In light of my frustrated trading yesterday, I had little desire to pursue opportunity in the Nasdaq futures today. Instead I reviewed tape and read a book while keeping one eye on the marketplace. How I felt yesterday was very subjective, with a distorted perception of reality. When trading, it is up to us to change our attitude and act with purpose. You can sit around waiting for someone to help you or you can take action today.

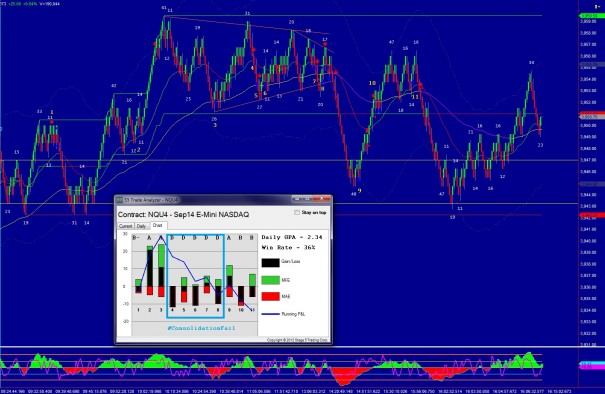

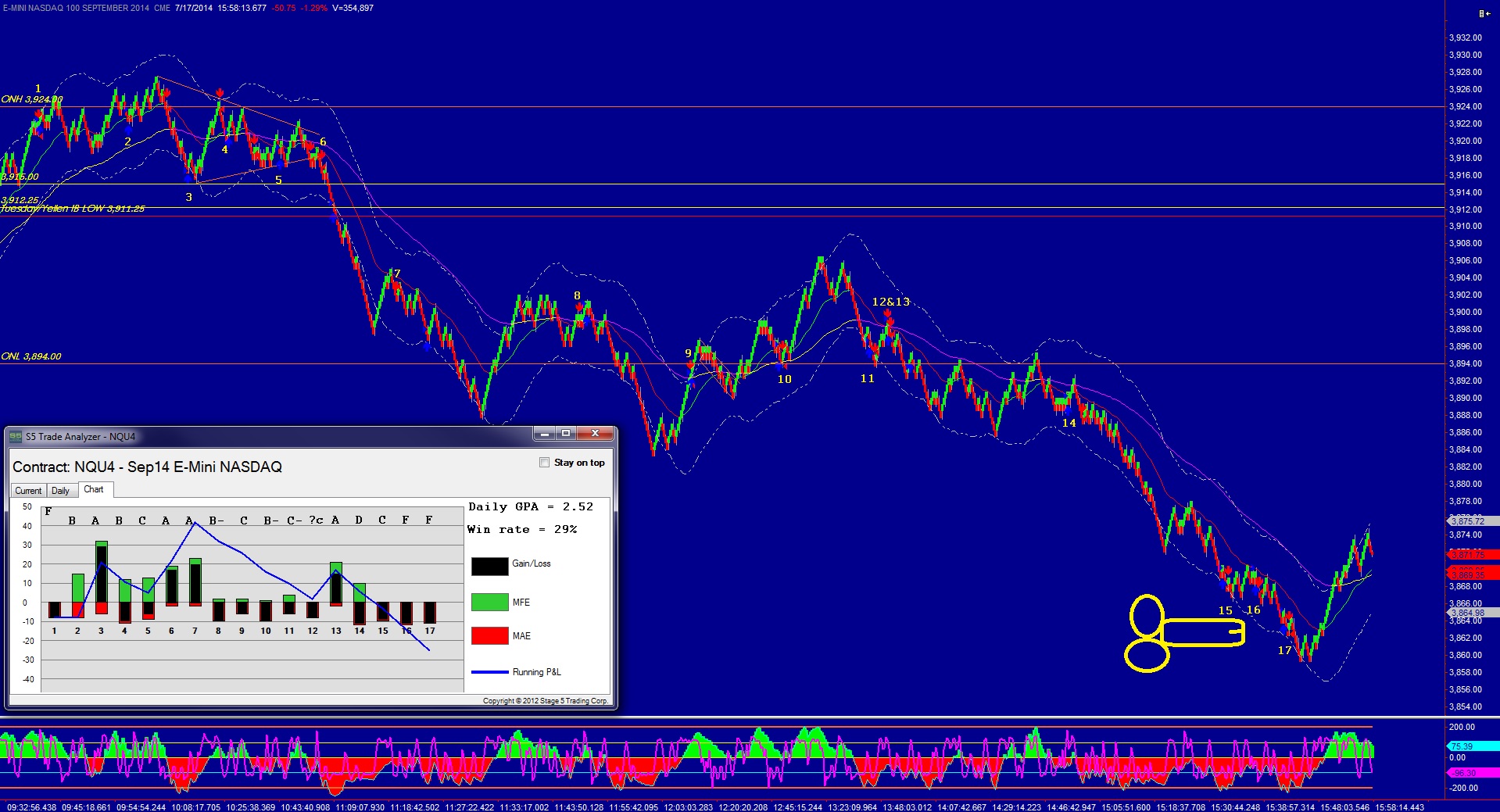

We printed another normal day in the NQ, the second this week. A normal day is generally created by a swift entry of the other timeframe participant which has the effect of establishing a wide initial balance. The rest of the day the other timeframe buyer and seller auction price back-and-forth and two way balanced trade takes place. These are anti-momentum days intraday. I am actually quite pleased to observe today’s normal day from the sidelines I tend to chop myself up in these conditions. The key today was in the hypotheses. As a matter of fact, the key to every day is the hypotheses. Trades taken without a plan, no matter how nice the conditions look, back door screw me way too often. Less is more intraday. This is simple, only trade while applying a hypothesis after a trading picture emerges. Simple, but not easy.

The big news on the session came from our favorite real estate apps, Z and TRLA. Zillow is pursuing a bid to acquire Truila for a very cool two billion. This calls into question the valuation of all internet real estate, because face it, internet real estate is very real. You and I and Aunt Yellen have no idea how to truly value of these properties. Smarter folks then us will use the open market to determine this, naturally.

I took down August calls in WUBA early and then some PCLN yolo action around lunchtime. Other than that, I continue to sit here, in no particular hurry, watching my book of potent rockets sit at ground zero.

Tomorrow I will form a set of very high quality hypotheses after taking care to present you with the finest Nasdaq analysis money can buy (it’s free), and conditions willing I will take a trade or two. No more guns blazing, especially on Fridays.

http://youtu.be/EwfI677mRXo

Comments »