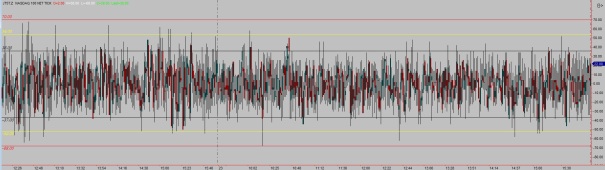

Ahoy mates, I saved you the rigmarole of running standard deviation studies on the NASDAQ 100 TICK. Using high quality IQ Feed data, I ran a study on 1-minute bars to determine 1st-3rd standard deviation for the indicator.

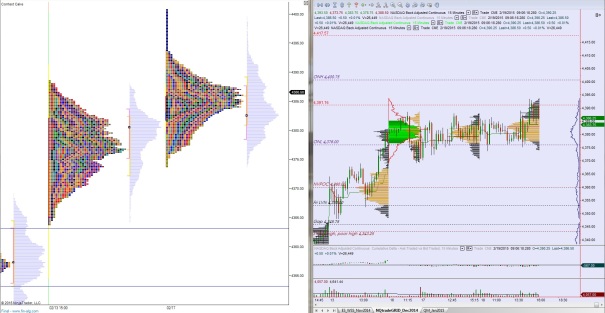

I set audio alerts for the 2nd and 3rd thresholds using Multicharts. We’ll see if those last or end up in the junkyard with the other algo scraps.

Here’s how the data looks on my side:

Positive TICK 1st, 2nd, 3rd sigma: 36, 54, 70

Negative TICK 1st, 2nd, 3rd sigma: -37, -52, -68

Why does any of this matter? Have you ever looked at something and thought, “hmm, that’s different”? Would you want to know if something you’re seeing is in fact abnormal? I do. When I am in a trade I accept that my limbic system will be active and a big part of my job is being aware of the waves of emotion that sometimes get in the way of trading. One of my boulders to channeling that creative energy into objective trading is basing my observations and decisions on cold-dead numbers, logic.

Are they Holy Grail trading signals? No, but they do offer a peek inside the engine of our good friend /NQ_F.