For about the second time this year it seems buyers and sellers have come to a draw, and without some intervention they’re likely to sort of stick around these levels for a bit.

Boy-o-buddy did we thrown one heck of a who-ha yesterday. Despite wind gusts upwards of 50mph we managed to draw well over a hundred folks to the urban farmstead. It was a real show of power, over both the hearts of minds of the people and nature.

That said, I very much look forward to setting the farm work aside for the next six months and to make to to make to for to make to recluse myself into books and lifting iron.

Updating my research.

And getting back to trading.

Raul Santos, November 6th 2022

And now the 409th strategy session.

Stocklabs Strategy Session: 11/07/22 – 11/11/22

I. Executive Summary

Raul’s bias score 2.80, neutral. Watch for earnings out of Berkshire early Monday to set the tone for markets to start the week. Then third reaction to CPI data Thursday morning provides visibility on price action into end-of-week.

II. RECAP OF THE ACTION

Bit of a rally to begin the week before some heavy selling Tuesday. Then third reaction to the FOMC rate hike Wednesday resolved lower and that selling carried into Thursday. Friday markets sort of caught a bounce. Except for the Russell, which was bearish divergent.

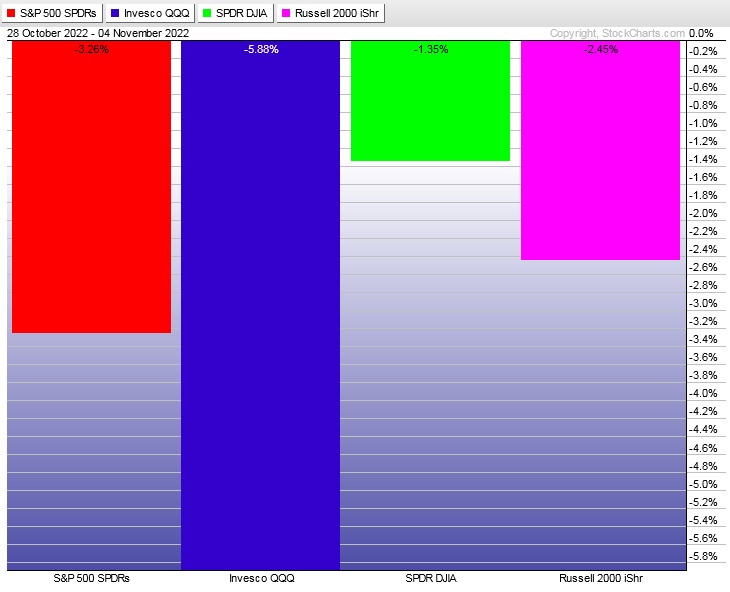

The last week performance of each major index is shown below:

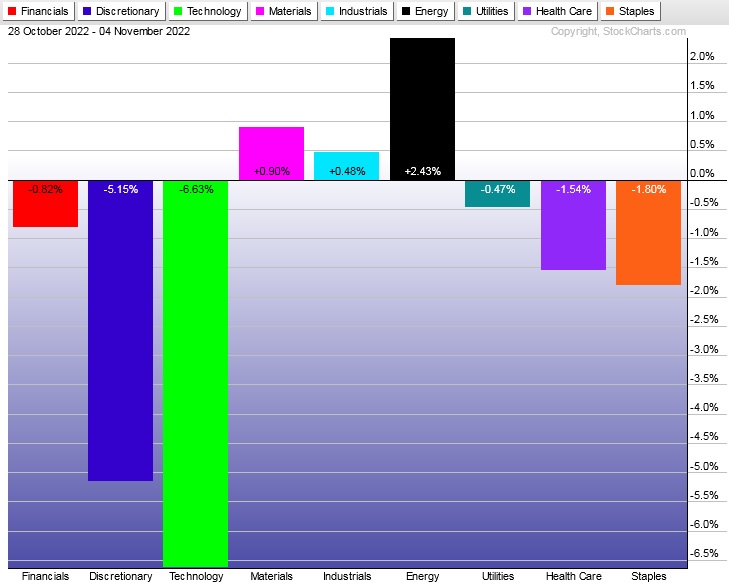

Rotational Report:

Our best sectors came under pressure last week, perhaps in part due to big tech earnings the week prior. Nothing about last week’s rotations bodes well for equity bulls.

bearish

For the week, the performance of each sector can be seen below:

Concentrated Money Flows:

Money flows were pretty balanced.

neutral

Here are this week’s results:

III. Stocklabs ACADEMY

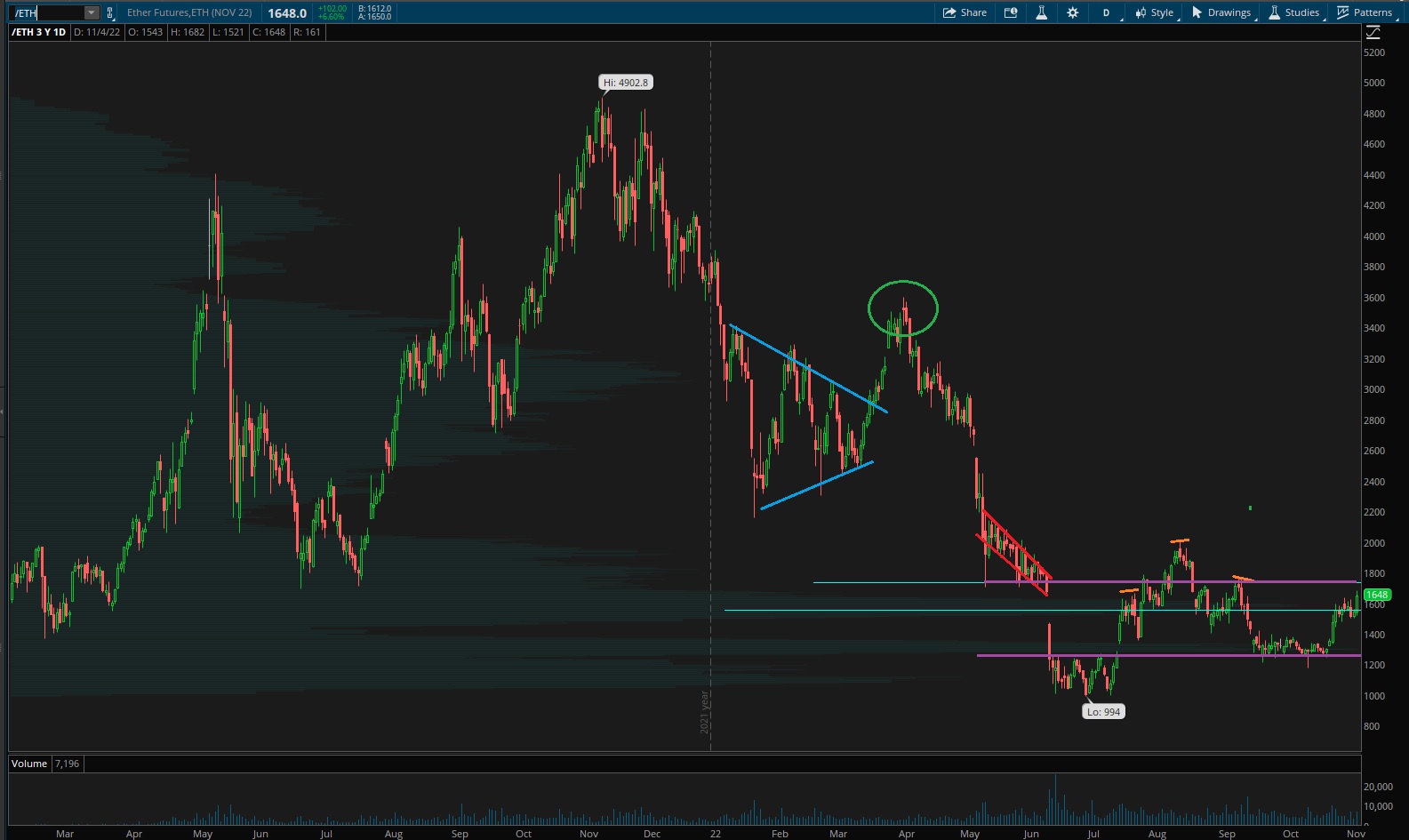

Ether decoupled from stocks a bit

Ethereum was bullish divergent last week and steadily marched higher, even shaking off the Fed rate hike volatility spike. This commodity finished nearly on its weekly high.

Interesting to see risk assets start to behave independent of one another. Perhaps we are beginning to stabilize.

Note: The next two sections are auction theory.

What is The Market Trying To Do?

Week ended searching for buyers.

IV. THE WEEK AHEAD

What is The Market Likely To Do from Here?

Weekly forecast:

Watch for earnings out of Berkshire early Monday to set the tone for markets to start the week. Then third reaction to CPI data Thursday morning provides visibility on price action into end-of-week.

Bias Book:

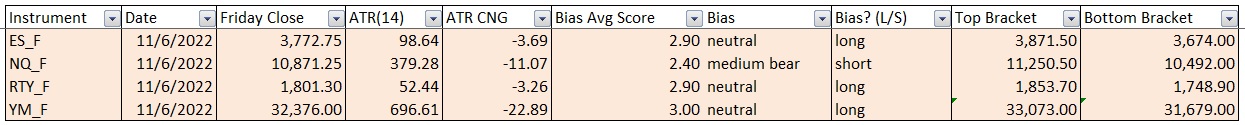

Here are the bias trades and price levels for this week:

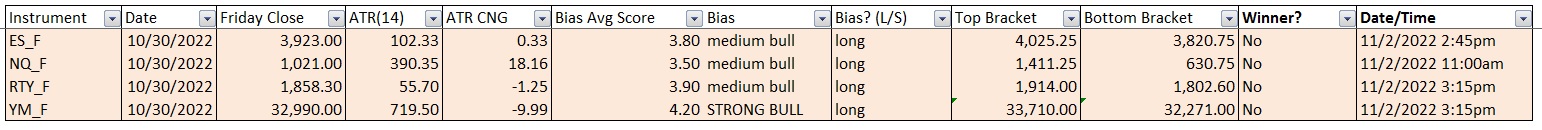

Here are last week’s bias trade results:

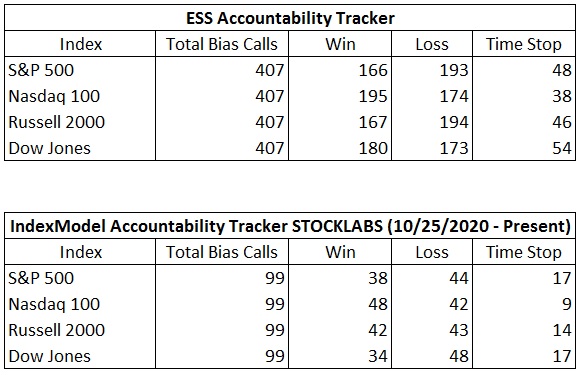

Bias Book Performance [11/17/2014-Present]:

Stabilizing across the board

Readers are encouraged to apply these techniques to all markets. Markets fluctuate between two states—balance and discovery. Discovery is an explosive directional move and can last for months. In theory, the longer the compression leading up to a break in balance, the more order flow energy to push the discovery phase.

Market are most often in balance.

Every week this newsletter uses auction theory to monitor three instruments, the Nasdaq Transportation Index, PHLX Semiconductor Index and ethereum

Transports are sort of wiggling around inside range.

See below:

Semiconductors may have formed a higher lower. We saw buyers defending their conviction zone on Friday.

Ether seems to be drawn to the seventeen hundred level.

V. INDEX MODEL

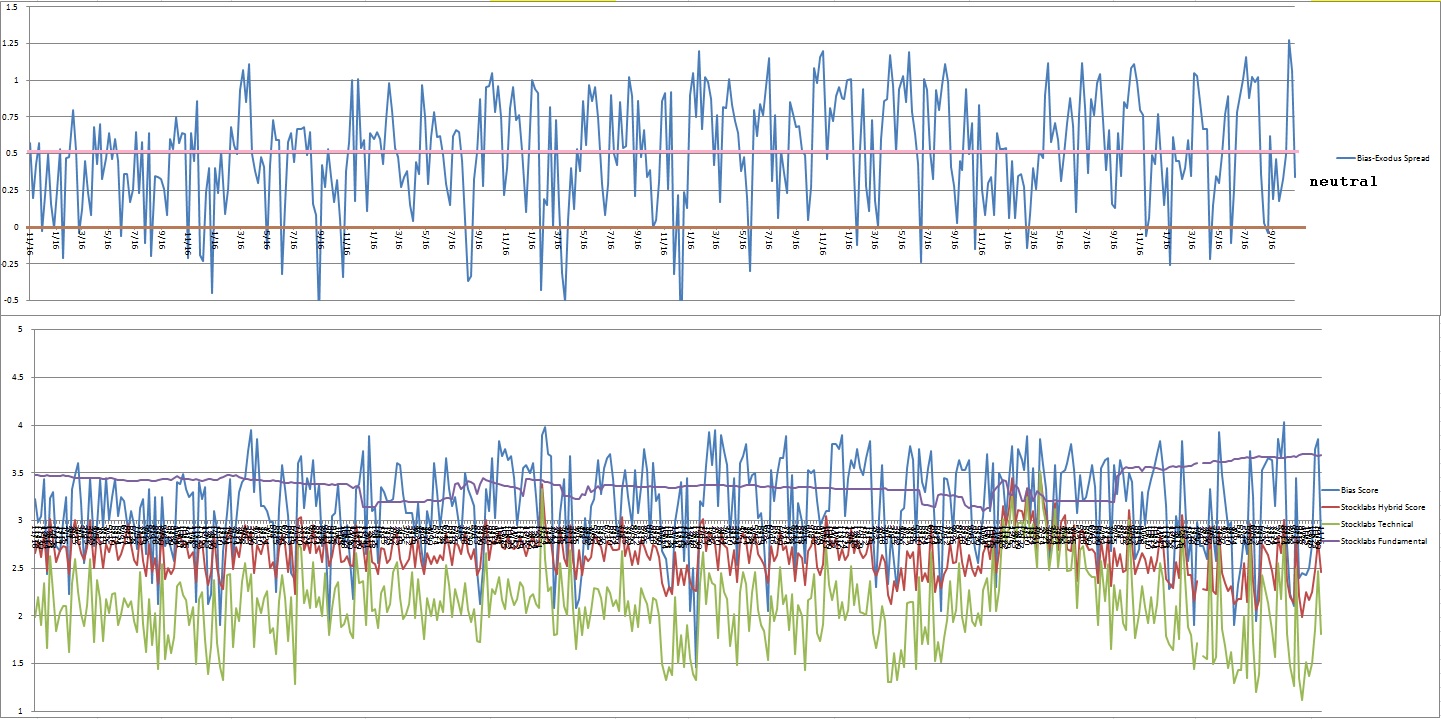

Bias model is neutral after two consecutive weeks of extreme Rose Colored Sunglasses (e[RCS]) bullishness.

There were five Bunker Busters in recent history — nine weeks ago, eighteen weeks back, twenty-five weeks ago, thirty-eight reports back and forty reports back.

Here is the current spread:

VI. QUOTE OF THE WEEK:

“Do your own thinking independently. Be the chess player, not the chess piece.” – Ralph Charell

Trade simple, do your own research

If you enjoy the content at iBankCoin, please follow us on Twitter