Nasdaq futures are up a touch premarket in a quiet session of trade. Durable Goods fell off a bit according to this morning’s release where numbers came in a bit softer than expected. The initial reaction is a bit of sell flow. We have consumer confidence information coming out shortly after the open at 10:00am.

After gapping higher to start the week, we printed a tight open auction, explored higher out of the tight initial balance and then went neutral on the session. Price stopped just one tick shy of a full gap fill before turning higher and rejecting out of Friday’s range. The afternoon snap back was not strong enough to press prices back to the VPOC in the upper distribution. Instead we saw a VPOC shift lower to end the session.

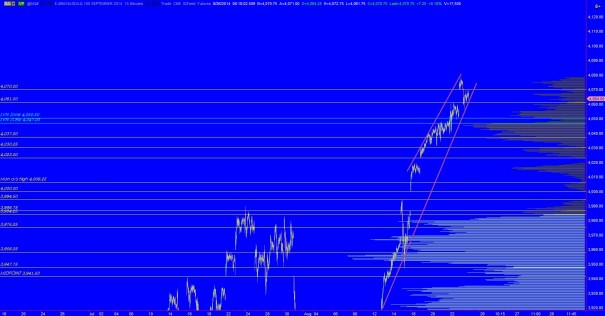

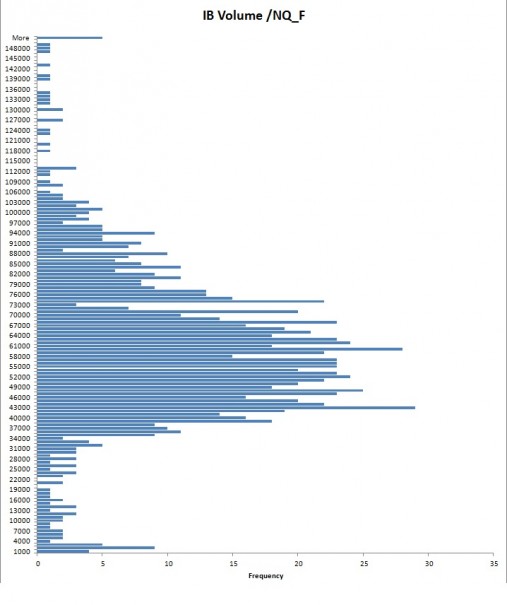

Taking a zoomed out look at the intermediate term time frame we can see just how ruthless the upside progress has been. Prices have been gapping and legging higher since taking out prior swing highs. The resulting volume composite resembles a series of peaks and valleys as the market explores higher to discover a fair value. I have noted the key low volume nodes on the following chart as well:

I have noted the key price levels I will be observing in this morning’s trade below: