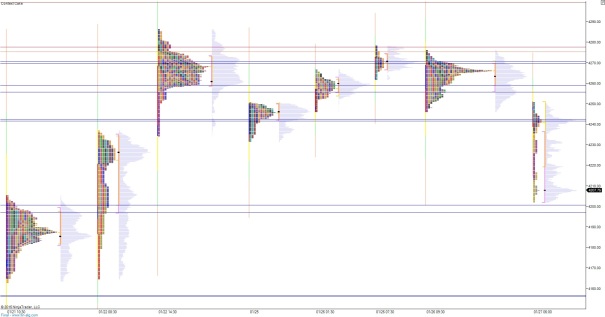

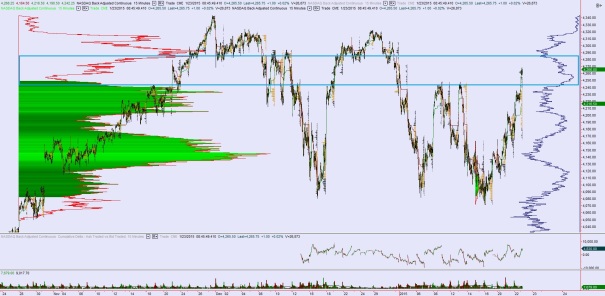

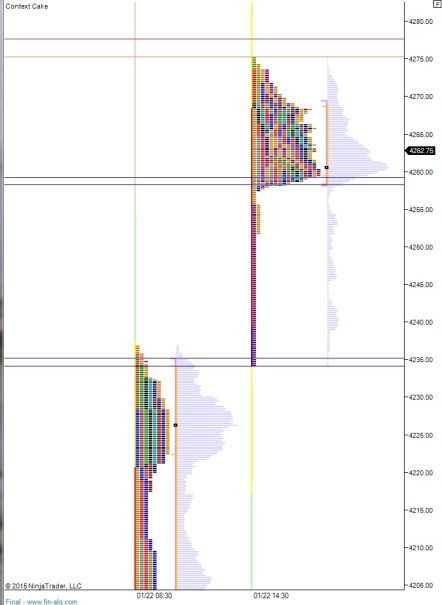

The Nasdaq is ending the session with one of my favorite day types, the neutral day. These day types are rare. Since January 2012 they happen 23.32% of the time. But when they occur you want to be ready because they are fun times.

Today was no exception. We two ticked the IB high and fell right back into it, setting up a trade back to the mean. This typically happens before we go anywhere else. The exception, and even more rare print, is a neutral extreme which gains speed on the second range extension and closes near an extreme.

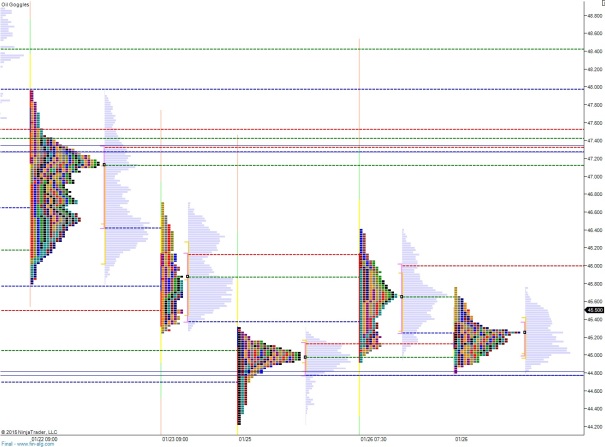

Today was the first time I have live traded through a NYSE Rule 48 and it was without question the most bizarre day I have ever seen. Stocks were trading flat-to-positive while the Nasdaq futures absolutely careened lower. It appears Microsoft trading action had a big impact on the behavior, so now we have to turn our attention to Apple.

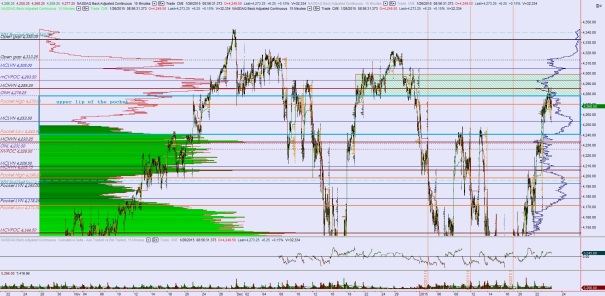

Less is seeming like more for the portfolio until this range settles. However, I keep looking to buy on the low end. This morning, amid the selling, I picked up some GPRO. The only thing it has going for it is it’s intraday bearish head and shoulders, which satisfies my “flip it over” logic. It also has earnings next week.

As exciting as these big days are, you have to stay focused or the opportunities slide right by. By the end of one of these large range days, I need to blow my muscles to bits, otherwise my mind goes haywire. It’s all about the decompression.

Get your fruit trays ready, it is Apple time. May they outshine the brutality of Microsoft, amen.

Comments »