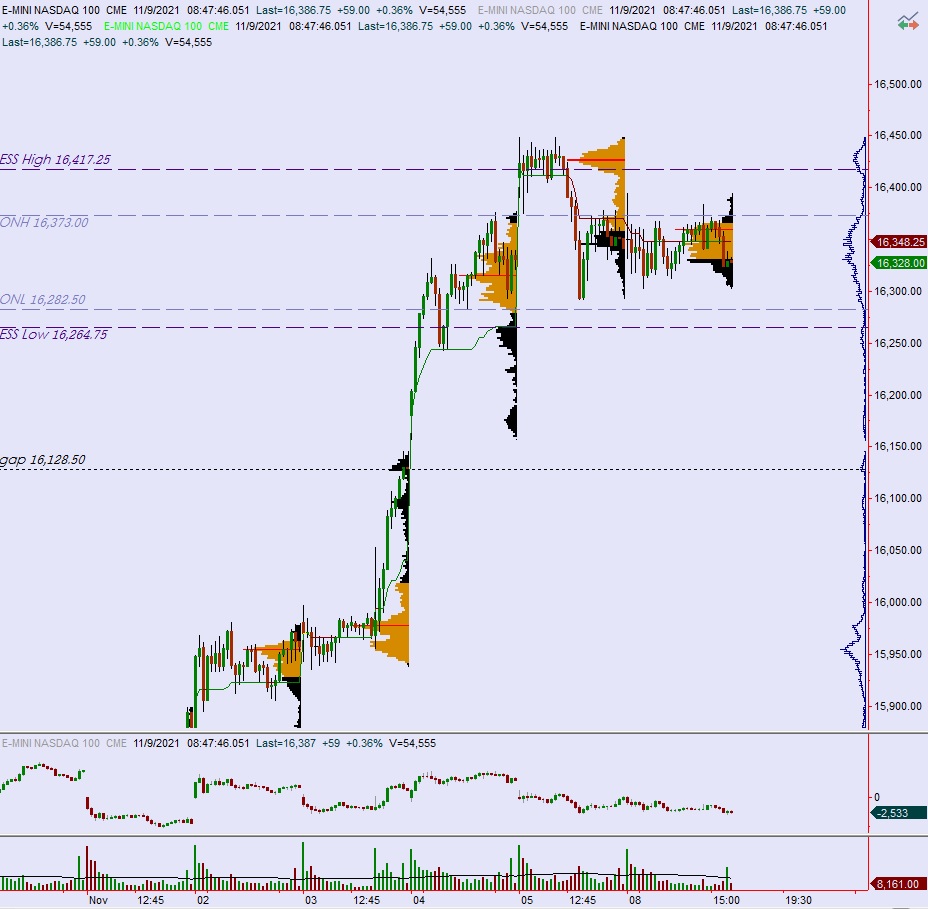

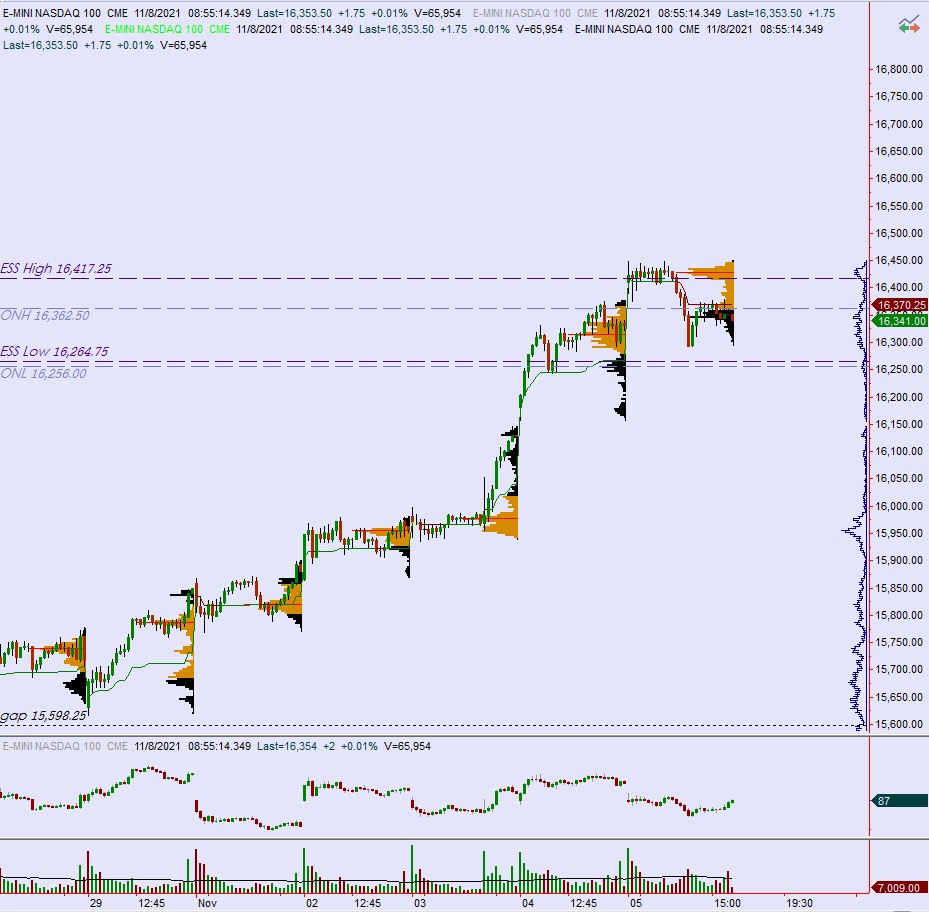

NASDAQ futures are coming into this Tuesday before Thanksgiving with a slight gap down after an overnight session featuring extreme range and volume. Price first probed lower overnight, probing down near last Wednesday’s low before catching a bid. Since then we are about +100 points higher and as we approach cash open price is hovering just below the Monday low.

On the economic calendar today we have PMI composite flash at 9:45am, a 2-year note auction at 11:30am and a 7-year note auction at 1pm.

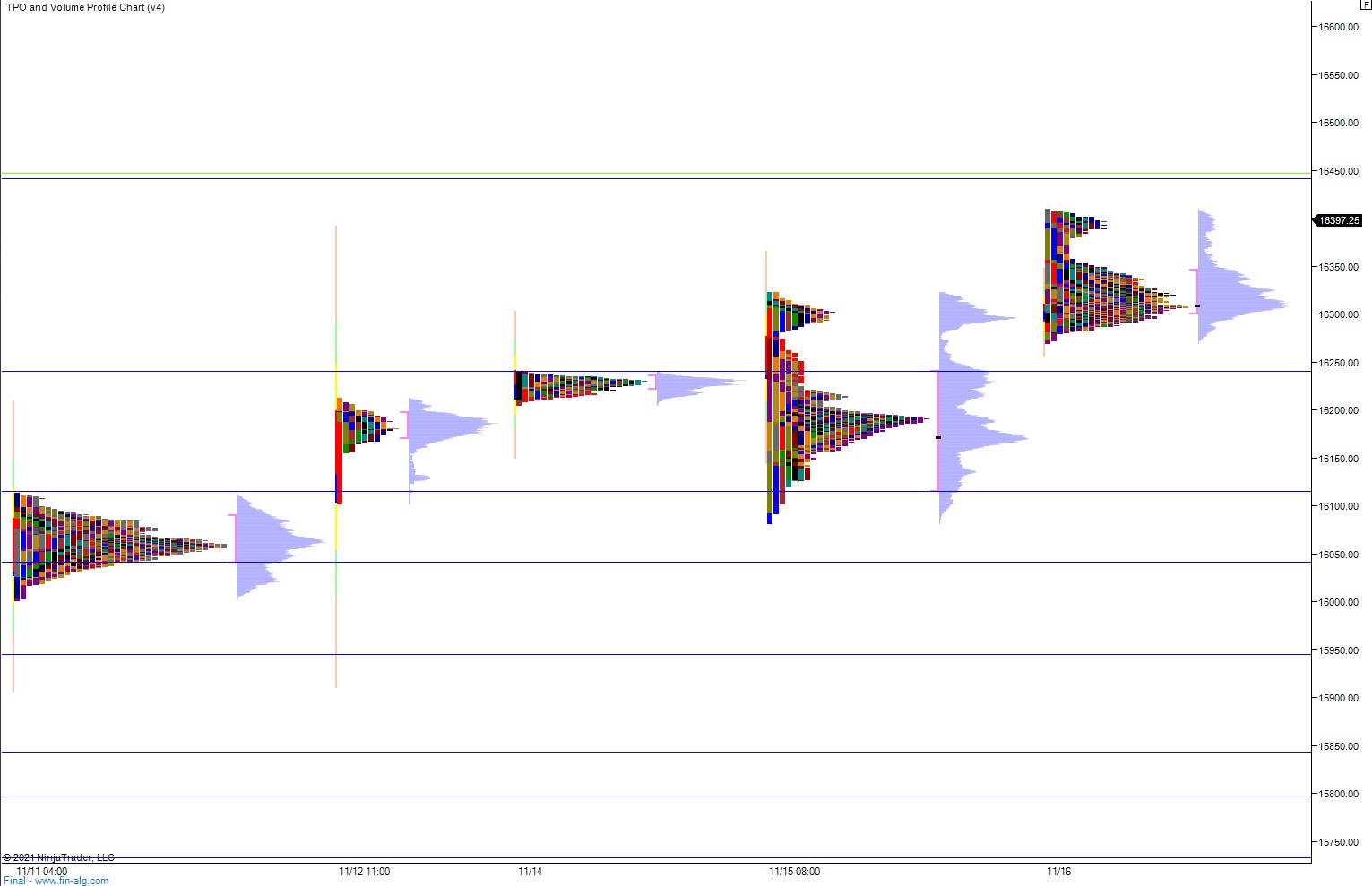

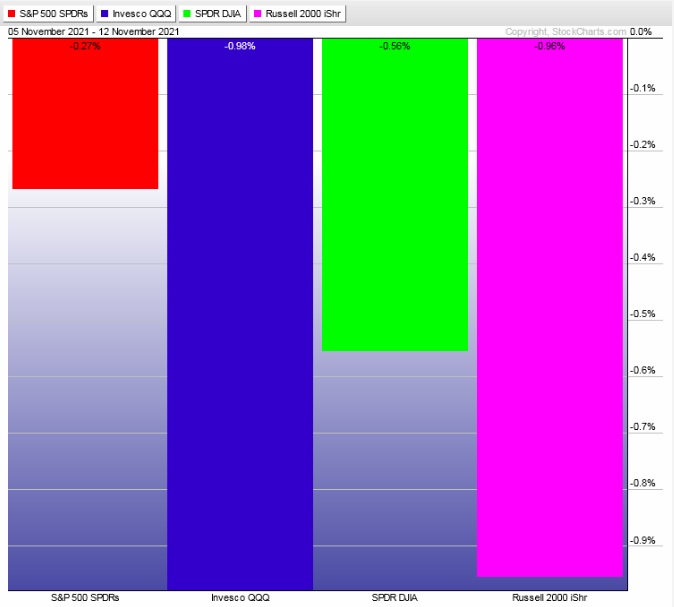

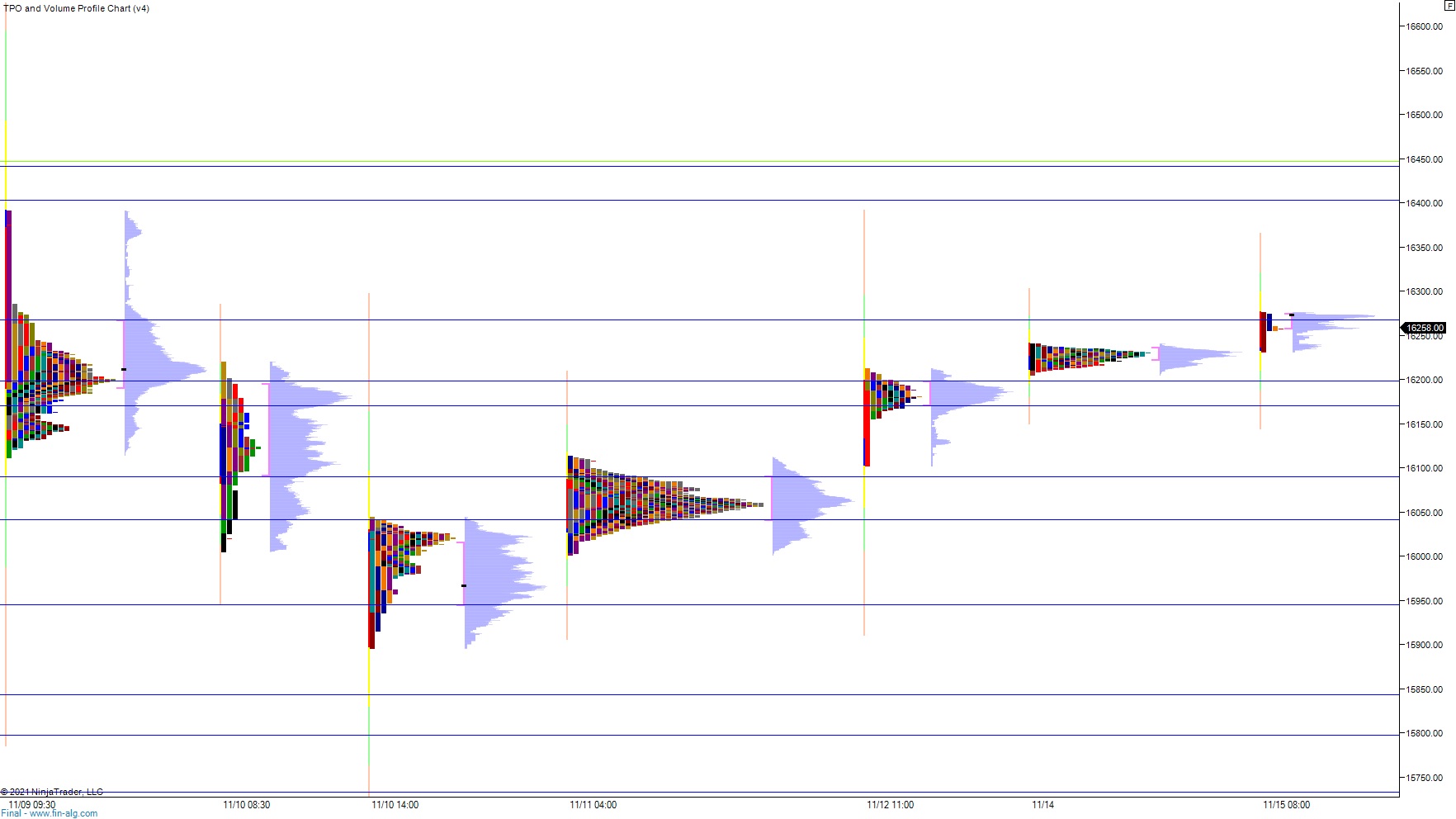

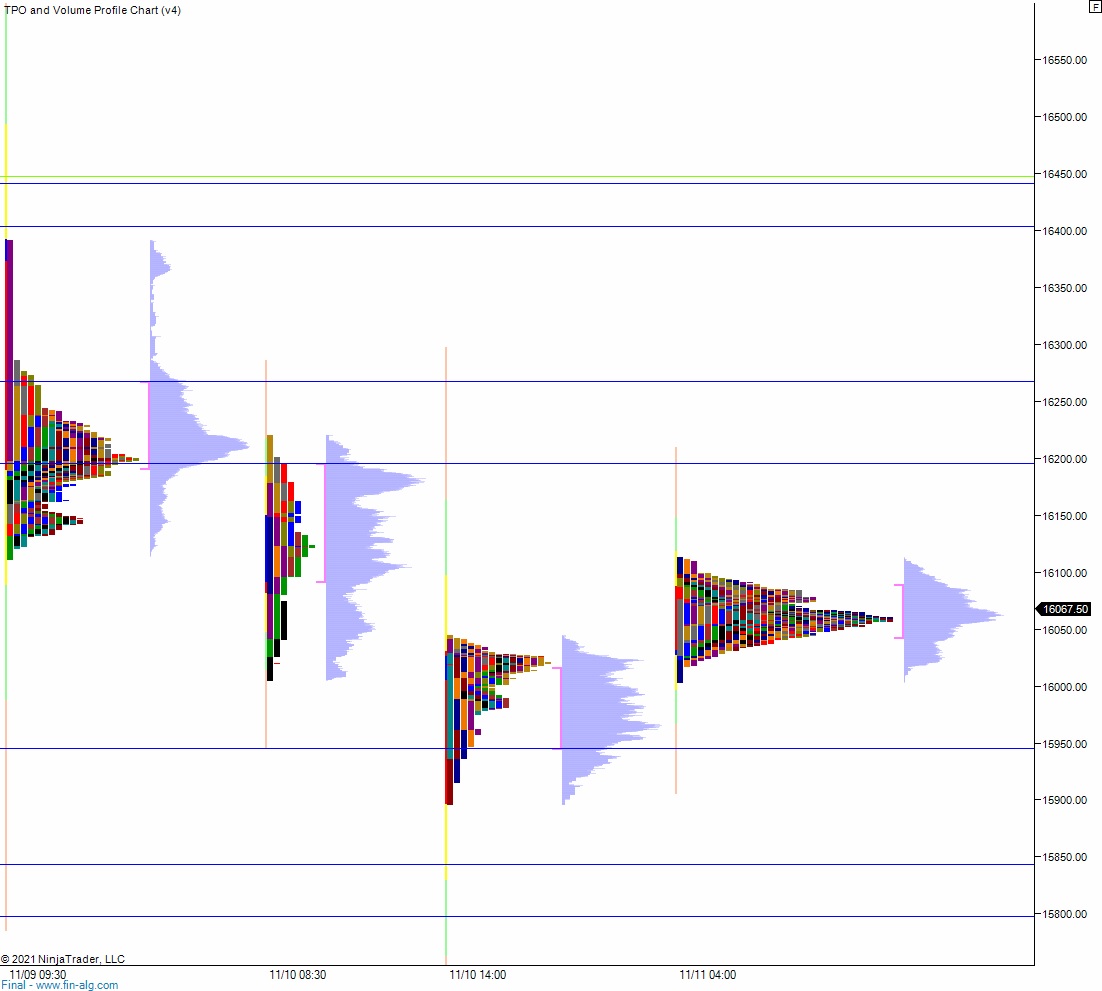

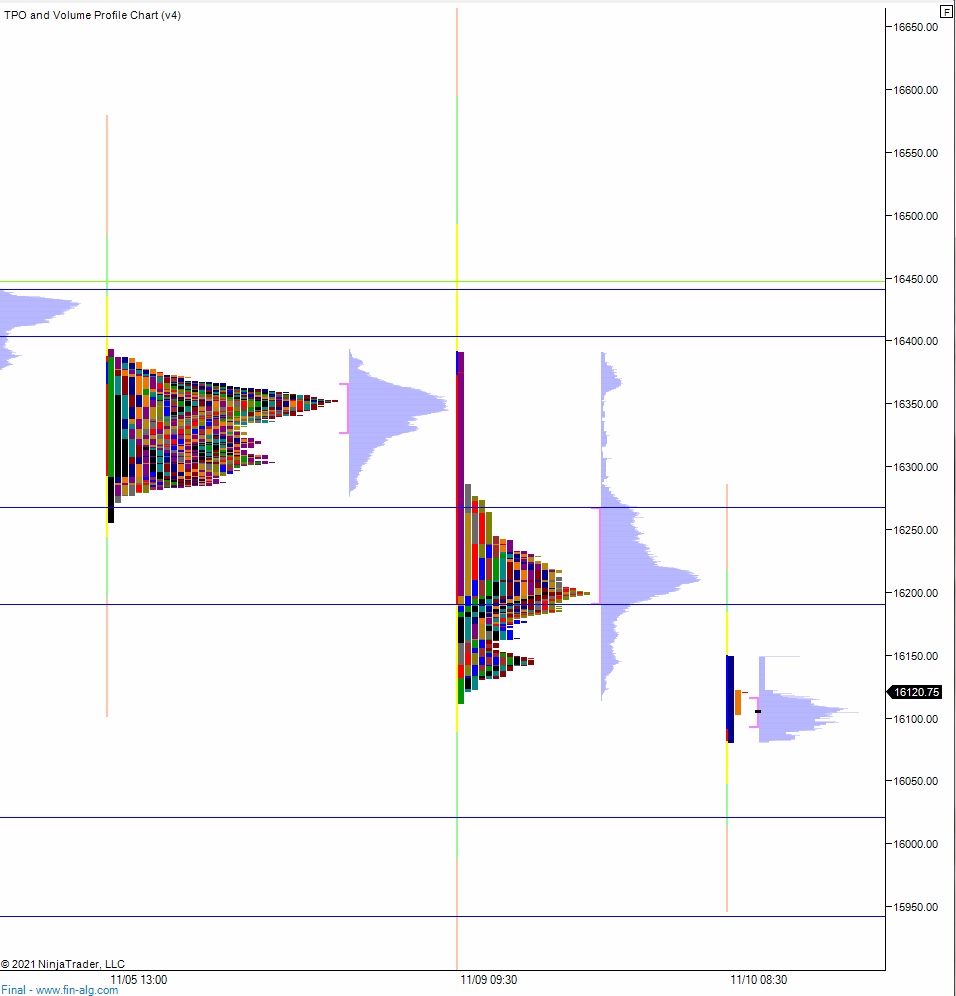

Yesterday we printed a double distribution trend down. The action was methodical, almost appearing choreographed. The day started out with a drive higher. Buyers drove higher for the first 45 minutes, tagging the weekly ATR high band. Before buyers could push a range extension up responsive sellers stepped in and made a hard move down through the midpoint, setting up an early range extension down and gap fill. Seller than continued lower and closed the Thursday gap. Buyers showed up here and began sort of grinding price back towards the mid but they never made it there. Instead sellers made a second leg lower, effectively tagging the weekly ATR low band as we closed out the session.

Heading into today my primary expectation is for buyers to press up through overnight high 16,414.50 before two way trade ensues.

Hypo 2 stronger buyers trade up to 16,459.25 before two way trade ensues.

Hypo 3 sellers press down through overnight low 16,274 setting up a move down to 16,227.

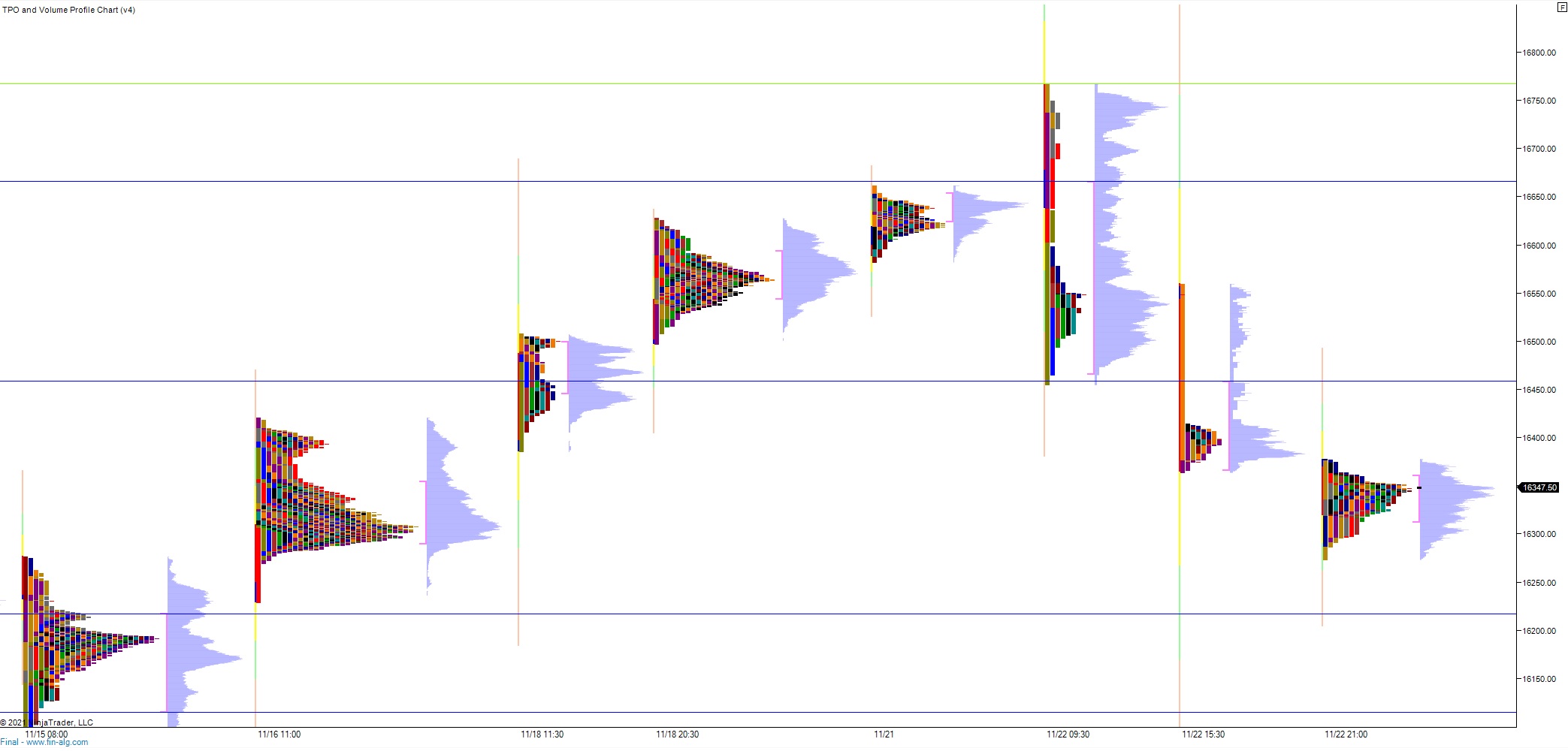

Levels:

Volume profiles, gaps and measured moves: