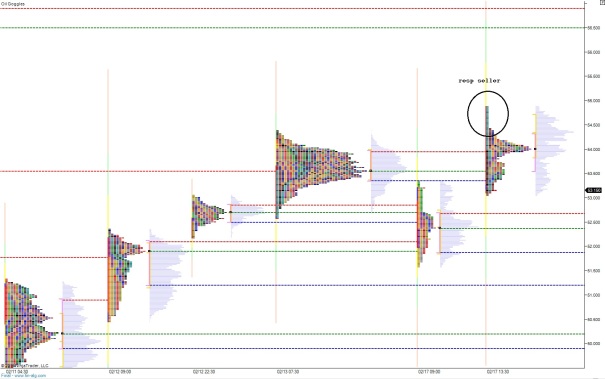

The Nasdaq is up a touch, trading in the upper half of yesterday’s range. Price exceeded yesterday’s high briefly this morning on [untrue] reports of an agreement of sorts in Greece. The move went on to test the 4400 century mark before falling back into the weekly long value/balance we have formed.

At 8:30am Initial/Continuing Claims came out a touch worse than expected as was the revision to the prior number. This brought in a small bit of buying but nothing overly notable. At 10am we have Leading Indicators and the Philadelphia Fed, at 10:30am the Natural Gas Storage statistics, and at 11am Crude/Gas Inventory stats.

Wal-Mart reporting earnings this morning and they are often considered the purest data point to the overall health of the retail front in America. They are trading a touch lower premarket after beating earnings expectations and raising the dividend. The selling pressure may be attributed to their guidance where they cite the strong dollar as a potential headwind to forecasts.

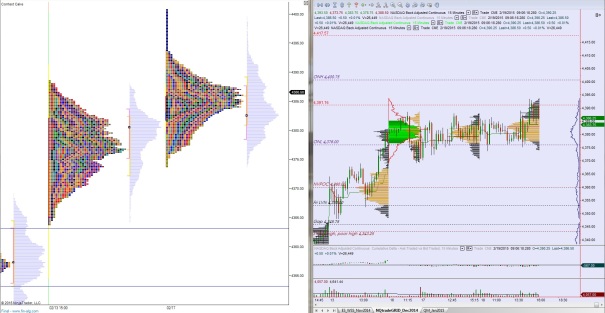

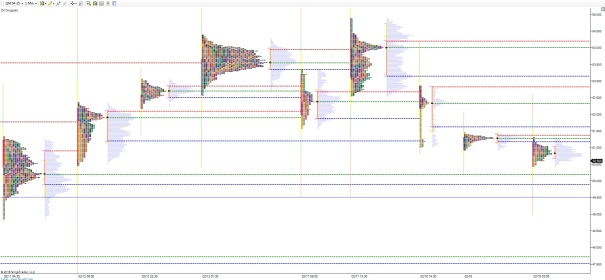

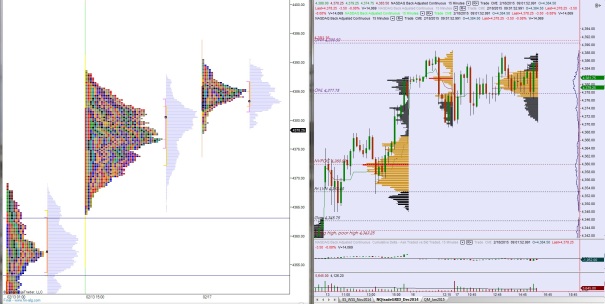

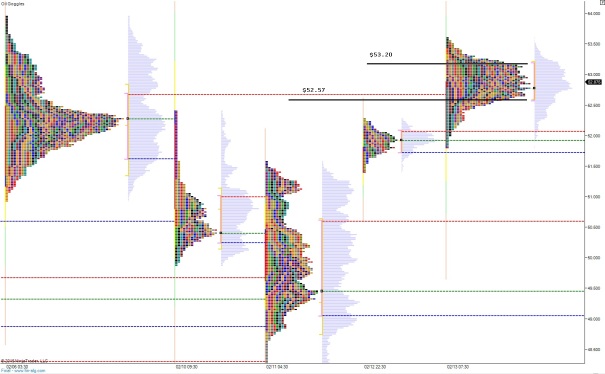

As stated earlier, we are in 3 days of balance. This is occurring just after the market made new swing high and as we push through the monthly option expiration week. The action is in stark contrast to the rest of the year so far, which has featured large/fast ranges.

Heading into today’s session my primary expectation is for sellers to push into the overnight inventory and test down to 4382. Below here I will look for buyers to respond and start working toward yesterday’s high 4393.50.

Hypo 2 is sellers push down through the overnight low 4376. In this instance I will look for responsive buyers at 4372.75. They struggle to reclaim 4382 setting up a liquidation lower to target 4363.25 then the naked VPOC at 4360.00.

Hypo 3 is a variation of hypo 2 where the responsive buyers at 4372.75 hold and 2-way balance ensues a bit lower.

Hypo 4 is we drive and take out the overnight high 4400 century mark to target the measured move to 4417.50.

Levels are highlighted on the following charts:

Comments »