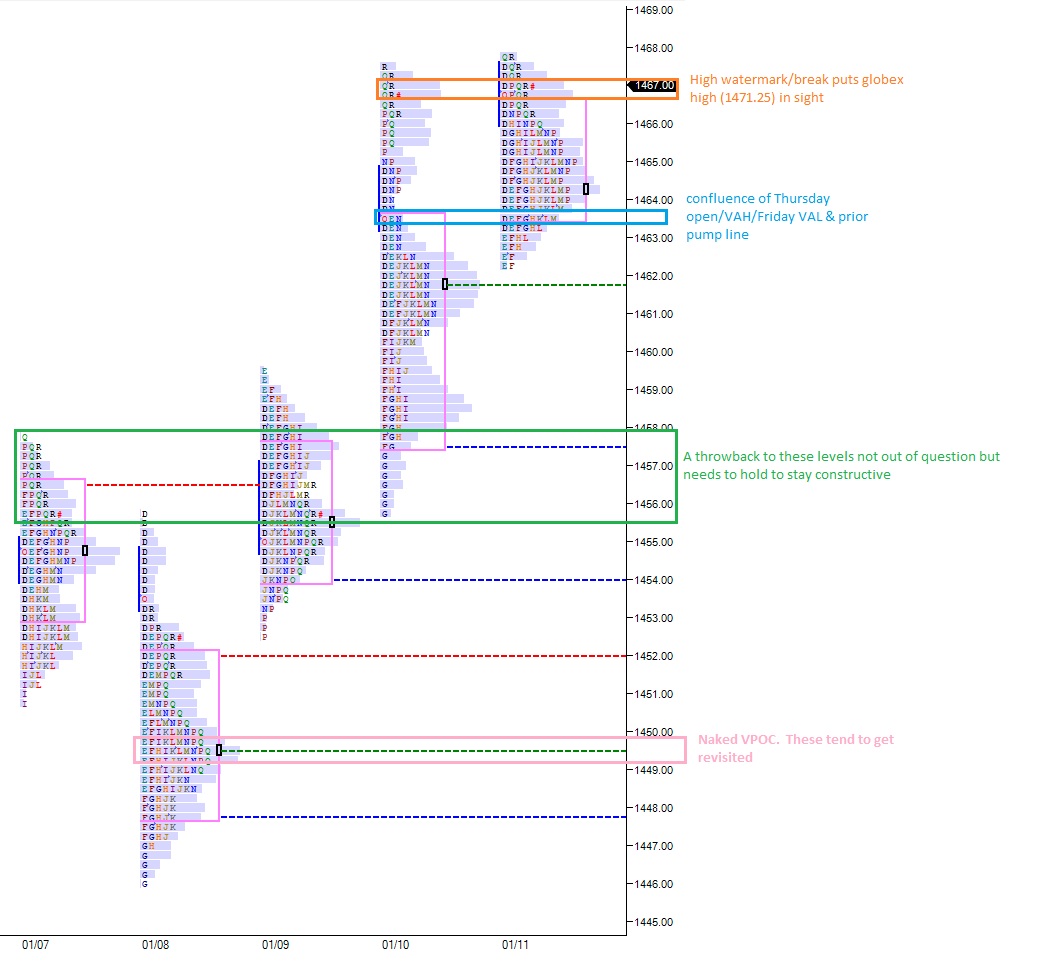

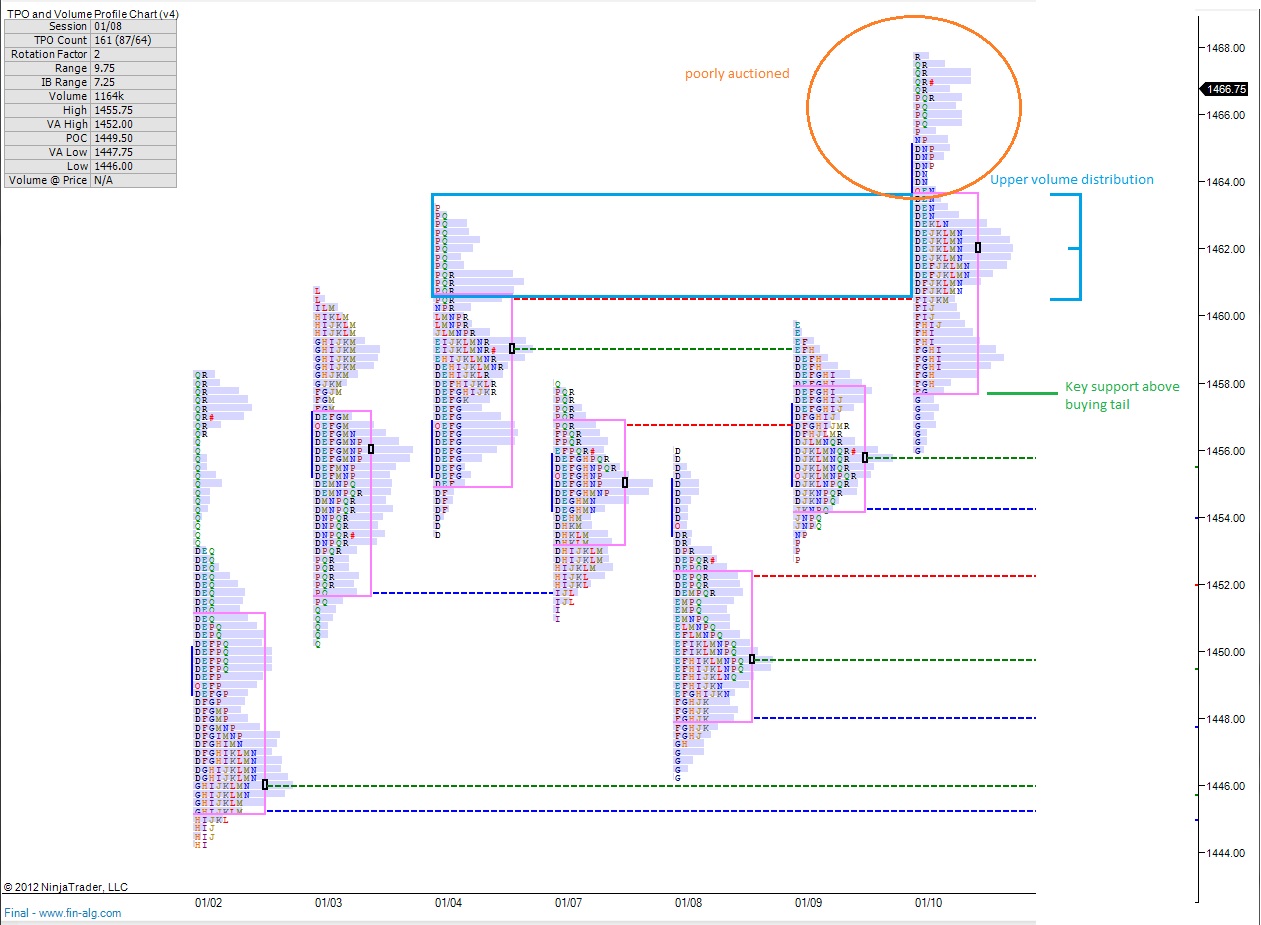

After a gap lower today the market was mostly occupied with buying which kept the S&P on a tight grind higher throughout the entire session. It’s had a slight algorithmic feel the entire session. Despite the steady strength of the bulls, I spent most of my session lightening up current longs. The only exception was my AM purchase of $MLNX, a longtime favorite stock of mine, that continues its dog like ways.

Tomorrow we get to hear earnings from JP Morgan and Goldman, two of the high velocity rockets that have been vital in lifting these markets higher. They are both trading well into earnings with their stocks still showing positive momentum and even offering what could be considered an entry point today. They’re almost trading too good to remain constructive on the names into earnings.

Now I could be wrong, and as Fly pointed out this morning traders don’t belong in the earnings forecasting game, but both Goldman and JP Morgue could announce stellar earnings and profits and still sell off. Should this occur it would be a soggy blanket on the entire rally. The way the benchmark S&P has been trading in conjunction with a weak Apple and flat banks is impressive. But I’m embracing the uncertainty of tomorrow’s news.

My cash levels are near 50% after selling out of GS. Obviously now I welcome any pullback. I feel a little underinvested, so I will be digging into the charts this evening to flush out some potential longs I can grab should we continue pumping.

I still like meats. I still like Textile and Apparel. I had no idea my “Amalgamation” pick (SU) would trade so slowly but I still like it. Everything else is subject to whimsical liquidation.

Comments »