Some of you guys crack me up. Ferreting in-and-out of the tickers of garbage pail companies, clicking your hard-earned money around in some futile attempt to cure boredom? I think? It is not a money making pursuit from what I can see.

If you want to extract fiat american dollars from the global financial complex there are three ways:

- Invest—-sit and fast and think.

- Trade one instrument better than 99% of the competition.

- Consistently execute the signals of an algorithm.

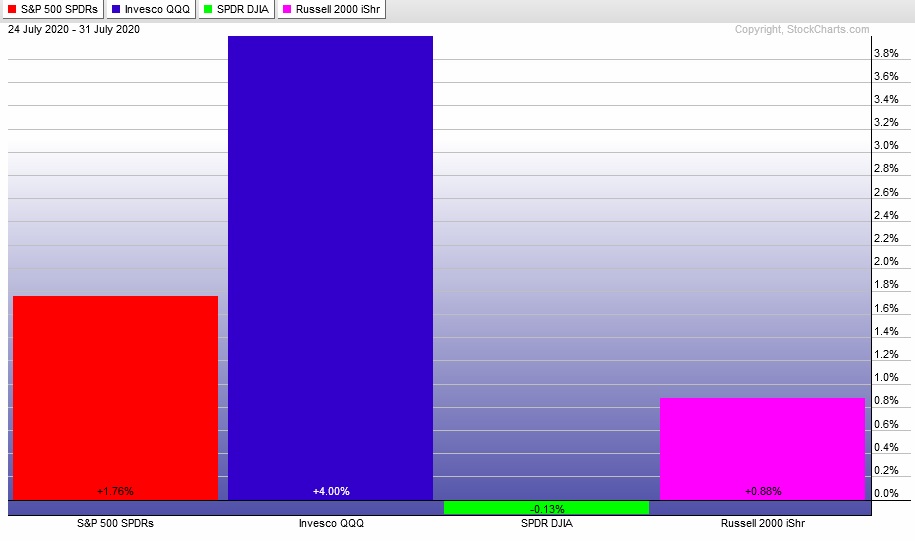

I pulled off a bunch of big wins these last few weeks simply by investing in the absolute best companies and CEOs in the world. I didn’t go out and try to find “the next {insert quality company here}” like all these Motley fucking fools. I let Our True Leaders do the heavy lifting. I just sat in the back seat, telling jokes and enjoying the scenery.

Square was a no brainer. I will invest in any CEO who can spend two months at a silent retreat. Noble Jack works hardt then STFU and listens to the wind. That is where all the best ideas come from.

Making money in the stock market can be so simple but some of you jokers take the most convoluted route down this gold-bricked road.

I am in far too good of a mood to sully it trading this Friday tape. I’d imagine most of the real hitters are off enjoying these final days of summer anyhow. Only lonely souls unable to find meaning in life are spending their whole day staring at computer screens on a Friday in August.

Go build something. Anything. No sense waiting for the perfect place to build. Start where ever you are now.

This is Plato’s republic.

Now I am off to work outside.

Cheers and good tidings,

Raul Santos, August 7th, 2020

Comments »